Saudi Arabia’s central bank SAMA said on Monday it provided 50 billion riyals as a measure to support liquidity in the banking sector, after consumer spending contracted sharply in April due to the coronavirus pandemic. SAMA data published late on Sunday showed a collapse in consumer spending, with point-of-sale transactions down 33% and cash withdrawals down by 35% in April from a year ago. On the other hand lending to the private sector increased in April by 12.2% y/y. SAMA said the stimulus will help banks support and finance the private sector. The kingdom’s economy faces the impact of coronavirus containment measures, amplified by challenging conditions in the oil sector.

The Commerce Department said that U.S. construction spending fell 2.9% in April, marking the largest drop in 18 months, with declines across all building activity as coronavirus shutdowns halted projects. The April drop followed an almost flat reading in March, and was the biggest monthly drop since a 3% contraction in October 2018. Broken down by segment the data for April showed, spending on residential construction dropped 4.5% , with single-family construction down 6.6 % and the smaller apartment segment down 9.1%. Construction of non-residential projects that includes office buildings and hotels fell 1.3%. The data also showed spending on construction by the federal, state and local governments was down 2.5% during April.

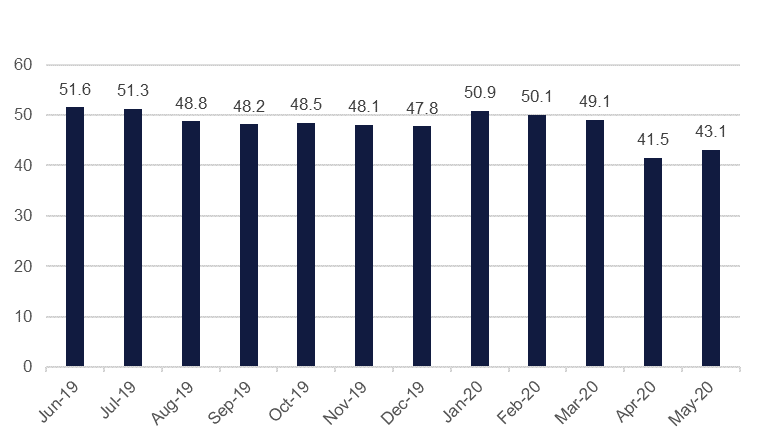

The Institute for Supply Management said its index of national factory activity rose to 43.1 last month from 41.5 in April, which was the lowest level since April 2009. While reading below 50 indicates contraction in manufacturing, which accounts for 11% of the U.S. economy, by easing off an 11 year low the US manufacturing data is beginning to reflect signs that the worst of the crisis is over as businesses take steps towards normalizations. May marked the third straight monthly contraction, as disruptions to the supply chains are limiting some manufacturers’ ability to restart production, while others such a food, beverage and tobacco industries are overwhelmed by increased demand. The ISM’s forward-looking new orders sub-index rose to 31.8 in May from 27.1 in April, which was the lowest since December 2008, while it’s measure of factory employment advanced to a reading of 32.1 in May after dropping to 27.5 in the prior month, which was the lowest since February 1949.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries traded mixed amid mixed news on the economy and heightened political tensions. Yields on the 2y UST and 10y UST ended the day at 0.15% (-1 bp) and 0.65% (+1 bp) respectively. The curve continues to steepen with the spread between the 2y and 30y USTs ending at the highest close since 2017 of 114 bps.

Regional bond markets saw continued profit booking at the start of the new week. The YTW on Bloomberg Barclays GCC Credit and High Yield index ended the week rose +2 bps to 3.52% while credit spreads remained flat at 288 bps.

The Emirate of Sharjah raised AED 2bn from one-year sukuk which pays a profit rate of 1.5%. Elsewhere, Fitch affirmed Emirates Development Bank at AA- with stable outlook.

The dollar continued its bearish form on Monday following increased tensions between the U.S. and China, with the latter accusing the former of "disregarding facts" and undermining bilateral relations. China has also opted to halt some agriculture imports. The DXY index is now holding around 97.880, well below the 200-day moving average (98.515). Despite this, JPY was largely unchanged at 107.70.

The euro had some particularly choppy movemen but managed to settle up for a fifth straight day against the USD. It has been giving up some of Monday’s gains to trade around 1.1120. GBP experienced a significant advance against the dollar, increasing over 1.10% to close at 1.2492 overnight, a three week-high for the currency. UK manufacturing output improved slightly in May as lockdown restrictions have started to ease. The AUD and NZD were similarly positive, increasing over 1.90% and 1.400% respectively, with the former reaching its highest point since late January and the latter reaching highs not seen since mid-March.

Developed market equities closed higher as investors focused on economic data and shrugged off, for now, protests in the US and reports that Chinese officials had told agricultural companies to pause purchase of some US farm goods. The S&P 500 index and the Euro Stoxx 600 index added +0.4% and +1.1% respectively.

Regional markets shared the optimism seen in broader markets and closed higher. The DFM index and the Tadawul were notable performers with gains of +1.5% and +1.1% respectively. Market heavyweights led the rally with Emaar Properties and Sabic adding +1.6% and +2.6% respectively.

Oil prices started the week higher on hope that OPEC+ would extend the deep level of the production cut agreement currently in place. Brent futures (August) rose 1.3% to settle at USD 38.32/b and are nudging higher today while WTI was off slightly but is pushing above USD 35.50/b in early trade this morning.

OPEC+ is reportedly considering whether to keep the deep level of production cuts in place for longer than agreed in light of the substantial improvement in oil prices over the last month. According to the targets of the OPEC+ deal, production is meant to be cut by 9.7m b/d for the first two months of the deal (May – June 2020) and then increase slightly for the remainder of 2020. However, there appears to be some reticence from producing countries over whether to extend the length of the deep cuts, despite pressure from Saudi Arabia to maintain them. Total OPEC+ output is tentatively set to increase by almost 3m b/d from June to July should the bloc fail to agree to extend the deeper cuts. Given the still volatile nature of oil markets and uncertainty over the scale of demand such an increase could risk oil prices testing lower in short order.