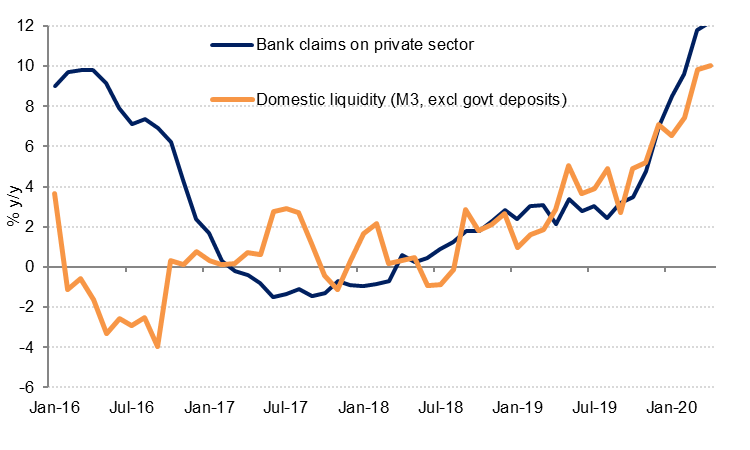

M3 growth accelerated slightly to 10.0% y/y in April from 9.8% in March and 6.6% y/y in January 2020. The main driver was growth in narrow money (M1) with both cash in circulation and demand deposits up more than 10% y/y in April. Liquidity has been injected into the banking system by the central bank, with the value of SAMA bills and repos falling by –SAR 34bn in March and April, with the bulk of the liquidity injection in March.

Private sector credit growth also grew at a faster rate of 12.2% y/y in April, up from 7.0% y/y at the end of last year. Public sector borrowing slowed to 17.4% y/y in April from 19% y/y in March and 24.1% y/y in December 2019. SAMA announced on Monday that it would provide another SAR 50bn in liquidity to the banking system to boost the lending capacity of banks.

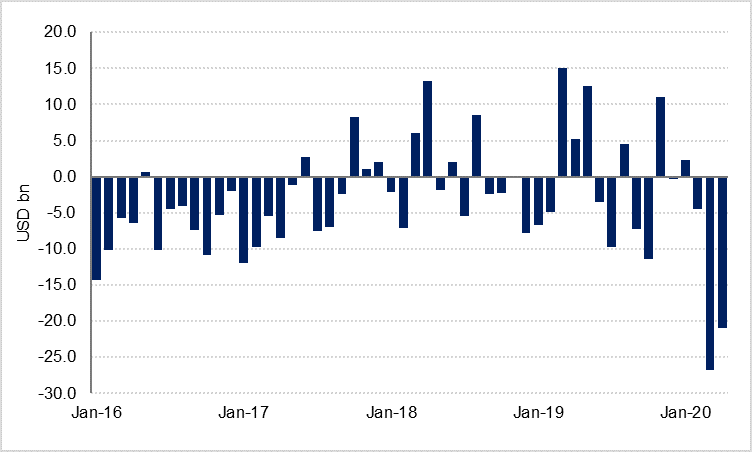

Government deposits declined by just over SAR 20bn in April, following a SAR 32bn drop in March. The balance in the government’s current account at SAMA fell to SAR 24.4bn at the end of April, the lowest level since July 2018. The government would have tapped its deposits to cover domestic expenditure as oil revenues declined sharply on the back of the global coronavirus disruptions.

Source: SAMA, Emirates NBD Research

Source: SAMA, Emirates NBD Research

Net foreign assets at the central bank declined by –USD 20.9bn in April to USD 444.2bn. NFA have fallen by almost USD 50bn year-to-April despite bond issuance of USD 12bn since the start of the year. The finance minister said on Friday that the government had transferred about USD 40bn to the Public Investment Fund (PIF) in March and April, to allow PIF to boost its investments.

Source: SAMA, Emirates NBD Research

Source: SAMA, Emirates NBD Research