The North African tourism sector is not having the summer it was hoping for, as the lingering Covid-19 pandemic, both at home and abroad, has curtailed travel for another year. Numbers are mounting a steady recovery as restrictions ease and governments look to entice visitors back, but they remain far off the levels seen prior to the pandemic and will likely remain so through the remainder of 2021 at least. Egypt received just 500,000 tourists over January-March, compared to 2.4mn in the same period in 2018.

While the coronavirus is now seemingly on the back foot in most countries, mounting concerns over the risks posed by new strains of the virus will leave many travellers reticent to go abroad, while requirements around vaccinations and testing will deter still others. This slower-than-anticipated recovery in tourism will weigh on growth and we have already downgraded some of our regional growth forecasts on the back of this earlier in the year.

Source: World Travel & Tourism Council, Emirates NBD Research

Source: World Travel & Tourism Council, Emirates NBD Research

As the pandemic took hold last year, industries closely related to travel and tourism in Egypt, Morocco and Tunisia underwent significant contractions. In Morocco, the hotels & restaurants component of GDP contracted by 90.6% y/y in real terms in Q2 2020, and it remained down -50.3% y/y in Q1 2021. In Tunisia, hotels & restaurants GDP contracted -74.1% in Q2 2020. While domestic demand also drives these industries, the foreign tourism sector is hugely important. Tunisia’s hospitality sector managed a partial recovery as it reopened briefly last summer but having recently undergone another damaging wave of the disease the sector will have been devastated once more, even as domestic restrictions have been more lax than previously.

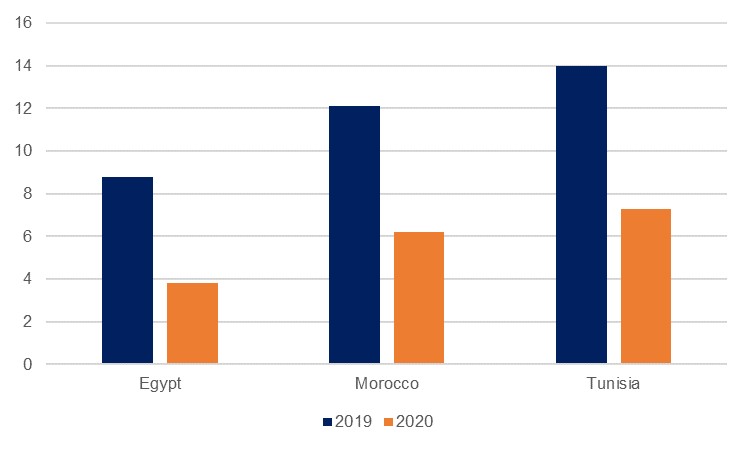

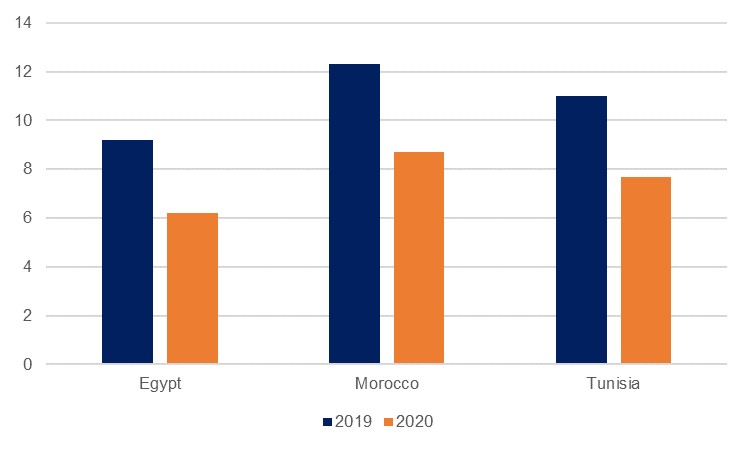

The tourism sector generally is an employment-intensive industry, and its slow recovery is bad news for many households which rely on it for their incomes. According to the World Travel & Tourism Council, tourism provided 12.3% of jobs in Morocco, 11.0% of jobs in Tunisia, and 9.2% in Egypt in 2019. Last year, this fell to 8.7%, 7.7% and 6.2% respectively. In Morocco, unemployment has risen to 12.5% and 17.1% in urban areas, but the outlook is starting to improve as the pace of job losses has slowed to 202,000 in the first quarter compared to 451,000 in Q4 2020. Nevertheless, many in the tourism sector, and those other industries related to it, remain under pressure, as evidenced by calls for more support by Morocco’s National Confederation of Tourism. The trade body is asking for the government support measures which expired at the end of June to be reintroduced and extended to December, but the drag on employment will prevent a robust expansion in private consumption levels this year, especially as government support measures are reduced.

Source: World Travel & Tourism Council, Emirates NBD Research

Source: World Travel & Tourism Council, Emirates NBD Research

Looking ahead, we do expect that the final quarter of the year will see a marked improvement on the first three, but it will likely be a two-speed recovery. While Tunisia’s severe fourth wave of Covid-19 cases is now waning, the country will likely remain on travel watch lists for some time to come which will limit the scope of its tourism revival. Morocco and Egypt appear altogether more positive as Morocco restarted its tourism offering in June, but it has to be noted that the situation with the pandemic can change direction swiftly and the risks remain to the fore. Both countries are striving to boost their attractiveness, especially Egypt, which has widened its e-visa availability, invested in new yachting and cruise holiday facilities, and the opening of the new Egyptian Museum. In regards to the pandemic, restrictions on capacity have been eased and full-vaccination levels are being pursued in key resorts. A particular fillip is expected from the news that Russia will restart direct flights to Egyptian Red Sea resorts following a six-year hiatus after a plane explosion in 2015. Eight airlines have been granted permission to fly. More than 2.5mn Russians a year visited Egypt prior to this, so even a partial return of these numbers would represent a significant bonus to Egyptian hotels – the Egyptian authorities are hoping that 1mn Russians will visit Egypt this year.

The slow recovery of the tourism sector not only weighs on real GDP growth in Egypt but on the balance of payments also. Usually a key pillar of Egypt’s FX inflows, travel receipts remained seriously depressed in the first quarter, coming in at just USD 1.3bn, around half of what it had been in Q1 2019, prior to the pandemic. While the inflows were substantially greater than they had been in the preceding periods – Q1 receipts were up 34.2% on Q4 2020 – and will likely have continued to grow in the second quarter, we expect that this will remain a consideration of the central bank when it looks at setting interest rates. With travel receipts as yet unrecovered and set to remain under pressure for the time being, the CBE will be reluctant to do anything to jeopardise its portfolio inflows through cutting its real interest rate.