Markets are steadier this morning with only a few new developments in the coronavirus saga, with a little bit of risk sentiment returning on signs that the rate of contagion from the virus might be stabilizing. Fed Chair Jerome Powell will deliver his semi-annual testimony on monetary policy before the House Financial Services Committee today. He is likely to reiterate that while officials are unlikely to cut rates in the near term, they are unlikely to be raised either, even if inflation were to rise above the 2.0% target. The Fed’s February Monetary Policy Report released on Friday said that coronavirus ‘could lead to disruptions in China that spill over to the rest of the global economy’. The Fed noted that the outbreak is occurring just as there were ‘tentative signs of stabilization’ with receding downside risks as the global trade conflicts diminished, as growth abroad showed signs of stabilizing, Apart from this the other focus will be on the on the New Hampshire Democratic primary, with Bernie Sanders once again the front runner to win.

Singapore could see a 25% to 30% decline in tourist arrivals and spending this year because of the coronavirus outbreak, according to the city’s head of tourism anticipating a worse impact than during the 2003 SARS pandemic. Singapore is losing about 18,000 to 20,000 tourists a day apparently, and the figures could fall further depending on how long the coronavirus crisis persists. China accounts for about 20% of Singapore’s tourism intake, the biggest single source of visitors ahead of Indonesia and India.

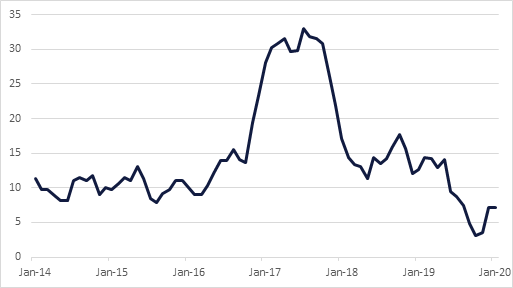

Egypt’s CPI inflation ticked up to 7.2% y/y in January, from 7.1% the previous month. On a m/m basis it rose from -0.2% to 0.7%. While this remains far higher than the multi-year lows seen in October and November (3.1% and 3.6%), it is nevertheless well within the CBE’s target range of 9% +/- 3 by year-end. While we do not anticipate any move by the MPC at its February 20 meeting, real rates remain over 5%, and we maintain our expectation of around 150bps of cuts later in the year.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as it continued to bear the brunt of potential impact of coronavirus relative to other risk assets. Yields on the 2y UST and 10y UST closed at 1.39% (-1 bp) and 1.57% (-1 bp) respectively.

Regional bonds traded in a tight range in line with moves on benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained below 3% at 2.98% and credit spreads widened to 147 bps.

The primary market saw some action with Emirates NBD raising USD 500mn in a 5 year paper which was priced at 125 bps over mid swaps. First Abu Dhabi Bank has also mandated banks for a possible 3y GBP paper.

The EUR has remained heavy amidst heightened political uncertainty in Germany yesterday as Chancellor Merkel’s designated successor Annegret Kamp Karrenbauer (AKK) yesterday announced that she is planning to step down as party leader and won't be the party's candidate in next year’s general election. The news adds to the sense of drift in the EU’s largest economy which will not help the single currency as growth remains challenging. Yesterday the

Eurozone Sentix investor confidence survey fell back in February. Although the headline number remained positive at 5.2, it dropped from 7.6 in January in the first set back since October last year. The breakdown showed that both the assessment of the current situation as well as the expectations reading fell back in February. The Aussie recovered overnight after data on December home-loan values beat estimates and as the news from China showed that the coronavirus spread might be stabilizing, with Asian equities also benefiting.

Developed market equities closed higher as investors continued to exude confidence in the global economy. The S&P 500 index and the Euro Stoxx 600 index added +0.7% and +0.1% respectively.

The DFM index (+0.5%) was a notable exception in what was another weak day of trading for regional equities. The KWSE PM index and the Qatar Exchange lost -1.0% and -0.5% respectively.

The DFM index was led higher by strength in Air Arabia (+4.7%) following company’s announcement of its 2019 financials. The airline reported FY 2019 net profit of AED 1bn compared to a loss last year. Further, the company provided an optimistic outlook for Q1 2020.

Crude oil futures extended their descent overnight with Brent losing more than 2% and WTI off by nearly 1.5%. A tentative recovery is underway in early trading today with Brent at USD 54.02/b, up 1.4%, while WTI has regained a USD 50/b handle and is up 1.2%. With no apparent OPEC+ action imminent the bias for crude prices looks lower in the short-term with a retest of USD 50/b in Brent and USD 45/b in WTI a possibility.

Forward curves in both Brent and WTI have now entrenched themselves in contango with the 1-2 month spread in Brent at USD 0.2/b and WIT at USD 0.29/b. December spreads have also now pushed into contango for Dec 20/21 in the Brent market.