Recent Q3 growth results for the US, Eurozone and UK all surprised to the upside, and the anticipated slowdown in the global economy has not manifested in the data as quickly as expected in many respects. Nevertheless, there were already signs within the backward-looking growth figures that consumer demand was starting to come under pressure, and the outlook through the final months of the year and into 2023 is clouding over further. Even for those markets that do not see economic contractions, growth will be weak in the coming quarters as high inflation, and central banks’ responses to that, start to weigh more meaningfully on demand. The IMF stopped short of predicting a global recession next year in its latest October WEO, predicting growth of 2.7%, but it did give a one-in-four chance of sub 2.0% growth and the downside risks appear to outweigh any chance of further positive upside surprises – a ‘growth recession’ appears to be the best outcome for developed markets to hope for as things stand.

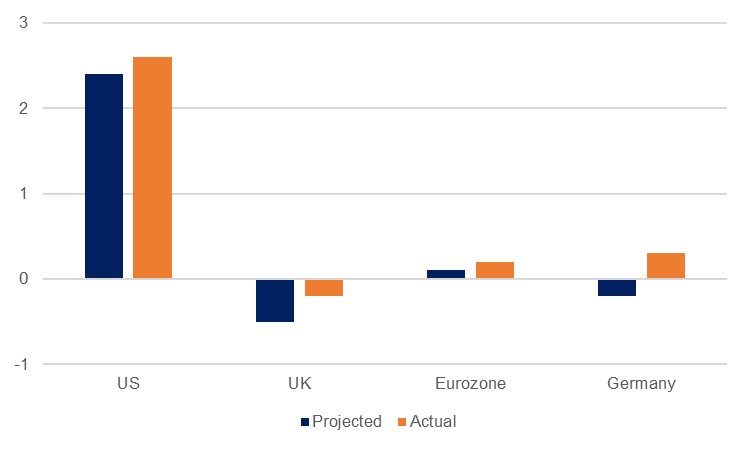

The global economy has shown a fair level of resilience so far to the buffeting it has already endured from months of high inflation and extraordinarily rapid monetary tightening, and the Citi Economic Surprises index for major economies has been consistently in positive territory over the past two months or so. Key amongst those upside surprises was a 2.6% q/q annualized growth for the US in the third quarter (consensus prediction was 2.4%), following two quarters of contraction in H1 2022. Personal consumption also surprised on the upside at 1.4% in Q3 (projected 1.0%), although consumption of goods actually declined, with spending on services driving the expansion.

Source: Bloomberg, Emirates NBD Research. US figure is annualised growth

Source: Bloomberg, Emirates NBD Research. US figure is annualised growth

In contrast to the US, the UK did contract in Q3 as it declined -0.2% q/q, but this was far shallower than the predicted -0.5%, and the unscheduled funeral for Queen Elizabeth II was a contributing factor to the slowdown. Private consumption contracted here but was offset by an increase in government spending, fixed investment and net exports. Meanwhile, the Eurozone’s Q3 growth also surprised to the upside as it remained positive, expanding 0.2% q/q. This was driven in large part by Germany’s 0.3% q/q growth, confounding expectations of contraction – consensus had predicted -0.2%. The consumer and retail numbers saw a modest uptick and the German GDP data showed that consumers were still active to date even as inflation bit, with private consumption the key driver of growth.

