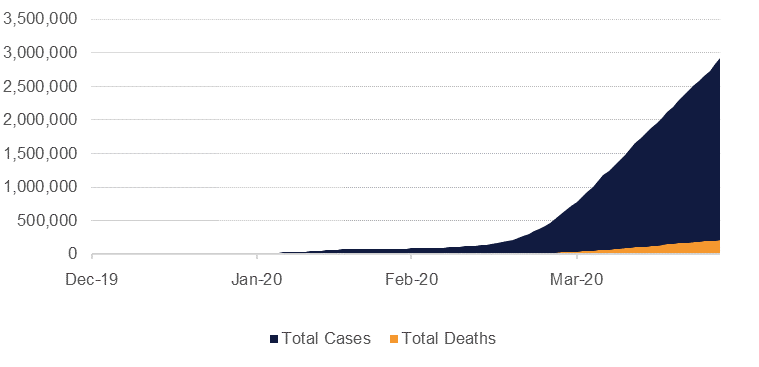

Global measures to ease the coronavirus lockdown are moving ahead as countries prepare staged ends to their lockdowns. Italy, which recorded world’s second-highest number of coronavirus deaths at around 27,000 will permit factories and building sites to reopen from May 4 and allow limited family visits. In New Zealand activities such as fishing, surfing, hunting and hiking will be allowed again for the first time in more than a month. Norway allowed range of small businesses, including hairdressers to open and sent first to fourth grade students back to school. In the United States several states including Georgia and Oklahoma and took tentative steps at restarting businesses on Friday, despite disapproval from medical experts and president Donald Trump. The UK on the other hand is sitting tight, with Prime Minister Boris Johnson making clear there will be no swift lifting of the lockdown but said plans for easing curbs would be outlined in the coming days. Globally coronavirus infections have reached close to 3 million with deaths crossing 200,000.

The Bank of Japan on Monday pledged to buy an unlimited amount of bonds to keep borrowing costs low as it tries to spend its way out of the economic pressures from the coronavirus pandemic. The move comes as policy makers in the country take more steps to expand its monetary stimulus after easing monetary policy a just month back. The BOJ also sharply revised its economic forecasts and projected inflation would be below its 2% target for three more years, indicating its near-term priority will be battling the current crisis. The BOJ will boost the amount of corporate bonds and commercial paper it buys to 20 trillion yen and committed to buy an unlimited amount of government bonds cancelling a previous guideline that limited those purchases to an annual celling of 80 trillion yen. BOJ Governor Haruhiko Kuroda said the purpose was to keep yields stable and low, which in turn could bolster the impact of fiscal spending.

In a step forward for GCC investments in food security, Saudi Arabia’s state grain buyer SAGO announced it bought 60,000 tons of wheat from an investment it made in Ukraine, marking the first time the kingdom executes a purchase from a food security investment. GCC countries are highly dependent on food imports that cover up to 90% of their domestic needs and have been investing heavily in agricultural and food security assets around the world to secure their domestic needs, particularly as hedge during periods of stress. The purchase comes as food importers in the region are pushed to bolster their reserves as the coronavirus lockdowns disrupts global supply chains.

Source: European Centre of Disease Prevention and Control, Emirates NBD Research

Source: European Centre of Disease Prevention and Control, Emirates NBD Research

Fixed Income

Treasuries closed lower as risk sentiment prevailed at the start of the week. Gains were led by the long end and the curve bear steepened. Yields on the 2y UST and 10y UST closed at 0.22% (flat) and 0.66% (+6 bps) respectively.

Regional bonds shrugged off decli ne in oil prices. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -2 bps to 4.23% and credit spreads tightened 7 bps to 359 bps.

Riyad Bank said it will redeem a SAR 4bn subordinated tier 2 sukuk on June 24 2020. The sukuk was set to mature on 24 June 2025.

The dollar's downside momentum continued from last Friday with the dollar weakening as risk sentiment improved slightly on the prospect of an easing of lockdown restrictions around the globe. It's DXY index dropped below the crucial 100.000 price but found support at 99.850 and has since partially recovered, now trading at 100.100 this morning. Subsequently the JPY experienced an uptrend, briefly touching the 107.00 mark but met resistance here and now trades at 107.30. The Bank of Japan announced additional stimulus in the fight against the coronavirus, stating that they will purchase as many government bonds as they need.

The Euro traded positively against the dollar for the majority of the day but reversed all of its gains in the evening, now trading at 1.0825. Sterling remained bullish for the whole day, spurred on by Prime Minister Boris Johnson's return to work. Buyers of the pound were encouraged by speculation that he may move towards lifting some lockdown restrictions. The AUD increased by over 1.40% to reach its highest level in over a month yesterday, but has seen a slight reversal in some of those gains this morning currently hovering around 0.6435 whilst the NZD has dropped to 0.5995.

Developed market equities closed higher as investors focused on plans to ease lockdown measures by increasing number of governments. Weakness in energy prices had negligible impact on investor sentiment. The S&P 500 index and the Euro Stoxx 600 index added +1.5% and +1.8% respectively.

Regional equities also built on the positive start to the week. The DFM index and the KWSE PM index added +1.5% and +1.6% respectively. Banking sector stocks led the rally on the DFM index and the KWSE index. First Abu Dhabu Bank (-3.5%) was an exception as the bank reported a 22% y/y decline in Q1 2020 profits. Petrochemical stocks did come under pressure following decline in oil prices.

Oil markets are presently beholden to fund investors moving positions out of near-dated contracts to avoid having to take delivery of any barrels, leaving prices vulnerable to excessive and volatile moves. WTI fell 25% overnight and if that wasn’t enough is already down by more than 15% in early trading today at less than USD 11/b. Brent was down less, by 6.8%, but is back below USD 20/b and is threatening to move even lower in trading this morning (down 4.7%). Brent futures expire at the end of this week but unlike WTI they can be cash settled so avoid the issue of where to take delivery of an underlying physical position.