The 8.1% m/m rebound in US consumption in May (data released Friday) was overshadowed somewhat by events over the weekend, with several US states pausing their re-opening schedule and reintroducing some restrictions as coronavirus cases surged ahead of the July 4th holiday. While spending data for the US and the Eurozone in May suggests there is pent up consumer demand, faster growth in the number of coronavirus cases and greater restrictions on movement may again weigh on sentiment, spending and employment in the coming weeks. Market focus this week will likely be on the June US payrolls data, due to be published on Thursday, with the consensus forecast at 3mn new jobs. Fed Chairman Jerome Powell’s will testify before the House Financial Services Committee on Tuesday, and the minutes of the last Fed meeting will be released on Wednesday.

The Central Bank of Egypt maintained its benchmark overnight deposit rate at 9.25% at its June 25 meeting. This marked the third consecutive meeting at which the MPC had elected to make no change to its interest rates, following the unscheduled 300bps cut made in March as the coronavirus pandemic began to take hold in the country. We expect that the bank will opt to keep rates on hold throughout the remainder of 2020, as potential inflationary pressures and the desire to maintain attractive real interest rates will preclude any further cuts. In other Egypt news, the IMF executive board approved the USD 5.2bn stand-by arrangement which was given staff-level approval some weeks ago. The funding will be disbursed in three tranches, with an immediate USD 2bn followed by two further payments subject to review.

Turkey’s central bank surprised on Thursday as it opted to keep its one-week repo rate on hold at 8.25%, the first time in 10 meetings that the TCMB has not cut rates. The bank cited inflationary pressures with headline CPI inflation picking up to 11.4% in May, pushing real rates deeper into negative territory at -3.2%.

Japanese retail sales rose by a smaller than forecast 2.1% m/m in May but were still down sharply y/y. In China, industrial profits rose 6% y/y in May after contracting -4.3% y/y in April.

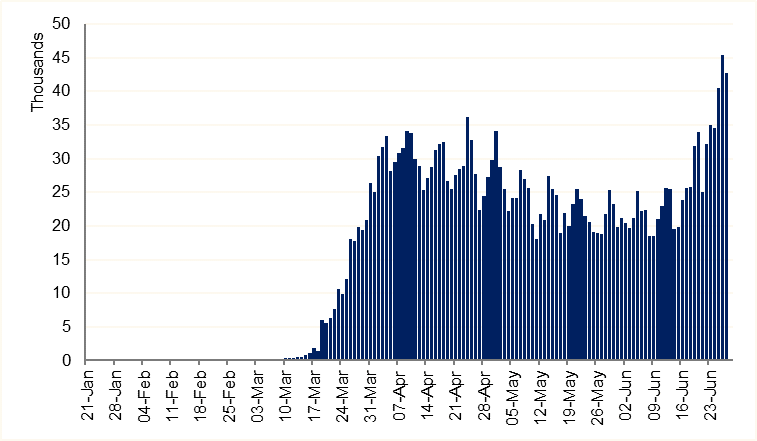

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

The surge in durable goods orders in May (15.8% m/m) and stabilization in the labour market wasn’t enough to prevent US treasury yields from slipping last week and see the curve bull flatten. Yields on 2yr USTs ended the week at 0.166%, a drop of almost 2bps, while 10yr yields fared worse, dropping by 5bps over the course of the week to close at 0.64%. The resurgence of Covid-19 cases in the US is fuelling a flight to safety, taking risk assets and UST yields down with it.

Emerging market bonds advanced last week although the pace of gains at just 0.14% in the Bloomberg USD EM index showed momentum was slowing. A drop in oil prices and anxiety over demand as Covid-19 cases mount again in key markets will act as a drag on EM assets generally and benchmark bond indices in particular, given their heavy weighting toward oil producers. The BUAEUL index of UAE USD-denominated bonds gained last week although spread compression was far more muted than we’ve seen over the past two months.

Saudi Arabia raised SAR 8.495bn in its June sukuk issuance, in three tranches with 7y, 10y and 15y maturity.

FX

Fears over a second wave of coronavirus infections has prompted a re-emergence in risk aversion, lending extra support to the dollar. Its DXY index, a measure of the dollar against a basket of its main trading partners, reversed almost all of the losses it experienced early in the week, but met resistance just above 97.600 to finish at 97.503. This marks a minor loss for the week of -0.12%. The USDJPY pair experienced a choppy week, but ultimately consolidated some modest gains of over 0.30% to close the week at 107.21. A break above the 50-day moving average (107.40) is on the cards, a level not reached since early June.

Despite briefly breaching the 1.1300 level early in the week, the euro ultimately declined towards the end of the week. Negative risk sentiment is affecting the euro but the single currency still recorded modest gains of over 0.35% to close at 1.1218. Sterling initially appeared close to recording massive gains, but declined heavily on Wednesday-Friday. Ultimately the currency slipped by just over -0.10% to finish the week at 1.2336. Similar to Sterling, the AUD and NZD looked to record vast gains but both currencies declined towards the end of the week. Still they both increased moderately to finish the week at 0.6865 and 0.6423 respectively.

Equities

Benchmark equity markets sank last week as fears over rising Covid-19 numbers weighed on the outlook for the rest of the year. The S&P 500 index gave up 2.9% while the FTSE 100 and Eurostoxx 500 both lost around 2%. Quarter-end rebalancing may also see some profit-taking after Q2 numbers showed a sharp improvement from the end of March when markets were in a tailspin: the S&P 500 had added more than 16% qtd up to the close on Friday.

Commodities

The rally in oil prices has started to stall as an acceleration in the number of Covid-19 cases globally threatens the viability of demand recovery. The reopening of several major US states has been put on hold as Covid-19 cases are increasing and in some instances posting record single-day numbers. Brent futures fell by 2.8% over the past week, setting at USD 41.02/b while WTI closed at USD 38.49/b, a more than 3% drop. For both benchmark oil futures last week was only the second weekly decline in the past nine weeks and falls in line with dissipating momentum in other risk assets—the S&P 500 index fell almost 3% last week while emerging market bond and equity indexes slowed their gains considerably.

Forward curves weakened in line with spot prices with longer-dated spreads all showing a wider contango last week. Front month Brent spreads are distorted by the pending expiry of August futures at the end of June. Dec spreads for 2020-21 widened to USD 2.37/b last week from less than USD 2/b a week before while in WTI the same spread increased to USD 1.46/b from around USD 1/b a week earlier.