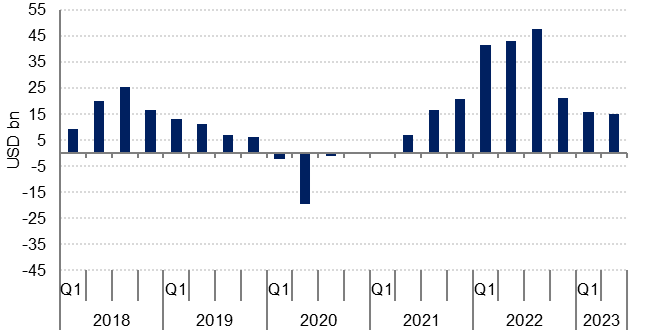

Saudi Arabia’s current account recorded a balance of USD 15.2bn in Q2 and USD 31.3bn in H1 2023, down more than 60% from the USD 84.6bn surplus recorded in H1 2022.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD ResearchThe decline was largely due to a deterioration in the merchandise trade surplus relative to H1 last year. Oil export revenue fell almost -25% y/y, on lower oil prices and production cuts from April, while imports grew more than 16% y/y. Nevertheless, the trade balance remained in surplus at USD 32.3bn.

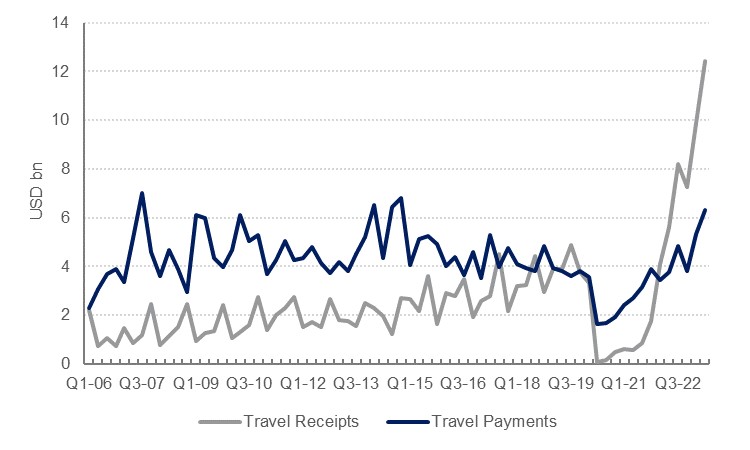

While the services balance remained in deficit – the kingdom was a net importer of transportation, construction and other services – the travel services balance showed a marked improvement. Travel receipts reached a record high of USD 12.4bn in Q2 2023, underpinned by a surge in visitors to the kingdom as new visas made it easier for both business travellers and tourists to go to Saudi Arabia.

Visitors to the kingdom were up 58% y/y over the year to July, and growth in tourism is a key target in Vision 2030. Ongoing investment in travel infrastructure, in addition to significant investment in sporting events (the latest being the announcement of a bid by KSA to host the 2034 FIFA World Cup), should see travel receipts in the current account continuing to grow over the medium term.

Even as outbound travel from the kingdom normalized post-pandemic, the overall balance on the travel services account reached USD 10.6bn in H1 2023, up from USD 2.4bn in H1 2022.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Consequently, we expect the full year current account surplus will be smaller in 2023 compared to last year. However, given the strong performance of the tourism sector, we have revised our forecast for the services deficit lower for the full year. We now expect a current account surplus of 5.4% of GDP (USD 58bn), compared with 13.7% of GDP in 2022. At this stage, we expect production cuts will start to be unwound in 2024, which should boost export revenue provided oil prices remain in the USD 80-90/b range. We forecast a widening of the current account surplus to 8.1% of GDP (USD 94bn) in 2024.

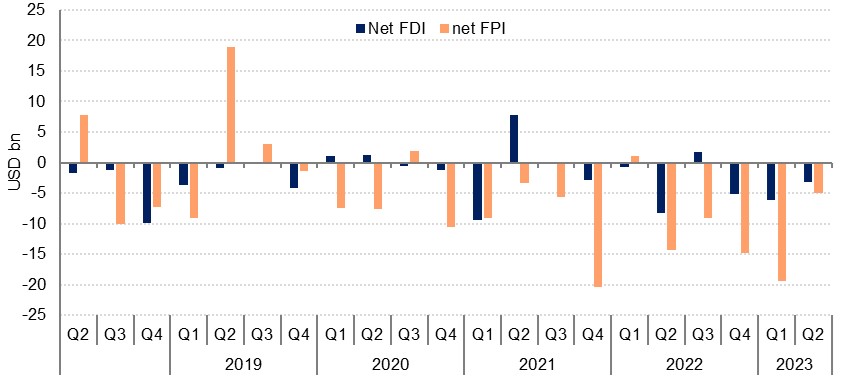

FDI inflows for H1 came in at USD 3.8bn, a 6.0% drop from the USD 4.1bn recorded in H1 2022. Meanwhile, direct investment by Saudi Arabia abroad in H1 2023 was broadly unchanged at USD 13.1bn, leaving a sizeable net direct investment outflow of USD 9.3bn in H1. This was marginally higher than the USD 9.0bn net FDI outflow in H1 last year.

Aside from 2021 when FDI was boosted by an Aramco-related asset sale, inward FDI has been much lower than targeted. Given the scale of investment that is planned in the kingdom over the next decade, FDI was expected to be a key source of support, providing capital as well as skills and technology transfer to drive growth and create jobs in the kingdom. Regulatory reform may boost inward FDI in the coming years, but there is little evidence of this in the H1 2023 data.

Foreign portfolio investment also showed a sizeable outflow of USD 24.3bn in H1 2023, likely reflecting PIF’s ongoing investment in global equity markets, with large holdings in major gaming and technology firms around the world.

Overall, the balance of payments in Saudi Arabia recorded a deficit of USD 16.6bn in H1 2023, which was broadly in line with the USD 16.8bn decline in net foreign assets at the central bank over the same period.