The geopolitical risk premium in oil markets related to the chance of a wider conflict in the Middle East is fading. Tentative signs of a ceasefire proposal for the Gaza-Israel conflict seemed to spark a drop in front-month futures at the start of the week with October Brent futures down USD 2/b to USD 77.66/b on August 19, or slightly more than 2.5%. WTI futures followed the move lower and have further extended their losses.

Some oil market structures are looking more and more downbeat on the direction for prices. The 25D risk reversal in Brent options has pulled well away from call premiums that it had hit earlier this month and back to pricing puts as more expensive, implying investors are seeking more downside protection than upside exposure. Risk-reversals have essentially returned to their average level of the past year, stripping out the wide swings related to geopolitical threats or anxiety over OPEC+ decisions on production levels.

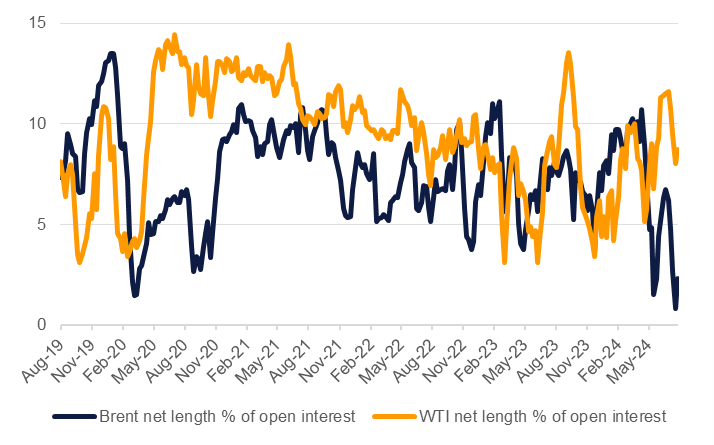

Speculative positions in Brent and WTI futures and options have also been shedding longs, cutting net length in four of the last five weeks in the Brent market and three of the last four in WTI. There was a modest close-out of some short positions in the past week in both markets but net length as a share of total open interest has fallen to just 2.3% as of August 13 in the Brent market, down from as much as nearly 11% in April this year when Iran and Israel directly exchanged fire.

Source: Bloomberg.

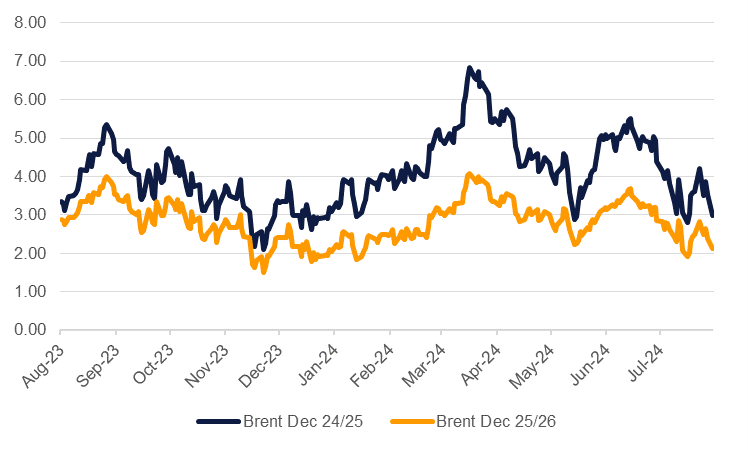

Source: Bloomberg.

Time spreads in both markets remain in fairly healthy backwardations given the broad negative macro themes with Brent 1-2 month spreads around USD 0.50/b and the same spread in WTI closer to USD 0.60/b. However, longer-dated spreads have been fading: Dec 24-25 has moved back toward USD 3/b in backwardation, down from over USD 5/b earlier in the summer with WTI futures showing a similar pattern.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Fundamental signals from the oil market are mixed. Data from China’s economy continues to underwhelm—industrial production extended its slowdown into July while construction activity has also been easing. The US economy is also showing signs of easing though not to a degree that would warrant emergency cuts from the Federal Reserve which could counter-intuitively be positive for oil if risk assets were to receive a boost from more accommodative policy.

OPEC+ is poised to return barrels to the market in Q4 but will be highly attentive to the risk sentiment currently at play. The producers’ alliance may need to temper their plan to increase production to forestall an expected surplus in Q4 24-Q1 25 but this strategy may arguably be already priced into the market. Any public dispute among OPEC+ members on where to take production from here could spark a more meaningful downside slump for oil.