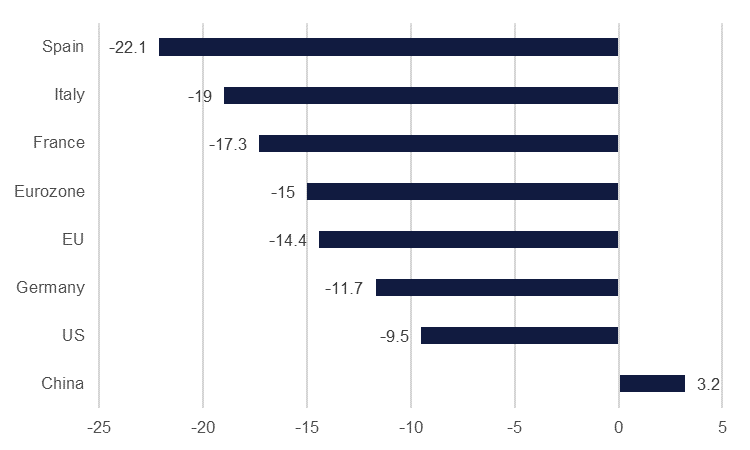

There were a number Q2 GDP releases at the close of last week, which largely confirmed fears regarding the massive impact of the coronavirus pandemic and related lockdowns on the global economy. The Eurozone saw a y/y contraction of -15.0%, with France (-17.3%), Italy (-19.0%) and Spain (-22.1%) among the worst affected, while Germany fared a little better, shrinking by ‘only’ -11.7%. The contraction has eradicated a decade’s worth of European economic growth. In the US, the annualised q/q growth rate indicated that the economy shrank by a staggering -32.9%, only slightly better than analyst expectations of -34.6%. The y/y rate was -9.5%. A drop in consumer spending, the lynchpin of the US economy, drove the contraction. Compounding the impact on markets, the prospects for a resounding recovery in Q3 are looking shakier as there was a second consecutive week of higher US initial jobless claims at the close of the week at 1.43mn.

The FOMC held its July meeting at the close of last week. The Fed opted to keep its benchmark rate unchanged at 0.0%-0.25%, but it did pledge to ‘increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities at least at the current pace’, signalling a preparedness to step up purchases more rapidly should it deem it necessary. Fed Chair Jerome Powell said that the government stimulus has been ‘well spent’ and helped keep people in their homes, but with ongoing wrangling over a new fiscal support package, this safety net could be taken away, with risks to the economic recovery. A potential escalation in tensions between the US and China this week, prompted by moves against the TikTok app could also rock the boat.

In the UAE, operations began at the country’s first nuclear plant, according to a statement by the Emirates Nuclear Energy Corporation (ENEC). Nuclear fission was started at one of the reactors at the Barakah plant, the first step to potentially meeting as much as a quarter of the country’s electricity demand from nuclear once the plant is fully operational.

Source: Emirates NBD Research

Source: Emirates NBD Research

A downbeat Federal Reserve and the worst quarterly decline in US GDP (-32.9% annualized in Q2) helped US Treasuries rally a fourth week running last week. Yields on 2yr USTs moved to as low as 0.105% while the 10yr yield hit 0.52%. Over the course of the week yields on the 10yr UST fell more than 6bps as markets hedge the decent performance of equity markets with anxiety over the outlook for the global economy. Fitch also placed the US sovereign rating on negative outlook although market reaction has been negligible in the context of other Covid-19 anxieties.

Emerging market bonds continued their move upward as well while spreads over treasuries fell to 3.76%, their tightest level since February. Local USD bonds caught much of that gain as well with the BUAEUL USD UAE index rising 0.9%, taking it to 17 weeks of gains in a row.

The broad sell-off of the dollar continued last week with the DXY index closing down by 1.1% at 93.349. Widening negative real yields on USTs along with poor economic data and a Fed seemingly inclined to keep policy accommodative ad infinitum means there are few immediate signals that could help pull the dollar out of its current dive.

Sterling was the outperformer among major pairs last week, rallying by 2.3% to close the week at 1.3085. Euro also managed to extend its rally, adding more than 1% to close at 1.1778 after having peaked above 1.19. Meanwhile JPY and CHF also strengthened against the dollar as markets maintain risk-averse options should the growing number of coronavirus cases warrant a re-introduction of lockdown measures.

Global equities were a somewhat mixed bag as July drew to a close. US and Asian equities have been driving the recovery over the past month, with the S&P 500 up 4.5%, and now up 1.3% ytd, while the Shanghai Composite gained 6.5% over July, and is now up 10.0% ytd. There remains heightened risk that renewed US-China tensions could prompt investor wariness towards these markets, but for now they both appear to be shrugging off any risks. The language used by Jerome Powell last week with regards ongoing asset purchases will likely have provided some support. Equitie indices in Europe have not been quite so sanguine, with the DAX, FTSE and CAC and DAX closing down 1.7%, 4.2% and 4.5% m/m respectively,

It was another week of relatively listless moves in oil markets with Brent slipping by all of US 4 cents to USD 43.30/b while WTI was off by a more considerably 2.5% to close at USD 40.27/b. OPEC+ will have begun to unwind the deeper level of its production cuts from the start of this month although the net effect will be limited by countries such as Iraq or Nigeria extending their own deep cuts to make up for failing to hit targets earlier.

Forward curves for WTI are beginning to deteriorate with time spreads across all durations widening their contango. The contango over the 1-6 month spread closed at USD 1.48/b last week from less than USD 0.9/b a week earlier. Brent contracts actually saw a narrowing of time spreads although that was likely linked to rolling over the expiring front dated contract at the end of last week.