.jpg?h=457&w=800&la=en&hash=9E37F2BC944A149D519FCBDE650312C6)

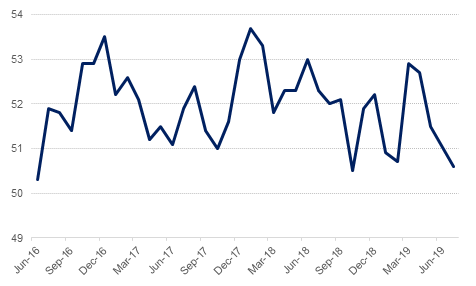

The Reserve Bank of Australia cut key interest rates to a record low of 1%, in its first consecutive monthly reductions since 2012. In terms of data, composite PMI for June came in at 52.5, down from 53.1 in the previous month while the services PMI dipped to 52.6 from 53.3 earlier. The RBA stated that depending on developments in the labour market, it may adjust monetary policy further if needed to support sustainable growth in the economy and the achievement of its inflation target over time.

Economic growth in the China continues to drag downwards. The Caixin China composite PMI reading fell to 50.6 in June from 51.5 in May. The services component fell more than concensus to 52.0 from 52.7 in the earlier month, albeit still well in the positive territory. In Europe, retail sales in Germany fell 0.6% m/m in May versus expectations of 0.5% growth. Though it reflects a healthy 4% increase over the prior year, the m/m fall points to continued slowing in sentiment and activity in the EU’s largest economy.

The UAE federal government has approved up to 100% foreign ownership of businesses in 122 economic activities across 13 sectors, including transport, construction, entertainment, e-commerce and renewable energy. However, each emirate can decide the maximum foreign ownership allowed within its jurisdiction. The government first signalled that foreign ownership limits would be lifted last year, but details were only released on Tuesday. The implementation timeline and individual emirate’s decision on exact allowed ownership on various activities and sectors is yet to be finalised. Though it will boost UAE’s position as a business friendly hub, overall impact on GDP growth is likely to be small in the foreseeable future.

As per media reports, Saudi Arabia has revived plans for the Aramco IPO. Expected timeliene is 2020/2021 though details about mandated banks, exchanges to be used, size and amount to be offered etc are yet to surface.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

BoE Governor Mark Carney’s comment that rising protectionism risks a widespread slowdown in the global economy that may require a major policy response fuelled safe haven bid. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed lower at 1.76% (-3bps), 1.74% (-5bps), 1.97% (-5bps) and 2.50% (-5bps) respectively and further strengthened market conviction about upcoming rate cuts. Following suit, yield on 10 yr Gilts dipped 9bps to 0.72%, the lowest in almost three years while those on 10yr Bunds declined a bp to -0.37%, the lowest on record. Nevertheless credit protection costs declined yesterday with CDS spread on US IG and Euro Main closing down by a bp each to 52bps and 50bps respectively.

Weaker oil prices did little to help GCC credit spreads that widened two bps to 164bps on the back of uncertain macro outlook, though average yield on Bloomberg Barclays bond index declined 2bps to 3.54% in response to falling benchmark UST yields.

In the primary market, the A+/A1 rated Saudi Arabian government priced EUR 1 billion in 8 year tranche at MS+80bps and the EUR 2 billion 20 year tranche at MS+140bps, nearly 30 bps lower than the IPT. Also Burgan Bank priced its USD 500 million Tier 1 NC5 perp security at 5.75%.

Following market expectations that policy makers will not lower interest rates at their meeting on July 25th, the euro is trading slightly firmer this morning and EURUSD is currently 0.06% higher at 1.1290. Having peaked at 1.1321 in the aftermath of the reports, some of the gains were soon pared as investors began to anticipate that the European Central Bank will use July’s meetings to pave the way for an interest rate cut in September. In addition, the EURUSD rebound was kept in check by the announcement that the European Union had nominated IMF Director Christine Lagarde to be Mario Draghi’s replacement.

Elsewhere, after the RBA lowered interest rates for the second time in 2019 on Tuesday, to a record low of 1.00%, the AUD remains below the 0.70 level. With Governor Lowe communicating that the central bank is prepared to cut rates further if it is deemed necessary to support growth and inflation, the RBA remains the most dovish central bank. This is likely to keep the AUD under pressure, despite the temporary trade truce between the U.S. and China.

Rising expectations of central banks’ put continued to support global equities, most of which inched higher yesterday despite ongoing trade tensions. Dow Jones and S&P 500 closed up by 0.26% and 0.29% respectively after FTSE 100 and Euro Stoxx recorded gains of 0.82% and 0.30% respectively. That said enthusiasm appears to be fading this morning with most of Asia opening in the red. Nikkei and Hang seng are nursing losses of 0.67% and 0.26% respectively so far in early morning trades.

Local equities were little changed with Dubai index closing up by 0.2% and Abu Dhabi closing nearly flat with less than AED 100 million in total trade value. Tadawul gave up some of earlier gains and lost 0.21% though Qatar gained 0.17% yesterday.

OPEC and its partners in cutting production have agreed formally to extend production cuts until the end of Q1 2020 and cooperate in a more organizer manner in addressing oil market balances. Extending the cuts was a foregone conclusion given the soft levels of demand growth expected for the rest of the year and an uncertain outlook for global growth next year. However, non-OPEC suppliers are still expected to post strong levels of growth so the effectiveness of the cuts in pushing prices close to fiscal breakeven levels for producers in the GCC will be limited.

Oil markets gave an immediately negative verdict to how effective they think extended production cuts by OPEC+ will be in getting markets close to balance or into stockdraws. Brent futures fell more than 4% overnight to USD 62.40/b while WTI dropped 4.8% to close the day at USD 56.52/b.