Initial trial results showed Pfizer Inc's experimental Covid-19 vaccine was more than 90% effective, a major milestone in the fight against a pandemic that has killed over a million people and battered the world's economy. Questions however remain around how effective the vaccine is for vulnerable groups and how long it will provide immunity, with experts believing the "new normal" of social distancing and face masks looks set to remain for the foreseeable future. The prospect of a vaccine jolted world markets higher with the S&P 500 and Dow hitting record highs as shares of banks, oil majors and travel companies soared. Pfizer expects to ask for broad US authorization for emergency use of the vaccine for people aged 16 to 85. To do so, it will need two months of safety data from about half the study's 44,000 participants, which is expected by the third week of November.

Sentix's investor confidence index for the Eurozone dropped to -10.0 in November from -8.3 in October, as investor morale fell for a second consecutive month. The decline was not as bad as feared (consensus was for -15.0) as lockdowns to curb the spread of the coronavirus did not hit the economy as hard as expected. The current situation index dropped to -32.3 from -32.0 the previous month. The expectations index dipped to 15.3 from 18.8, the lowest level since May. In Germany, the current situation index improved for the sixth consecutive month, reaching its highest level since March. Expectations in Germany however also dropped to their lowest level since May

EU Trade Commissioner Valdis Dombrovskis said the European Union will "regrettably" impose tariffs on imports of USD 4bn in US goods from Tuesday, hoping that President-elect Joe Biden will work to improve transatlantic ties. This came as part of a long-running US-EU battle over civil aviation subsidies in a case against US plane maker Boeing. The bloc would impose tariffs on US exports of planes and parts and a range of farm and industrial products, exercising the right to counter-measures awarded to it last month by the World Trade Organization. The US already had tariffs of USD 7.5bn on EU products which have been in place for over a year after a parallel WTO case against Airbus. The EU says the main objective of its measures is to persuade the United States to negotiate a solution.

Newly appointed Turkish central bank governor Naci Agbal issued a statement yesterday. Agbal intimated that there would be no change in monetary policy prior to the scheduled November 19 MPC meeting, saying that the situation will be reviewed until that date, and that ‘Necessary policy decisions will be made in the light of the data and evaluations to be formed.’ Nevertheless, the new appointment, and Agbal’s stated pledge that ‘Communication will be strengthened within the framework of transparency, accountability and predictability principles in monetary policy’ saw the lira strengthen to a two-week high.

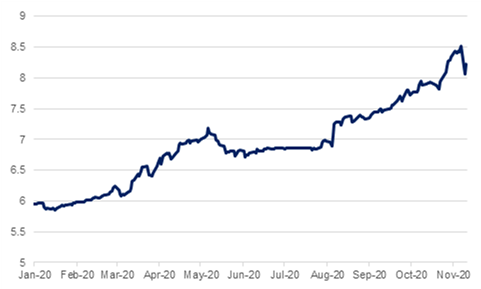

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

News that Pfizer had a successful run of testing its Covid-19 vaccine sent risk assets surging at the start of the week, already having been bolstered by the certainty of Joe Biden becoming US President-elect. Treasuries sank across the board as investors repositioned toward risk assets and away from havens. Yields on the 2yr UST moved up almost 2bps to 0.17% while the 10yr yield closed more than 10bps higher at 0.9235% after having hit an intraday high of more than 0.95%. The 2s10s curve steepened to more than 75bps on the expectation that a successful vaccine could be imminent, if not necessarily immediately deployed globally.

European bond markets responded in kind with yields on 10yr UK, German and French bonds up by 10-11bps each. Emerging market bonds rallied as well with the EM USD index gaining 0.4% on the day.

Fitch changed its outlook on Saudi Arabia’s sovereign rating to negative but affirmed the rating at ‘A’. Elsewhere in the region Oman seek to issue bonds with its holding in one of the country’s largest oil producing blocks as collateral.

Movement amongst major currencies in the wake of the US presidential election offered a mixed bag on Monday. The USD rallied following a surge in UST 10-year yields, off the back of the Pfizer vaccine news. The DXY index jumped from lows of 92.130 to 92.962 and now trades at 92.670. USDJPY was the biggest mover on the day, advancing by more than two big-figures to reach a high of 105.65, marking a break above the 50-day moving average of 105.28, but has since withdrawn from this position and now hovers around 104.85.

Broad-based USD strength caused the EUR to retreat from its highest point since September at 1.1920 and trades at 1.1830. Both the AUD and NZD recorded particularly volatile movement, with the former climbing to 0.7340 before dipping to 0.7280 whilst the latter rallied to its highest point since March 2019 at 0.6855 and currently trades at 0.6830. The GBP struggled to hold down major movement in either direction but has earned some modest gains this morning at 1.3185.

The positive news regarding the potential Covid-19 vaccine saw equity markets surge yesterday, building on the positive momentum already in play following President-elect Joe Biden’s victory in the US. The rally was global, with European equities doing particularly well as the CAC gained 7.6% and the FTSE 100 4.7%. In the US the outcome was a little more mixed, as the S&P 500 (1.2%) and the Dow Jones (3.0%) both benefitted from the news, while the tech-heavy NASDAQ (which has arguably been a major beneficiary of this year’s disruption, up 30.6% ytd) lost 1.5% on the day. The momentum has carried through to Asia this morning, with indices there all moving higher in early trading.

Oil prices jumped on the back of the Pfizer vaccine news as well as indications from OPEC+ energy ministers they were prepared to be flexible on the bloc’s production plans. Brent futures gained 7.5% to settle above USD 42/b while WTI was up 8.5% and closed above USD 40/b. Optimism that a vaccine will be deployed could transform behaviours if it is deployed widely, allowing a recovery across the barrel, particularly in jet fuel.

Prince Abdulaziz bin Salman, Saudi Arabia’s energy minister, said that OPEC+ cuts could be prolonged throughout 2022 while his UAE counterpart, Suhail al Mazrouei, said that OPEC+ was ready to adjust its production cut targets as needed.

Gold prices dumped as investors fled havens in response to the vaccine news. Spot gold fell more than 4.5% to USD 1,863/troy oz, bringing down the rest of the precious metals complex with it.