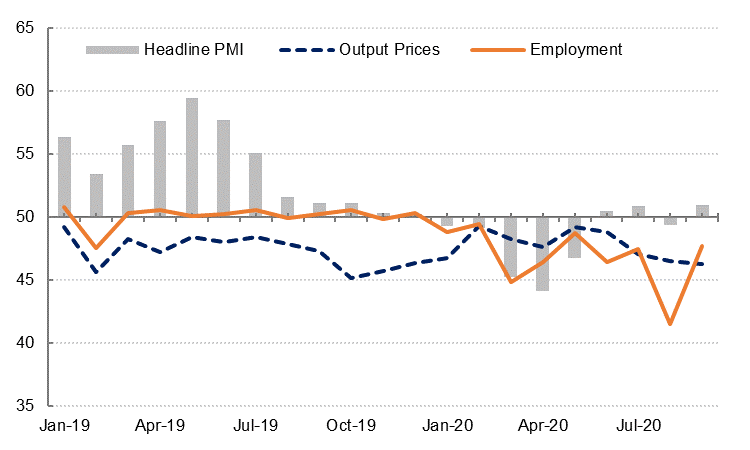

The UAE’s headline PMI rebounded to 51.0 in September from 49.4 in August, the highest reading since October 2019 but still only signaling a slight improvement in business conditions last month. Output rose at a faster rate than in August, while new order growth was unchanged. At least some of the improvement in domestic demand was likely driven by price discounting, as selling prices declined at the fastest rate this year. Seasonal summer sales may have been delayed this year due to the coronavirus restrictions. Nevertheless, the continued squeeze on margins is not helping what IHS Markit described as “ongoing cash flow issues” for businesses.

With a continued focus on cutting business costs, firms again reduced headcount in September, although not at the same rate as in August. The employment index improved to 47.7 last month from 41.5 in August, although it remained in contraction territory for the ninth month in a row. Firms also reduced their quantity of purchases in September for the first time since May, and inventories declined slightly.

Panelists were slightly more optimistic about their future output in September but many remained concerned about a subdued economic recovery.

The average PMI for Q3 was 50.4, which signals a stabilization/ slight expansion after the contraction in Q1 and Q2. We expect the recovery to gain momentum in Q4, although for the year as a whole we expect UAE GDP to contract by -5.5%.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

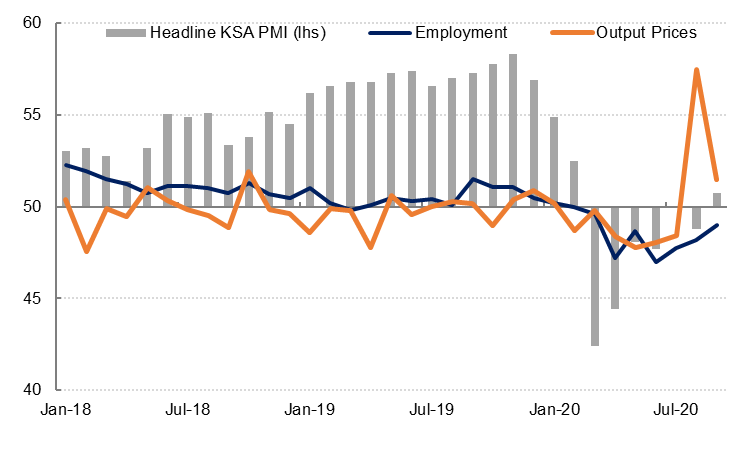

Saudi Arabia’s PMI rose to 50.7 in September from 48.8 in August, the highest reading since February. Private sector output and new orders increased for the first time since February, although the rate of growth was modest. Export orders also increased in September, by the most in a year. Despite the rise in output and new work, employment in the private sector declined again in September but at the slowest rate since March.

Both input and output price growth slowed in September, as the higher VAT rate was reflected in the August survey. Firms in Saudi Arabia were the most optimistic about their future output than they have been in seven months.

The average PMI for Q3 was 49.8, fractionally in contraction territory, but essentially indicating a stabilization after the coronavirus-driven contraction in Q2. We expect growth will continue to recover in Q4 but forecast GDP to shrink by just over 5% in 2020.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Egypt’s headline PMI rose to 50.4 in September, the first reading above the neutral 50-level in 14 months. Output and new orders increased m/m as coronavirus restrictions continued to be lifted, with the latter supported by higher new export orders growth. Employment in the private sector declined at the slowest rate since November 2019. Input cost inflation eased for the third month in a row, and firms were able to pass on some of these higher costs to buyers. As a result, selling prices increased at the fastest rate in a year in September.

After rising sharply in July as coronavirus restrictions were lifted, Qatar’s PMI declined to 51.4 in September as both output and new work growth slowed. Employment in the private sector was slightly lower again in September, although the rate of job shedding in Q3 was weaker than in Q2. Input costs declined for the first time in three months as supply chain disruptions eased. Selling prices declined for the first time since June as firms offered discounts on goods and services.