Saudi Arabia is planning to cut production in June further below its target level as part of the OPEC+ agreement reached earlier this year. The Kingdom will apparently cut output to 7.5m b/d, compared with an official target of around 8.5m b/d for June as per the OPEC+ agreement. The ‘oversized’ cuts would fit a pattern of Saudi overcompliance with OPEC production cuts over the past few years. As the largest producer in OPEC, and most influential exporter, Saudi Arabia exerts a significant influence on global oil markets and its policy announcements—if not necessarily followed exactly in practice—can have immediate impacts on the market. This is especially the case when other producers follow its lead, and both the UAE and Kuwait have also declared that they will reduce their output, with the UAE stating that it will cut by an additional 100,000 b/d, and Kuwait by an extra 80,000 b/d. Oil prices reversed their losses for the day on the news from the region, and a moderately brighter outlook in terms of demand as some countries move forward with easing their lockdowns.

While the UAE has followed Saudi Arabia in announcing deeper oil cuts, the UAE’s finance ministry has stated that there was no intention to raise VAT, as was announced in KSA yesterday.

The IMF yesterday approved a new USD 2.8bn to Egypt to help the country cope with the financial stresses induced by the coronavirus pandemic. The money is provided through a Rapid Financing Agreement, and is intended to limit the rapid decline in FX reserves seen over the past two months. Diminished tourism, remittances, canal fees and portfolio inflows have seen reserves fall by a record USD 5.4bn in March, and a further USD 3.1bn in April. This USD 2.7bn is likely to be followed by a larger sum as a separate Stand-By Arrangement.

A survey of 6,500 businesses by the Ifo economics institute in Munich for the first three weeks of April, showed almost one in five German companies laid off workers or did not extend their fixed contracts owing to the coronavirus pandemic. This is even despite the widely lauded Kurzarbeit programme which has been imitated throughout Europe, suggesting that European labour markets will take a substantial hit this year.

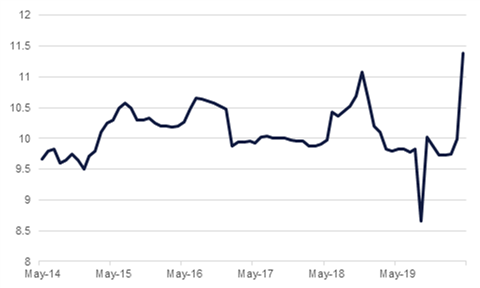

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower as supply weighs on prices. The curve bear steepened with yields on the 2y UST and 10y UST closing at 0.17% (+1 bps) and 0.70% (+2 bps) respectively. There was a pushback from Fed officials on market view that Fed may cut rates into negative territory.

Regional bonds continued their positive run shrugging off risk averse sentiment at the start of the week. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 5 bps to 3.75% while credit spreads tightened from 317 bps to 308 bps.

S&P, in a report, said that they expect financial support from GCC countries should Oman’s external reserves deteriorate significantly. However, they added that their baseline scenario is that the government of Oman will be able to meet all its funding needs over 2020-2023.

The dollar is reversing a large portion of the negative price action recorded towards the end of last week as risk aversion resumed. The DXY index, a measure of the dollar against other major currencies, broke through the crucial 100.00 barrier and now trades at 100.290. The key event to look out for will be comments from Fed Chairman Jerome Powell on Wednesday. The strengthening dollar weighed on the JPY with USDJPY recovering over the 107 level at 107.40.

The Euro was largely unchanged despite some choppy movement, but slipped in the early hours of this morning. EURUSD met resistance at 1.0875 and is currently trading at 1.0800. U.K. PM Boris Johnson's announcement of minor lockdown loosening did little to encourage investors, with Sterling dropping over 0.70% to reach 1.2316. The AUD and NZD both lost momentum after the positive movement they experienced towards the end of last week. Both currencies experienced losses after China banned meat from four Australian abattoirs, causing their losses to extend this morning, dropping over 1.30% and 1.15% respectively.

The ban put in place on local Turkish lenders trading in lira with international banks UBS, Citigroup and BNP Paribas has been lifted. The ban was imposed as the lira fell to new lows at the close of last week, ostensibly owing to the international banks not meeting their local currency obligations. The currency has strengthened modestly this week, but remains over the TRY 7.0/USD level, closing at TRY 7.07/USD yesterday.

Developed market equities traded mixed amid continued strength in technology stocks. The Nasdaq moved deeper into positive territory with gains of +0.8%. The wider Euro Stoxx 600 index dropped -0.4% while the S&P 500 index closed flat.

Regional equities closed largely lower as investors analyzed the decision of Saudi Arabia to increase VAT to 15% from 5% and to announce new austerity measures. The DFM index and the Tadawul lost -1.0% and -1.2% respectively. Banking sector stocks led losses with Dubai Islamic Bank and Abu Dhabi Commercial Bank losing -2.3% and -2.0% respectively.

Despite announcements from several key Gulf oil exporters that they would cut deeper than required as part of the OPEC+ agreement, oil futures slipped overnight. Brent settled back below USD 30/b and is holding steady at around USD 29.70/b in early trade this morning while WTI fell by 2.4% back to a USD 24/b handle where it is holding today.

Saudi Arabia, Kuwait and the UAE will all add more to their production cuts than their targets agreed with the rest of OPEC+. The GCC producers had delivered more than required in past rounds of OPEC cuts and these announcements help to make official what the market was likely expecting anyway. However, by over-complying there may be a tacit acceptance that other producers in OPEC+ will fail to meet their obligations. With oil prices still at depressed levels Saudi and the other GCC producers will have little to gain from trying to enforce compliance with higher output causing a price crash.