Q1 growth trends are helping to restore correlations between currencies and interest rates, at a time when geopolitical risks and trade distractions have for the moment at least abated. Although US Q1 GDP growth rate of 2.3% (annualized) was softer than in Q4 (2.9%), this was largely expected and it was still much stronger than the trends underway in the UK and in the Eurozone. As a consequence question marks have arisen about monetary tightening by the BOE and the ECB, while the Fed remains on track to tighten monetary policy at least twice more in 2018.

US Q1 GDP is often a relatively weak figure historically due to problems with seasonal adjustments, but at 2.3% this year it was almost twice as strong as in Q1 a year ago, and it was also above estimates of where the trend rate of growth in the US is, usually seen as between 1.5-2.0%. As a consequence such a pace of growth is still likely to pressure the unemployment rate and maintain upward pressure on wages and prices, and thus keep alive expectations of another two Fed rate hikes in 2018 at least.

The main disappointment with this year’s data was that consumption grew by only 1.1% annualized, from a 4.0% pace at the end of last year. That this happened even as taxes were cut was particularly concerning, although strength in business investment was strong, and exports also contributed positively. Consumption is likely to recover in Q2 as incomes continue to grow, and the housing sector is also likely to contribute more strongly in Q2. For the Fed it is likely to overlook the consumption slowdown for the time being, but it will be harder to ignore the pick-up in prices. The core PCE deflator rose to 2.5%, well above the Fed’s 2.0% target, while other measures of wages were also strong rising by 2.9% y/y in the Q1 employment cost index. While the Fed is unlikely to raise interest rates at the upcoming FOMC meeting this week, a June hike seems likely and will get further support if the April jobs data due out on Friday also bounces back from March’s 103k.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

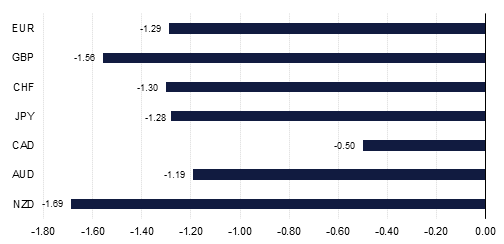

Despite the US slowdown, there was still a marked contrast with the UK economy where Q1 GDP growth was even weaker at just 0.1% q/q, dealing another blow to the likelihood of a May BOE rate hike. The implied probability of a BOE hike has fallen from over 80% at the start of April to less than 25% at the end of it. Bad weather probably played a significant part in the slowdown, with construction in particular very weak (-3.3% q/q). However, softness was also seen in manufacturing, suggesting more underlying causes as well. GBP not surprisingly lost further ground with GBPUSD posting a 6-week low of 1.3747, and it is likely to remain heavy at least until the May 10th MPC meeting is out of the way. Rate hikes probably have not gone away entirely, however, and if the economy recovers in Q2 the markets are likely to once again begin pricing one probably during the summer.

Click here to Download Full article