Saudi Arabia’s 2022 budget projects a surplus of SAR 90bn (2.5% of GDP) next year, as revenues have been revised sharply higher relative to the pre-budget statement published in October. The government now expects total revenue to reach SAR 1,045bn, slightly higher than our own forecast of SAR 1,035bn.

While the budget statement does not provide a breakdown of expected oil and non-oil revenues, the statement notes that tax revenue is expected to decline next year, suggesting that the government expects oil revenues higher than we have estimated based on our house view of an average USD 68/b for Brent in 2022.

In the past, the government has been relatively conservative in its oil price assumptions for budgeting purposes, but it appears as if the official 2022 revenue estimates are based on an assumed average oil price in excess of USD 70/b.

The budget statement includes two additional revenue scenarios to reflect the wide range of market forecasts for oil prices next year. In the “lowest revenue” scenario, the budget would post a smaller surplus (SAR 36bn) relative to the baseline (SAR 90bn), while in the “highest revenue” scenario, the surplus is projected at SAR 175bn. Expenditure remains unchanged at SAR 955bn in all scenarios as the government looks to “decouple” spending from volatile oil prices.

On the expenditure side, the budget sticks with the SAR 955bn that was published in the pre-bduget statement. We expect actual spending next year to overshoot this figure, and have pencilled in SAR 1,015bn in total expenditure next year. Consequently, we project a smaller budget surplus of SAR 20bn (0.6% of forecast GDP) compared the government's SAR 90bn projection.

Based on our assumptions for oil production, non-oil revenue and total expenditure, we estimate the budget break-even oil price for Saudi Arabia will fall to USD 65/b in 2022 from an estimated USD 73/b in 2021.

Next year's surplus will be used to boost reserves and support investment through development funds and the Public Investment Fund. The government still plans to issue debt next year to refinance debt maturing in 2022; the overall stock of debt is expected to remain unchanged at SAR 938bn, with the share of debt/ GDP declining to 25.9% from an estimated 29.2% in 2021 as the economy grows.

The sector with the biggest budget allocation (excluding general spending) in 2022 is education, followed by the military and then health and social development.

The official forecast for real GDP growth in the kingdom next year is 7.4%, marginally lower than the 7.5% forecast in the pre-budget statement but still much higher than our own 5.7% growth forecast. The government expects higher oil GDP to be the key driver of growth next year, with the non-oil GDP also expected to improve.

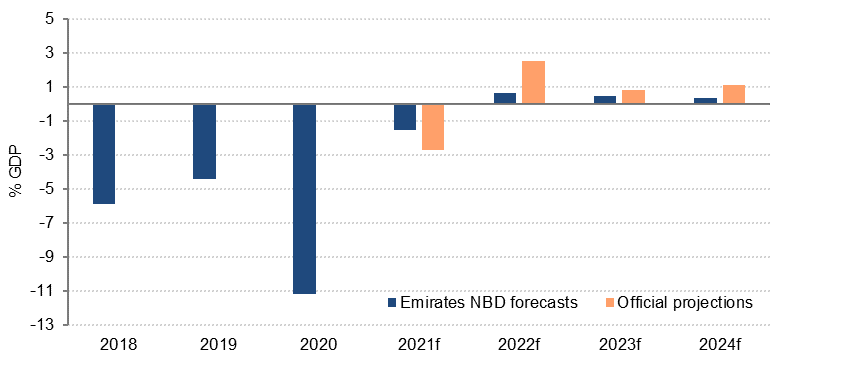

The preliminary estimates for 2021 show that the authorities were relatively disciplined with spending, which likely came in just 2.5% above budget. However, higher oil prices in H2 2021 and increased oil production will likely result in much higher revenue than budgeted for this year. We estimate this year’s budget deficit at -1.6% of GDP, smaller than the official projection of -2.7% GDP. Final budget data for 2021 will only be available in Q1 2022.

Source: Ministry of Finance, Haver Analytics, Emirates NBD Research

Source: Ministry of Finance, Haver Analytics, Emirates NBD Research