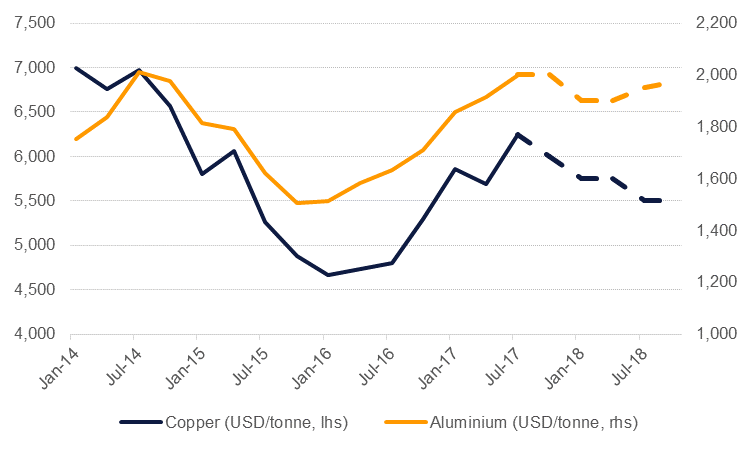

Base metals have been the commodity story of Q3, comfortably outpacing gains in gold and oil. Copper prices have broken above USD 6,900/tonne and momentum looks set to carry them above USD 7,000/tonne while aluminium prices have left the barrier of USD 2,000/tonne well behind. As a consequence of these strong gains we are marking our forecasts to market and revising our 2017 forecasts higher. We now expect that LME copper will average USD 5,950/tonne in 2017 (up USD 350/tonne from our prior forecast) and that LME aluminium will average around USD 1,950/tonne (compared with around USD 1,870/tonne previously).

However, we hold to the narrative that we outlined in our last Monthly Insights where we view the current rally to have moved beyond the outlook for fundamentals. In copper markets in particular, the resolution of a standoff between Indonesia’s government and Freeport-McMoran over the Grasberg mine will remove one of the supply disruptions that had provided legs for the current rally. Labour disputes will remain a catalyst for short-term rallies in copper, particularly if unions are motivated to seek more participation in the currently high prices. But high prices will encourage miners to proceed with bringing new output online with mines in Latin America and central Africa expected to begin production.

In the near term, the market is flashing warning signals that the rally is long in the tooth. Copper positioning is at extreme levels which could prompt a sharp sell off as long positions are liquidated: the long/short ratio in LME positions is near record levels. Copper inventories have also fluctuated substantially this year but not to points where we would consider the market stressed. As evidence, the copper market has moved into a deeper and deeper contango steadily all year with the cash-three month spread currently around USD 30/tonne.

In aluminium, we expect the outlook for 2018 to be brighter with prices sticking close to our forecast for 2017. The market has recovered strongly this year thanks to expectations of capacity closures—both permanent and temporary for the Chinese winter heating season. Provided the global economy does not decelerate significantly next year demand for aluminium should remain robust and contribute to a narrower market surplus.

We are hesitant that the restart of the Warwick smelter in the US is part of a broader trend of aluminium output increasing in OECD markets. If the US did impose tariffs on imports of Chinese metal that could prompt more activity in the US but metal trade policies may be low on the list of administration priorities as it needs to grapple with geopolitical tensions and a likely stand-off over the budget and debt ceiling.

Nor are we optimistic that the currently high aluminium prices will see output in other high cost regions. The Australian Energy Market Operator, the grid operator, warned that the country could be facing blackouts in the coming summer months as the country faces an exceptionally tight electricity market.