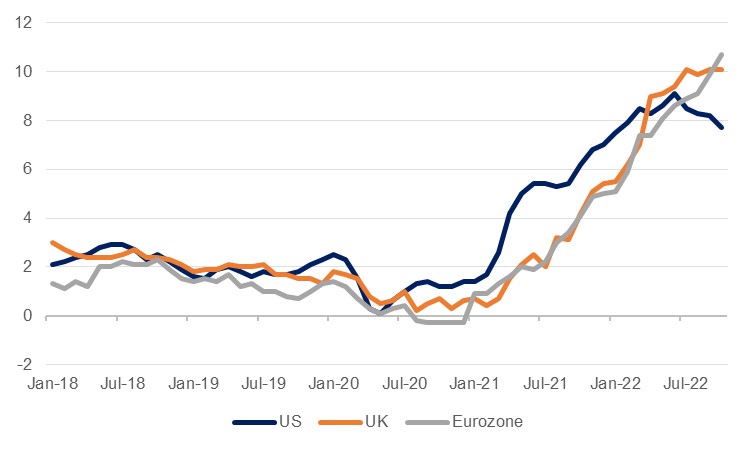

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

While there has been a slowdown, developed market consumer spending has arguably held up comparatively well through most of the year even as incomes have been eroded. This is thanks in part to savings accrued through the pandemic period when opportunities to spend – on travel and activities at least – were more limited. Helicopter money payments to households also boosted household savings and US personal savings as a percentage of disposable income averaged 17.1% in 2020, compared to the five-year average of 9.9%. However, at the latest print for September, this had fallen to 3.1%, which barring the 3.0% seen in June was the lowest level since the global financial crisis in 2008. The Federal Reserve estimated in October that lower income households still had excess savings of some USD 5,500 but expected that this would ‘continue dwindling rapidly’ in the following months. Meanwhile, German households deposited an excess of around EUR 73bn in banks through the pandemic period according to the IFO, but these have already been eroded over the subsequent quarters. These savings that helped cushion households through the past several months of wage erosion are being taken out of the equation, meaning that consumers will steadily become more circumspect with regards their spending, weighing on global demand.

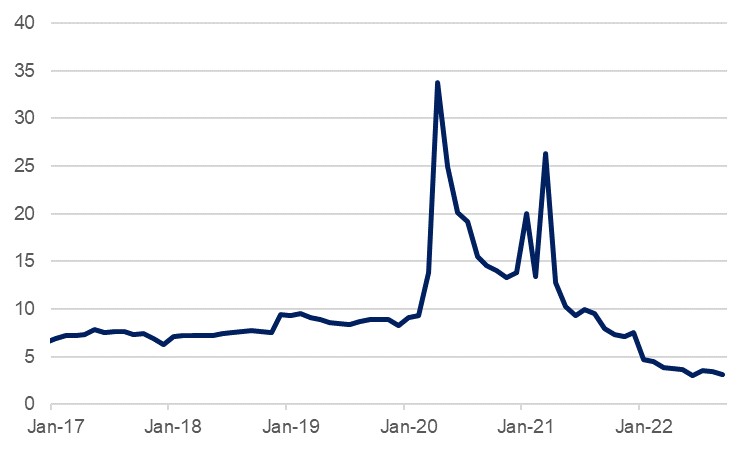

Source: Bloomberg, Emirates NBD Research

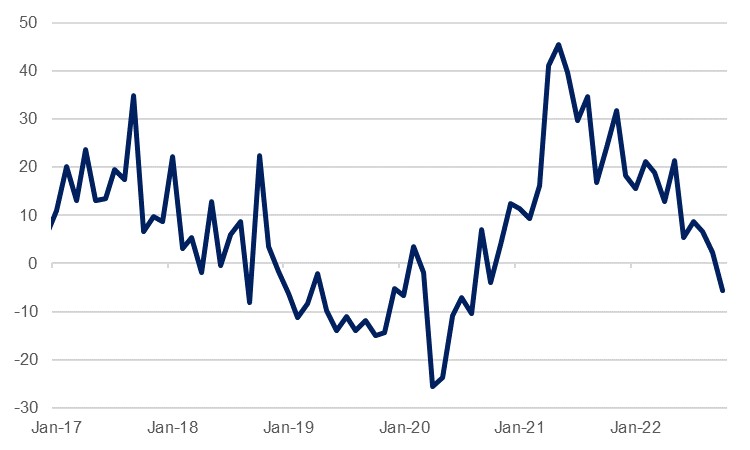

Source: Bloomberg, Emirates NBD Research

There are already indications that global trade is slowing sharply: South Korean exports, long used as a bellwether for global growth, turned negative in October with a y/y contraction of -5.7%. Inventories at key electrical manufacturing firms there are starting to build, and business optimism has turned sour. Key global shipping indicators are also showing signs of a sharp slowdown – the Shanghai Containerised Freight Index, after rising some five-fold through the pandemic, is at 1,443 rapidly coming back to its long-term average as demand slackens and supply chain imbalances ease. In this environment, Maersk – the largest container shipping line by TEU capacity – has warned that global container shipping demand will fall some -2% to -4% this year with further weakness to come in 2023.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

What does this mean for policy makers? For the time being, not overly much, for either central bankers or governments. The laser focus on stifling inflation will continue for the time being, and any central bank pivots are highly unlikely to appear in the next several months. The present high inflation is not being driven mainly by commodity price shocks or reopening frictions anymore, but increasingly by higher costs for services, and central banks will be loath to allow this to entrench further into a wage price spiral.

Governments are also cognizant of the pernicious threat of sticky inflation, and also cannot afford to antagonise markets by increasing borrowing in a rising interest rate environment, in the manner of the previous Conservative Party cabinet in the UK. As such, most policy makers appear resigned to bringing down inflation through demand destruction, meaning greater pain to come for consumers, and growth, yet. While the US might scrape through with a modest expansion in 2023, both the UK and Eurozone are likely to shrink.