The UK’s PM Theresa May won the no-confidence motion in parliament by a 325 to 306 majority yesterday. The outcome was largely expected however, and markets barely reacted. May has immediately opened talks with her opponents in an effort to break the stalemate and must return to Parliament to set out a new plan by Monday next week. Markets are hoping that these talks might result in a softer Brexit, a delay to it or even another referendum. She must also talk to the EU again. However, the EU is refusing to reopen the Brexit deal, and the question of whether May can persuade opponents in Westminster to support a new deal also has to be questioned following the events of this week. As a consequence markets may be too sanguine about how things will develop from here.

The impact of the U.S. government shutdown is starting to be felt on U.S. economic data releases with first tier data like retail sales that were supposed to be released yesterday being delayed. Housing starts data and TIC investment flow data due today will also be postponed. Q1 will also probably see slightly weaker economic growth as a result of the shutdown. Previous experience suggests that much of the weakness in economic growth due to government shut downs eventually gets reversed in the following months and on an annualized basis the impact is minimal. However, this shutdown is likely to be longer than previous ones so the impact could be greater.

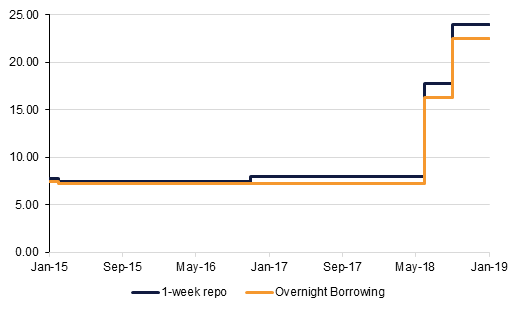

The Turkish central bank kept the benchmark one-week repo on hold yesterday, as was widely anticipated. While CPI inflation has fallen in recent months – down to 20.3% in December – it is still more than four-times the TCMB’s 5.0% end-2019 target rate. The bank’s communiqué highlighted that economic rebalancing was underway, with its tight monetary policy stance contributing to a slowdown in economic activity, but cautioned that ‘risks to price stability continue to prevail’. Reassuringly to markets, the statement ended with a pledge that the bank would tighten further if necessary.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries continued to trade in a tight range despite continuation of the risk on mood. Yields on the 2y UST, 5y UST and 10y UST closed at 2.54% (flat), 2.53% (flat) and 2.72% (+1 bp) respectively.

Regional bonds rose sharply. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped slightly to 4.54% while credit spreads tightened 6 bps to 194 bps.

GBP continued to rise on Wednesday, following the defeat of Prime Minister May’s Brexit deal by Parliament the previous evening, outperforming the other G10 currencies. Over the course of the day GBPUSD rose by 0.19% to 1.2885. Again however, further gains were halted by resistance near the 100-day moving average of 1.2890. This same level has halted advances this morning and needs to be overcome, with a daily close above before further gains can be achieved. As we go to print, GBPUSD is trading 0.10% lower at 1.287.

Developed market equities continued their positive run amid strong corporate earnings and continued optimism over Brexit. The S&P 500 index and the Euro Stoxx 50 index added +0.2% and +0.3% respectively.

It was largely a positive day of trading for regional markets. The DFM index gained +0.4% and the Tadawul rallied +0.7%. In continuation of the recent trend, banking sector stocks continued their positive run. Riyad Bank and Banque Saudi Fransi added +4.5% and +5.2% respectively.

Oil prices gained over with Brent rising 1.1% to USD 61.32/b and WTI up 0.4% at USD 52.31/b. Both are slightly lower this morning. Crude oil inventories in the US fell by 2.7m bbl last week, still slightly above their five year average, while there were again solid builds in gasoline and diesel. Production in the US hit 11.9m b/d, up more than 2.1m b/d on the same week a year earlier while exports hit nearly 3m b/d.