.jpg?h=457&w=800&la=en&hash=9D25BC49271F183D10B135CBF7C6FA0E)

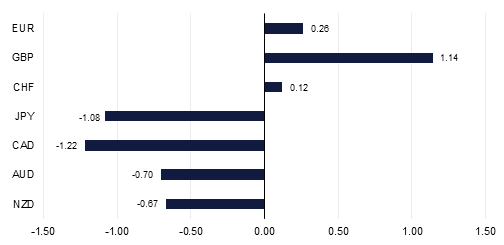

Risk appetite is benefiting from an easing in trade tensions, better than expected U.S. Q4 GDP data, the FOMC’s dovishness and expectations that the ECB may provide more stimulus measures. These are more than compensating for the breakdown of the U.S. - North Korean nuclear talks and the overhang of Brexit, although even this is becoming less of a concern as the threat of ‘no-deal’ appears to fade. This week's calendar of data and events includes China's National People's Congress, U.S. non-farm payrolls data and ECB, BoC, and RBA policy meetings. The outcomes of these could go a long way in setting direction for the rest of the month, but for the time being currencies are being supported and safe havens and the USD are out of favour, with the GBP and EUR rising and the JPY losing out. Furthermore, the USD is likely to feel the impact of President Trump’s weekend comments in which he argued for a ‘little bit lower dollar’ and criticized the Fed for raising interest rates.

Recession fears in the U.S. were at least partially cooled by better than expected Q4 GDP data, which rose by 2.6% on an annualized basis. The result included a solid contribution from domestic consumption and capital investment, although with retail sales having tailed off in December (-1.8% m/m) and personal spending also dropping (-0.6%), the omens for Q1 are probably much less favourable, especially with the February ISM manufacturing index declining as well. Attention will now be on the February employment report and a number of other delayed indicators, with markets currently expecting the labour market to remain firm. Fed Chairman Powell will also remain a focal point as he will be discussing Monetary Policy Normalization at Stanford University at the end of the week, although he is expected to reiterate the Fed’s patient approach.

In China the National People's Congress will start on Tuesday, and could announce new GDP growth targets. Key data on manufacturing activity, external trade and inflation will also be watched closely by the markets and by policymakers. Australia's RBA and the Bank of Canada both have policy meetings scheduled, with both seen on hold, with rates steady at 1.50%, and 1.75% respectively. The ECB policy meeting will be the other major event, with markets expecting less hawkish guidance by President Draghi.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg