.jpg?h=457&w=800&la=en&hash=3EABC07259C07F413FBBF51D9A9F8264)

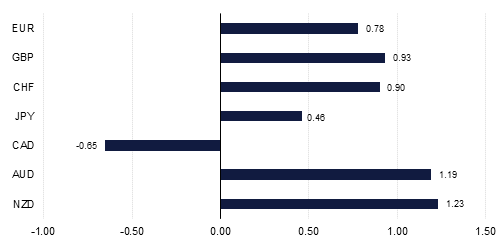

Risk on sentiment was boosted by strong US jobs data at the end of last week, which reinforced the better than expected Q3 GDP growth data (1.9%) seen earlier in the week. U.S. October nonfarm payrolls increased 128k after an upward revised 180k gain in September and 219k in August, leaving a much stronger profile of jobs growth over the last three months. The unemployment rate rose slightly to 3.6% from 3.5% previously and average hourly earnings were up 0.2% versus the prior unchanged reading and were steady at 3.0% y/y. With equities and bond yields improving currencies also benefited at the dollar’s expense, with most major currencies recording gains on the week. Expectations about further cuts in US interest rate have not surprisingly diminished, although we still retain a further 25bps cut in our forecasts for next year reflecting the uncertain landscape both politically as well as economically in 2020 in the US.

The improvement in US data also complemented sentiment as regards to the trade talks and Brexit which have both entered a period of limbo. US trade talks with China will continue, as the two sides work towards a “phase one” deal, but with the APAC summit in Chile having been cancelled, there is no longer a mid-month deadline to which the negotiators are working, and White House Economic adviser Larry Kudlow has said that tariffs could still be introduced in December if a deal is not agreed. The UK Brexit process has also been effectively suspended for the period of the general election campaign in the UK, which will get underway properly in the coming week. The Bank of England meets as well but no change in the 0.75% policy rate is expected.

Likewise in Australia the RBA is expected to leave policy rates unchanged at 0.75% for now. Otherwise the week is a relatively quiet one with a few activity indices likely to be the main focus. In the US the non-manufacturing ISM index will be watched, following the disappointing manufacturing index which only recovered fractionally in October to 48.3 from 47.8 in September, still signaling contractionary forces. China’s service sector PMI is also released while in our region the PMIs for October are also published. Germany will see industrial production data which is likely to be soft, while the UK services PMI is also expected to remain in contractionary territory, with the composite PMI also below 50.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg