.jpg?h=457&w=800&la=en&hash=934AB5D52A3E41F86D72C5E2324BC40F)

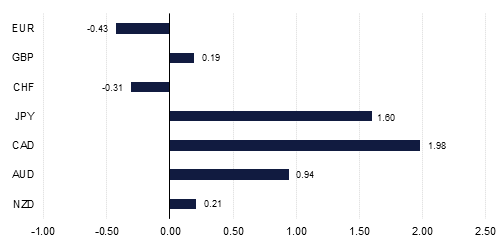

Risk aversion remained a dominant theme for the majority of 2019’s opening week. Amid thinner than normal market liquidity, softer than expected economic data out of the world’s two largest economies (U.S. and China) triggered renewed concerns about a slowdown in global growth. Under these circumstances haven currencies like JPY prospered while riskier assets like GBP found themselves under pressure.

However, a more cautious tone from Federal Reserve Chairman Jerome Powell and stronger than expected U.S. employment data reassured the markets on Friday, and the week ended on a more positive note. Powell conveyed some sympathy with market concerns about slower growth, but portrayed fears of a recession as premature and indicated the Fed’s preparedness to be patient when it comes to raising interest rates. Interestingly, he also ruled out resigning if requested to do so by President Trump, highlighting the Fed’s historic independence.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg