The US Federal Reserves raised benchmark interest rates by 25bps last month to 1.50% - 1.75% range and retained its projection of only two more rate hikes this year even though GDP growth and inflation expectations were revised slightly upwards. Overall messaging from the Fed was not as hawkish as expected and although sentiment remains fickle, it provided some short-term support to bond and sukuk markets via lowering of the benchmark UST yield curve. Yields on 2yr, 5yr, 10yr and 30yr treasuries closed the month at 2.27% (+2bps m/m), 2.56% (-8bps m/m), 2.74% (-12ps m/m) and 2.97% (-15bps m/m) respectively.

Consequently, sukuk portfolios did well. Total return on Markit iBoxx Emirates NBD USD Sukuk index for the month was a gain of 0.08%. Excluding the benefit of coupon collection, the return on index would have been a loss of -0.25% as a result of the interest rate hike during the month.

Despite solid economic growth and 10% increase in oil prices during the month, sukuk market generally suffered from pressures exerted by a) large new supply; b) fears of trade wars being more negative for EM markets than the DM markets, c) fears of capital outflow from EM bonds as yields rise in the DM world; and d) negative rating trend. During the month, yield on average GCC sukuk universe increased by 9bps to 4.47%.

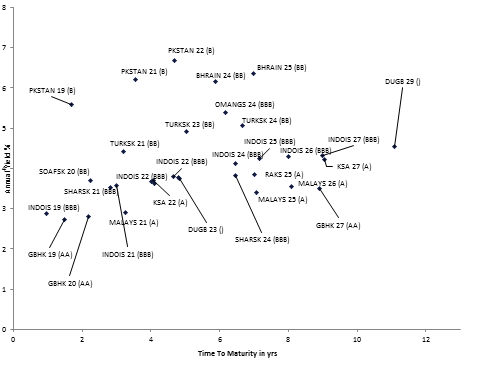

Looking at current yields, we make following relative value observations:

In the sovereign sector :

Click here to Download Full article