Thin markets and wide ranging geopolitical tensions added up to heightened risk aversion yesterday, with little prospect that this will end fast as China held its cards close to its chest over its likely response to President Trump’s threats to impose more tariffs on Chinese goods. US Trade negotiator Lighthizer has reiterated that the US will indeed raise tariffs at the end of the week claiming backtracking on China’s part with regard to key promises that have been made in the negotiations to date. The key near term indicator is probably whether Chinese officials still travel to Washington for talks on Thursday. If talks proceed as scheduled, then the tariff hikes could be postponed again, but right now it is very unclear.

Economic data was not significant enough to move the dial much, although on the whole this was a little firmer than expected adding to the recent evidence of economic stabilization beginning to be seen. Eurozone retail sales were unchanged over the month in March, while February was revised up to 0.5% m/m from 0.4% m/m reported initially. The Sentix Investor Confidence index improved in May too, with the German index at the highest level since November last year, and the overall reading for the Eurozone also improving to 5.3 in May from -0.3 in April. To the extent that they mattered the final Eurozone April PMIs were also revised higher although they still signaled subdued growth. The services reading was revised up to 52.8 from 52.5 in the preliminary release, but still down from 53.3 in March. This left the composite at 51.5, also slightly above the flash report, but versus 51.6 in the previous month.

In a surprise move the RBA left interest rates unchanged at 1.50% this morning confounding market expectations that undershooting inflation would cause them to ease again from already historically low levels. The comments from the RBA meeting acknowledged the softness of inflation and indicated that further jobs need to be created before inflation is likely to meet the RBA’s target.

Source: Bloomberg,Emirates NBD Research

Source: Bloomberg,Emirates NBD Research

Investor sentiment was fragile yesterday as market awaits developments in the US-China trade negotiations. US treasuries were boosted by the safe-haven bid amid the rising volatility and uncertainty. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed lower at 2.29% (-4bps), 2.26% (-6bps), 2.47% (-6bps) and 2.88% (-3bps) respectively. Sovereign bonds in the Europe also had a bid bias. Yields on 10yr Gilts and Bunds closed at 1.22% (unchanged) and 0.004% (-2bps) respectively. Credit spreads in the developed world were mixed with 1bp increase in CDS levels on US IG to 59 bps but two bps decline in CDS spreads on the Euro Main to 59bps.

Regional GCC markets were steady with average yield on Barclays GCC index reducing by a bp to 3.96% on the back of benchmark yield tightening, though credit spreads increased 3bps to 156bps. Five year CDS spreads on GCC sovereigns were range bound with KSA, Qatar and Abu Dhabi closing unchanged at 78bps, 65bps and 57bps respectively.

In the primary market, Majid Al Futtaim remains to be priced. In the interim, Pearl Petroleum, partly owned by Dana Gas, stated plans to issue USD 300 million – USD 400 million in bonds to finance operations in Iraq’s Kurdish region.

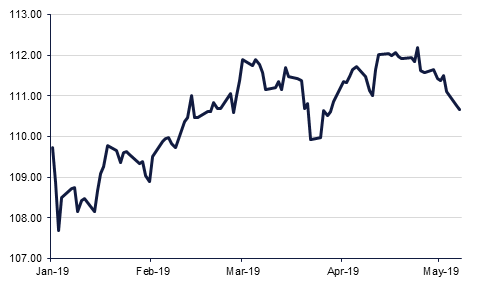

The JPY has been the main beneficiary of heightened trade war tensions, with renewed gains overnight after it curbed some of these yesterday as Wall Street attempted to rally. As we go to print, USDJPY is trading 0.11% lower at 110.64, just above the 50-day moving average (110.60) which was able to provide support yesterday.The CNY settled down to some extent after the losses the previous evening, but the market mood remains quite grim.

Elsewhere the AUD rallied in the aftermath of the RBA meeting today at which the central bank left interest rates unchanged. This morning AUDUSD is trading 0.65% firmer at 0.70371. We expect resistance at the 50-day moving average 0.7090 and support at the 23.6% one-year Fibonacci retracement (0.6962), a level which provided support yesterday.

Global stocks were mixed with a sell-off bias as investors assessed the impact of re-escalating trade wars. Though FTSE 100 gained 0.40%, S&P 500 slid 0.45% yesterday. Bourses in the Europe were hard hit with Euro Stoxx 50 closing down by 1.13%. In Asia, though China and Hong Kong recovered some of their previous losses, Korean and Japanese shares continue to slid. Nikkei is trailing down by 1.36% in early morning trades today.

GCC markets generally tracked their global counterparts. Saudi’s Tadawul closed down by nearly 3% and Abu Dhabi was not far behind, closing the day lower by 1.8%. Dubai index was amongst the more stable ones, closing lower by 0.9% mainly attributed to declines in real estate and banking shares.

Both benchmarks closed up modestly overnight, with Brent futures up 0.6% to USD 71.24, and WTI up 0.5% to USD 62.25/USD, and both are trading at around the same levels this morning. Oil futures had been down as much as 3.0% on Monday over renewed fears of trade wars between the US and China, and their impact on global demand, but this was shaken off as geopolitical concerns came to the fore. The US is sending a bomber force and an aircraft carrier strike group to the Arabian Gulf region, with US national security advisor John Bolton saying that the deployment sends an ‘unmistakable message’ to Iran, at a time of already heightened tensions.