S&P downgraded Pakistan’s long-term credit rating to B- from B. The rating agency cited weak growth prospects and elevated external and fiscal balance deficits as reasons for the downgrade. It further added that the protracted talks with the IMF for an aid package suggest that the resulting reforms will be less expedient than earlier anticipated. The recent bilateral aid from friendly countries will help to alleviate the immediate stress but not necessarily improve financial condition over the medium term. The outlook was retained as stable reflecting expectations that Pakistan will be able to meet its external obligations over the next 12 months.

The Reserve Bank of Australia left interest rates unchanged at 1.5%. The central bank expects the economy to grow around 3% in 2019 and slightly slower in 2020. The bank also expects the unemployment rate to drop to 4.75% from 5% over the next couple of years. On inflation, they expect the pick-up to be only gradual and actually take a little longer than expected to reach their target. Before the central bank decision, retail sales data showed the biggest drop in 12 months. Sales dropped -0.4% in December relative to expectations of a flat reading.

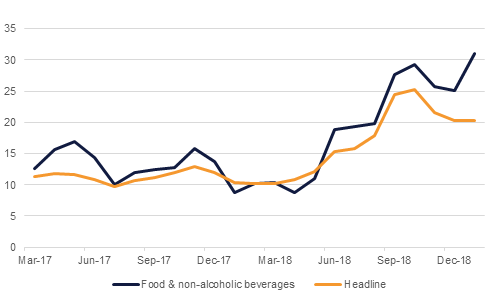

Turkish inflation’s slowdown paused in January according to data released yesterday, as y/y price growth came in at 20.35%, compared to 20.30% the previous month and analyst expectations of 20.30%. Inflation was 1.06% m/m, from -0.4% in December. Higher food prices, caused by flash flooding in Antalya, was the primary factor behind this, which is likely to harden the tight monetary policy stance reaffirmed by the Turkish central bank in recent statements.

Elsewhere, factory orders in the US fell more sharply than expected in November with orders dropping by -0.6% in November. Durable goods order also came in weaker than expected at +0.7% (versus expectation of +1.5%). The report was delayed due to government shutdown.

Treasuries closed lower with the curve continuing to steepen. Yields on the 2y UST, 5y UST and 10y UST closed at 2.53% (+3 bps), 2.53% (+3 bps) and 2.72% (+4 bps) respectively.

Regional bonds drifted marginally lower. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 1 bp to 4.41% but credit spreads tightened 3 bps to 182 bps.

Fitch affirmed the rating of First Abu Dhabi Bank at AA- with stable outlook. The rating agency also affirmed Oman Electricity Transmission Co rating at BB+ with stable outlook.

Despite softer than expected economic data, the USD finished firmer on Monday, the Dollar Index gaining 0.29% to close at 95.852. As we go to print, the index is trading at 95.828 and remains below the 100-day moving average of 96.172, a level which can be expected to provide resistance. Should this level fail to halt additional advances, stronger resistance is likely to be encountered at the 50-day moving average (96.390) which halted gains earlier in January. It is worth noting that while the price realizes daily closes below the 96.200 level, a retest of the 200-day moving average (95.351) cannot be ruled out.

This morning’s the Australian dollar reversed its fortunes to go from the weakest performing G-10 currency to the strongest performing. While the nation’s trade balance widened to AUD 3681mn in December from 2256mn the previous month, retail sales contracted 0.4% m/m during the same period, following a 0.5% m/m increase in November and the AUDUSD fell to as low as 0.7194. However after the RBA left interest rates unchanged at 1.50% (see macro), AUDUSD reversed its fortunes and currently trades 0.10% higher at 0.7234.

Developed market equities closed higher on the back of strength in technology stocks. The S&P 500 index added +0.7% while the Nasdaq rallied +1.2%.

It was largely a positive day of trading for regional equities. The ADX index gained +1.0% while the Qatar Exchange added +0.4%. Banking sector stocks renewed their positive run with ADCB adding +2.0% and FAB rallying +2.3%.

Oil markets softened to begin the week as disappointing data out of the US added to concerns over the performance of the global economy. WTI futures fell 1.27% to close at USD 54.46/b while Brent dipped 0.38% to close at USD 62.51/b. It was a choppy day of trading as at one point Brent moved to as high as USD 63.63/b, its highest level in 2019 so far before falling to a USD 61/b handle.

Russia’s energy minister said his country would comply fully with terms of the production cut deal after saying output fell by 47k b/d in January from October baseline levels. Russia’s production may not decline as suddenly or dramatically as other OPEC producers given it has a multitude of oil companies controlling production in the country.