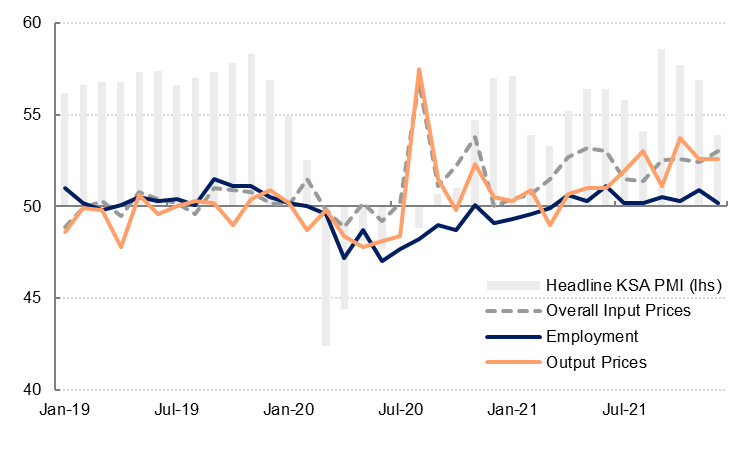

Saudi Arabia’s PMI slipped to 53.9 in December from 56.9 in November, the lowest reading since March 2021. Output and new order growth slowed as concerns about the spread of the Omicron strain of corovanavirus weighed on demand. New export orders grew at the slowest pace since April, reflecting softer external demand as well. Inventory increased as output growth slowed. Employment in the private sector was broadly unchanged in December.

Input costs increased at the fastest rate since May on higher raw material and transport costs. Firms in the kingdom passed on some of these increased costs to buyers by raising selling prices – output prices have increased every month since April 2021.

Businesses were more cautious about the outlook over the next year, with only 8% of panellists expecting their output to be higher in 12 months’ time. Fears about a new Covid wave dampened sentiment in December, with the future output index falling to 53.6, the lowest level since mid-2020.

While the final PMI reading for 2021 was relatively soft, the average for Q4 was 56.2, the same as Q3 2021 and indicating a solid expansion in the non-oil private sector in the final quarter of last year. We retain our forecast for non-oil growth in the kingdom at 5% in 2021. However, there is downside risk to growth in Q1 2022 if rising coronavirus cases lead to renewed restrictions on activity and/or reduced consumer spending. We still expect non-oil sector growth to average 4.0% this year, with headline GDP growth forecast at 5.7% on the back of stronger oil sector growth.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

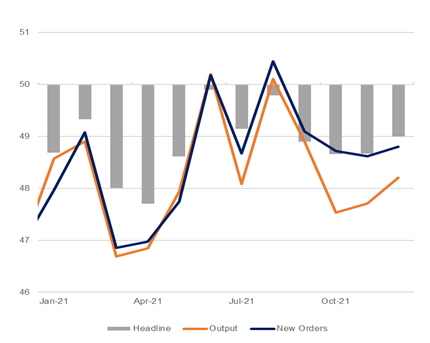

Egypt’s headline PMI survey picked up modestly in December to 49.0 from 48.7 in November, the highest reading since August. The recent soft PMI readings suggest that growth in Egypt is likely being driven by the public sector; this is consistent with the communiqué from the latest MPC meeting from the Central Bank of Egypt, which expects real GDP growth over the near-term horizon to be driven by gross domestic investments, likely implemented by the government.

There were some notable positive takeaways from the survey, however, not least that price pressures appear to have peaked for now. The pace of acceleration in both purchase prices and staff costs has slowed, with firms benefitting from softer commodity price rises and a weaker uptick in wages. This saw output prices rise at a softer rate also, with that subcomponent at a three-month low, which should see CPI inflation continue to moderate.

New export orders expanded at the fastest pace since February although total new orders were negative, weighed down by soft domestic demand. While business optimism improved modestly in December, it remains low compared to the series average. Output contracted again but at a slower rate than in November. Firms appear cautious on hiring, with the employment subcomponent slightly below 50 but higher than the November reading. Encouragingly, manufacturing and services reported an uptick in hiring, while there were declines in the construction and retail sectors.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The UAE PMI for December 2021 will be released on Wednesday 5 January.