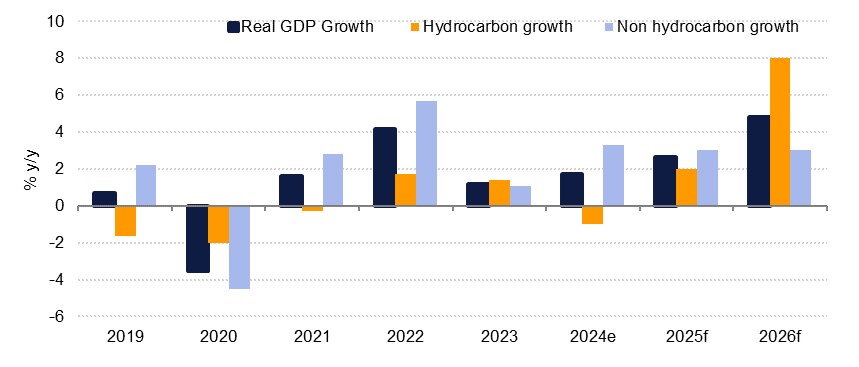

Qatar recorded real GDP growth of 2.0% y/y in Q3 2024, up from 0.7% the previous quarter and the strongest pace of growth since Q2 2023. On a quarterly basis the economy grew by 1.9%. Growth was driven by the non-hydrocarbons sector which expanded by 4.5% y/y, up from 2.7% previously, while the ‘mining and quarrying’ component of GDP contracted on an annual basis for the second quarter in a row, falling 2.3% y/y following Q2’s 2.6% decline. Annual growth over the first three quarters of the year came in at 1.4% and while we estimate a modest improvement through the final quarter, we have revised down our 2024 growth figure to 1.7%, from 2.0% previously. In 2025, we forecast that headline GDP growth will pick up to 2.6% as the hydrocarbons sector returns to growth and the non-hydrocarbons sector maintains its pace, before accelerating to 4.8% in 2026 as more gas comes online.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

LNG exports from Qatar over the course of 2024 were down 1.1% y/y, which has weighed on output from the hydrocarbon economy. Looking at industrial production data, extraction of crude oil and natural gas averaged a y/y decline of 3.0% over January to September, with the latest figure showing a 4.8% contraction. The outlook for the coming years is more positive, however, with substantial investment into developing new natural gas fields likely to boost activity both in the near term, as extraction capabilities are developed, and over the longer time horizon as they start producing. As such, after a projected return to growth at 2.0% in this year, we forecast that hydrocarbons growth will accelerate to 8.0% in 2026.

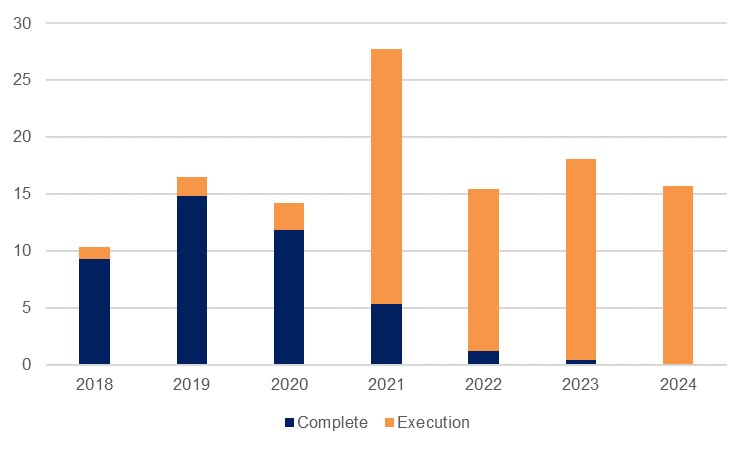

The LNG expansion should also prompt some spillover benefits for the non-hydrocarbon economy over the next several years. Growth has been somewhat softer following the FIFA World Cup, averaging a quarterly rate of 2.3% over Q1 2023- Q3 2024, compared with an average pace of 4.3% over 2021-2022 (though this was also somewhat boosted by post-pandemic reopening), with much of the planned project work completed for the event. Nevertheless, activity has been picking up, and building and construction logged y/y growth of 7.7% in Q3, its strongest pace since Q1 2023. According to MEED Projects data there remains USD 77.2bn worth of contracts awarded still in the execution stage which will be supportive of activity through the coming years. Respondents to the Qatar Financial Centre PMI survey in December cited industrial development and investment in infrastructure among the reasons behind their business optimism.

Source: MEED Projects, Emirates NBD Research

Source: MEED Projects, Emirates NBD Research

A major success story in Qatar’s GDP results has been the transport & storage and the accommodation & food services sectors, which averaged 7.4% y/y and 6.7% y/y respectively over the three-quarter period. Qatar saw a new record of 5.1mn visitors in 2024, up 25.5% y/y, which will have supported the country’s hospitality trade in addition to boosting numbers through Hamad International Airport. The ongoing growth of Qatar Airways has also been supportive of increased transit traffic at the facility, and the airport logged 25.9mn passengers in H1, up 25% y/y, while freight handling was up 12%. With ongoing investment in new tourism infrastructure and advertising in international markets we would anticipate a robust pace of growth to continue through the next several years.

The economy more generally should receive a boost from further interest rate cuts over the next 12 months as the Qatar Central Bank has been cutting in tandem with the US Federal Reserve but at a slightly quicker rate, lowering the overnight lending rate by 115bps so far compared with the Fed’s cumulative 100bps of cuts. We expect a further 75bps reduction to the Fed funds rate over the course of 2025 which should be at least matched in Qatar, giving a boost to private sector activity both in terms of households and businesses. Reduced price pressures should also be supportive of activity, and we forecast an average CPI inflation rate of 1.0% y/y in 2025, compared with 3.0% in 2023 and an estimated 1.3% last year.