The RBI cut rates by 35bps at its latest meeting, taking repo rates to 5.4% and bringing the total scale of easing to 110 bps so far this year. Growth in India has been flagging this year with services and consumption contracting according to high-frequency data. All previous cuts from the RBI in 2019 had been 25bps and the larger move this month likely reflects a push by the RBI to improve the transmission of easier monetary policy through the banking system. The RBI will maintain an ‘accommodative’ monetary policy stance while it downgraded growth expectations for the 2019/20 fiscal year to 6.9% from 7% previously. As inflation remains below the target level of 4%, the RBI has scope for more rate cuts later this year.

German industrial production contracted much more than had been forecast in June, falling -1.5% m/m (-5.2% y/y), the sharpest annual decline since 2009. The May reading was revised lower as well, increasing the likelihood that GDP contracted in Germany in Q2. Recent survey data suggests that industrial output declined further in July (the German manufacturing PMI fell to 43.2 last month).

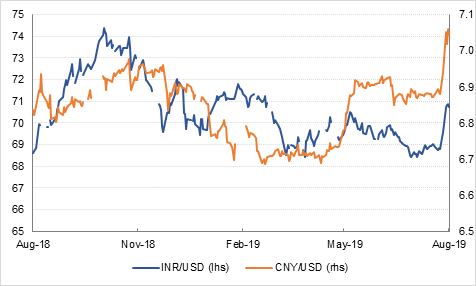

China’s FX reserves declined by just over USD 15bn in July to USD 3.104tn, mostly likely reflecting valuation effects rather than direct intervention. China’s trade surplus declined by less than expected in July, with exports rising 3.3% y/y against forecasts for a -1.1% decline. Imports fell by -5.6% y/y last month, a smaller drop than was recorded in June, and also better than had been expected. While the PBOC fixed the yuan weaker than 7/USD this morning, the fixing was stronger than the market had been expecting at 7.0039/USD.

Bloomberg reports that Saudi Arabia has contacted other oil producers to discuss possible measures to stem the decline in oil prices, prompting a recovery in both WTI and Brent this morning.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

The UST yield curve moved in a tight range albeit with slight hawkish bias in the belly part of the curve, after China’s stronger than expected daily fixing of its currency eased fears about a worsening trade conflict. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed at 1.59% (Unchg), 1.47% (+1bp), 1.61% (+1bps) and 1.84% (-1bp) respectively. That said, sovereign bonds across the pond had a bid bias with yield on 10 yr Gilts and Bunds falling 3bps to 0.48% and 5bps to -0.59% respectively as economic data continued to remain week, particularly out of Germany. Credit protections costs were range bound with CDS levels on US IG remaining unchanged at 60bps but those on Euro Main widening a bp to 58bps.

Fluctuating oil prices had minimal impact on GCC bonds with credit spreads on Bloomberg Barclays GCC index remaining unchanged at 173bps, though previous day’s fall in benchmark yields translated into yield on the index falling 6bps to 3.34% yesterday.

This morning the AUD is trading firmer against the other major currencies, following a stronger than expected fixing rate for CNY. After easing investor concerns over trade and currency wars, AUDUSD is trading 0.26% higher at 0.67751. However, the price still remains below the 23.6% one-year Fibonacci retracement, 0.6860, and as a result the medium term outlook remains fragile for the cross.

Global equities had a bit of relief rally amid signs of easing currency war fears. S&P 500 rose 0.08%, FTSE was up by 0.38% and Euro Stoxx closed in the green by 0.56%. Stocks in Asia are also in the positive territory this morning. China’s Shanghai Composite rose from the lowest level since February , Nikkei is up 0.57% and Hang Seng is trailing at +0.67% now.

Regional GCC equities followed suite with their global counter parts with most markets closing up yesterday. Dubai index climbed 1.2%, followed by 1.06% gain in the Tadawul and 0.93% gain in Muscat SM30. Abu Dhabi index was also up by 0.74% though Bahrain remained subdued, closing marginally down by 0.06%.

Oil prices pitched lower again thanks to an unexpected build in US crude inventories and the market taking only tentative risk positions in the wake of US-China trade tension. Brent futures fell 4.6% to close at USD 56.23/b and WTI collapsed 4.7% to finish trading just above USD 51/b. Both benchmarks are in bear markets with Brent down almost 23% from its peak of USD 74.57/b this year and WTI down almost 21% from its peak level.

OPEC commentary has helped to support markets somewhat this morning although we are skeptical how effective cutting production or exports even more would be in turning around attitudes toward crude in the current market. Cutting production or exports at this stage may see prices in Brent rebound back up to USD 60/b but not catalyse much more upside beyond those levels.

US crude stocks rose by 2.4m bbl last week along with healthy builds across much of the rest of the barrel. Total inventories of crude and products rose 10.4m bbl last week, helping to keep inventories well above their five-year average. Production rose to 12.3m b/d, up 1.5m b/d on year ago levels.

Gold prices closed above USD 1,500/troy oz for the first time since 2013 thanks to a 1.8% gain. Gold’s escape velocity from the atmosphere of risk hitting financial markets helped to drag silver higher (up almost 4%) as gold’s sister metal operates with a higher beta while platinum closed up 1.7% and palladium fell back 1.5%. Should trade war fears directly hit movements in vehicles shipments, platinum group metals could be at risk of a sharp move downward.