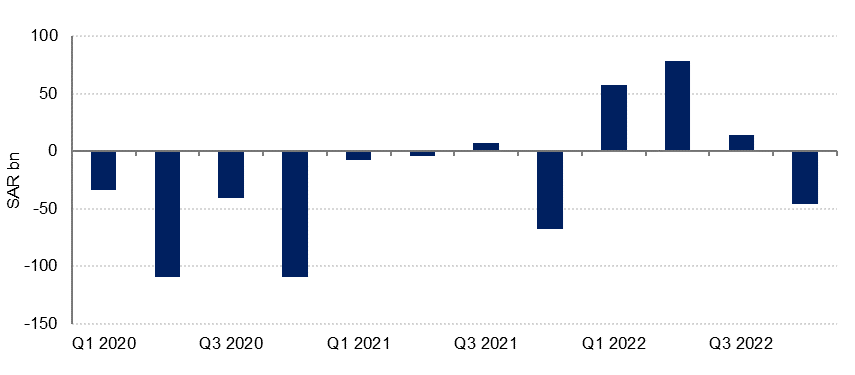

Saudi Arabia’s budget recorded a (surprising to us) deficit of -SAR 45.7bn in Q4 2022, bringing the total surplus for last year down to SAR 103.9bn (USD 27.7bn; 2.5% of GDP) compared with SAR 149.5bn (USD 40bn) at the end of Q3 2022.

Oil revenues declined -15% q/q in Q4 on both lower output and lower oil prices, but this was more than offset by higher non-oil revenues (including investment income) and total budget revenue rose 5.3% q/q (18.1% y/y) to SAR 318bn in the final quarter of 2022.

However, as is usual, expenses rose sharply in Q4, up 26.4% q/q and 7.8% y/y to SAR 363.7bn. This was driven by a surge in goods and services expenditure, as well as payment of grants and social benefits. Wages and salaries expenditure also jumped 6.7% q/q in Q4.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The full year surplus of 2.5% of GDP was significantly lower than the 6.4% of GDP we had expected given the strong performance in Q1 -Q3 2022, but higher than the budgeted SAR 90bn surplus which would have been equivalent to 2.2% of GDP.

Total expenditure of SAR 1.2tn was 22% higher than budgeted for 2022, with goods and services spending up 26% y/y and capex up 22% y/y. Wage growth was relatively restrained at 4% in 2022, and with average inflation at 3% it provided a modest real boost to household income.

In terms of spending priorities, spending on municipal services doubled last year relative to 2021 and was 152% of the initial allocation for the sector. There was also significant overspending (relative to initial allocations) for health and social development, military spending and public administration.

In light of the recent developments in global financial markets, and the downward revision to our house view on oil prices this year, we have revised our forecasts for the GCC budgets lower as well. We now estimate only a small surplus of 0.7% of GDP in Saudi Arabia this year, based on an average oil price of USD 88/b for Brent. We expect a similar sized surplus in 2024 also.

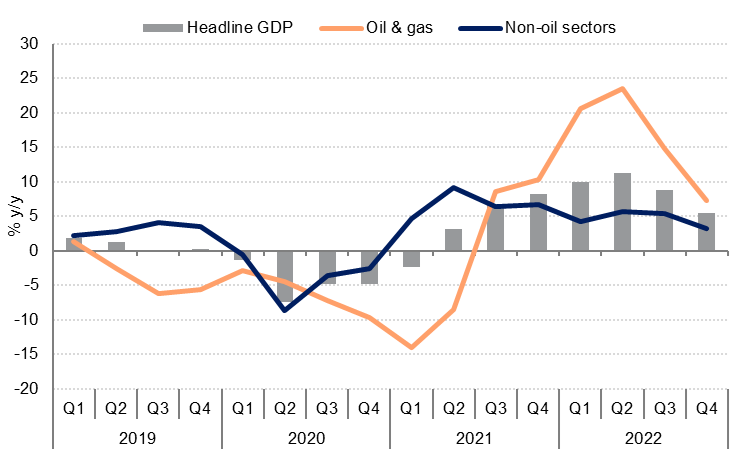

Final GDP data showed a moderation in growth in the final quarter of 2022 to 5.5% y/y from 8.7% in Q3 and 10.0% in Q1 2022. This was largely due to the decline in oil & gas GDP in Q4, as production was cut slightly.

Non-oil GDP growth remained solid at 1.1% q/q (seasonally adjusted) in Q4 2022 but slowed on an annual basis to 3.2% y/y. Transport, storage and communication was the best performing non-oil sector in Q4 at 13.1% y/y. Trade, restaurants and hotels also grew robustly at 5.1% y/y.

Source: Haver Analytics. Emirates NBD Research

Source: Haver Analytics. Emirates NBD Research

Full-year GDP growth was confirmed at 8.7% y/y in 2022, with the hydrocarbons sector growing 15.4% y/y and non-oil GDP (private and government) expanding 4.8% y/y. In addition to transport & storage (9.1% y/y) and trade & hospitality (5.1% y/y), the construction sector saw robust growth at 4.5% in 2022 as the government pushed ahead with infrastructure investment. We expect construction to continue to do well in 2023, despite our lower oil price forecast. We retain our 2023 GDP growth forecast of 3.1%.