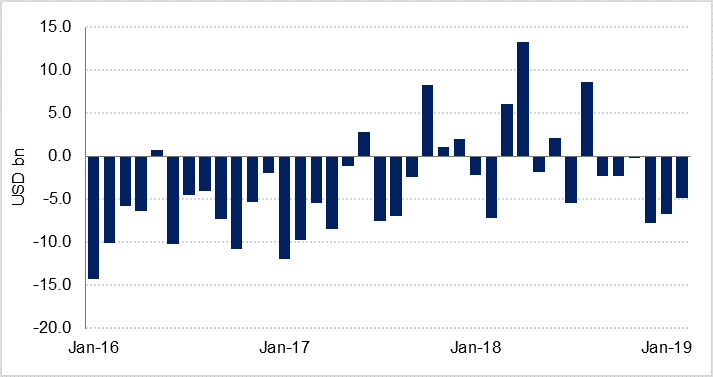

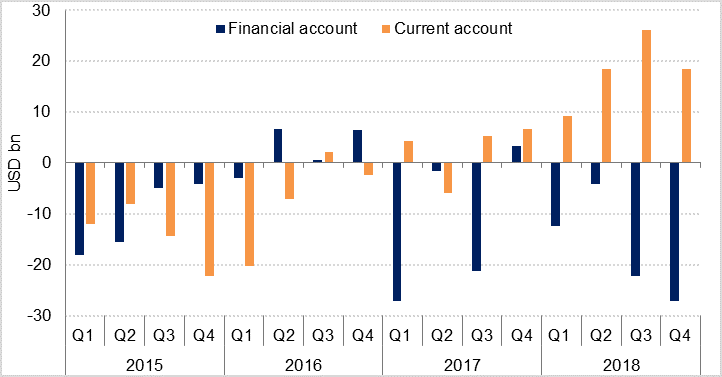

SAMA’s net foreign assets declined to USD 478bn in February, down -USD11bn since December 2018. FX reserves have declined for the last 6 months in a row. Recently released balance of payments data for Q4 2018 show that while the Kingdom recorded a surplus on its current account of USD 18.5bn, there was a USD 27.1bn outflow from the financial account, reflecting a surge in outward FDI, as well as portfolio and other investments abroad. The official reserves data for the first two months of this year suggests that the outflow of capital from the Kingdom has continued to exceed the trade surplus at the start of this year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Broad money supply (excluding government deposits) grew just 1.5% y/y in February, with M1 growth at 2.4% y/y but FX deposits down -2.5% y/y. Government deposits have declined at a sharper rate over the last three months, after stabilising somewhat in August and September 2018.

Public sector borrowing rose 21.2% y/y in February while private sector credit growth rose to 3.0% y/y in February from 2.4% in January.

Click here to download the full report.