Oil markets recorded a mixed performance last week with Brent managing to extend gains by 1%, settling at USD 43.24/b, while WTI was marginally lower over the week, closing at USD 40.55/b. Both contracts got a boost on Friday in line with most other markets on hope that a new treatment would be effective in treating Covid-19. Cases of the virus continue climb in the US with the country reporting more than 60k new cases each day for the last four days. States that adopted a looser return to work strategy remain the worst affected with the numbers in states like Florida or Texas rising by around 4% on a daily basis since the middle of June.

The IEA also delivered its latest assessment of oil market conditions last week and revised higher its expectation for demand this year. The agency now expects oil demand to fall by 7.9m b/d this year compared with 8.3m b/d in its last estimate. However, the IEA warned that rising case numbers means that downside risks for oil are “almost certainly to the downside.” The resurgence of cases in the Australian state of Victoria—which prompted the government to re-impose lockdown conditions—shows the effect that a lack of control over the virus can have over consumer fuel demand. After showing a solid upward trend from mid-April, Google mobility data linked to workplace or transit station activity has turned back downward as residents avoid heading into offices or reject taking public transport. As we outlined in our outlook for oil markets last week the potential a of a viral relapse into lockdown conditions is a major risk to the sustainability of oil prices around their current levels, not to mention a drag on them pushing significantly higher.

The OPEC+ joint market monitoring committee will meet this week to decide whether to push forward with the producers’ bloc plan to begin tapering its production cuts from August—as proposed in early June—or to maintain the deeper level of cuts that have been in place from May. OPEC+ countries would add more than 2m b/d to markets in August, assuming the JMMC endorses the increase. We have assumed that OPEC+ countries stick to their targets fully for 2020-21 and the increase in levels won’t be enough to push the market into surplus, provided demand recovers as strongly as the IEA assumes.

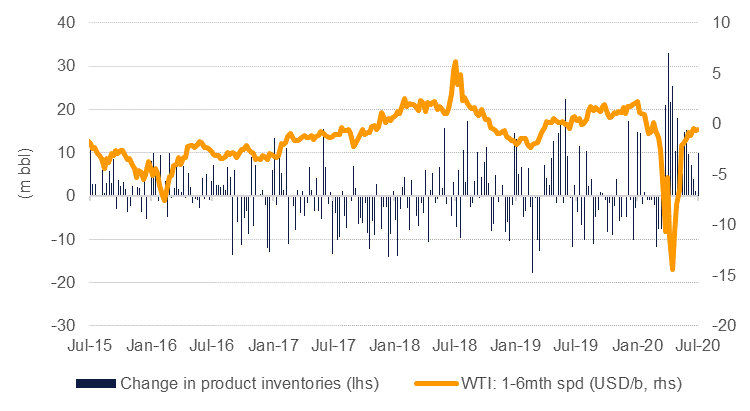

Oil curves turned decidedly downward last week with the contango in both the Brent and WTI markets widening across the curve. Front-month spreads both settled at around USD 0.22/b for 1-2 month contracts while December spreads are pushing back to a USD 2/b contango. While crude inventories have shown some weeks of sizeable draws, product inventories remain bloated. In the US product stocks have risen every week barring one since late March with the average weekly build at over 12m bbl during that period. Forward curves will struggle to push into backwardation while the level of product stocks remains so burdensome and any surge upward may prove a tempting profit taking opportunity for investors still taking a relatively large amount of long speculative positions (see charts below).

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.