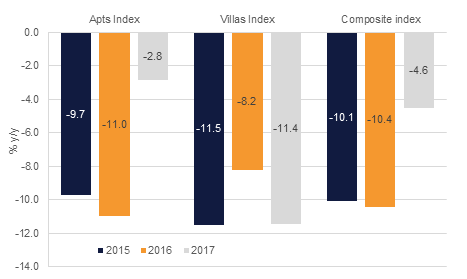

The latest data on Dubai’s residential real estate prices1 (Phidar Advisory’s 9/5 House Price Index) show that on average prices fell another -4.6% in 2017. The total decline since the 2014 peak is -23.4%. Phidar Advisory’s Dubai 9/5 House Price Index, which is based on Dubai Land Department (DLD) data from nine apartment communities and five villa communities in investor zones in Dubai, indicated that apartments fared better than villas. Apartment prices declined just -2.8% in 2017 compared with a -11.4% fall in freehold villa prices. Low-range properties held their values better than the premium and the mid- costs segments.

The softness in residential real estate prices continued at the start of 2018 with apartment prices again faring better than villas in January. Apartment prices were down -6.8% y/y, recording the highest annual decline since January last year while villa prices fell -12.2% y/y the same month.

Given the more upbeat outlook for the GCC economies, oil prices, VAT exception for residential transactions as well as better global growth prospects, we expect the downside for residential real estate to be limited this year. Phidar Advisory expects residential real estate prices to recover modestly in 2019 and rise further in 2020-2021.

The value of real estate investments reached USD 29.1bn in 2017, up by 17.3% compared with the -32.6% decline in 2016, according to Dubai Land Department. Dubai’s property market attracted investors from all continents with UAE nationals topping the list at USD 6.9bn or 23.6% of the total. India ranked second (USD 4.2bn), followed by Saudi Arabia (USD 1.9bn), UK (USD 1.6bn), and Pakistan (USD 1.4bn). Other top investors in Dubai’s real estate include citizens from China, Jordan, Egypt, and Canada.

The slower contraction in residential real estate prices over 2017 has been accompanied by higher transaction volumes in all areas of Dubai. This has been particularly evident in the apartments sector. Overall transaction volumes increased 0.7% y/y in 2017 compared with -20.4% decline recorded in 2016. However, in January 2018, total sales were down by -20.0% y/y due to lower apartment transactions (-23.6% y/y). The number of villas sales recorded in January was up by 14.0% y/y. Looking at the freehold areas included in Phidar Advisory’s 9/5 Index, overall transaction volumes have fallen -17.5% y/y in 2017, mainly driven by the significantly lower transaction volumes on villas.

Rents in the Dubai 9/5 Index areas have declined on an annual basis in 2017, more or less aligned with the annual fall in sales prices. Average apartment and villa rents were down in 2017 by -8.4% and -9.2% y/y, respectively. Overall however, yields on villas remained unchanged in January 2018 at 4.8%, slightly below the 2017 average of 4.9%. Gross rental yields on apartments have moderated since Q2 2016, but remain attractive by global standards at 7.1% in January and 7.4% for the whole 2017.