Despite Fed Chair Jerome Powell’s call for increased stimulus earlier in the evening, President Trump announced that he’d instructed his representatives to break off talks on a new stimulus package with House Speaker Nancy Pelosi, sending equities lower. Trump tweeted that he would pass a “major” stimulus bill after his re-election. Household incomes fell in August after the expiration of the USD 600/week federal unemployment benefits at the end of July, and several large companies including airlines and Walt Disney Co have said they will lay off thousands of workers partly due to the expiration of government support.

Powell had warned earlier warned that the US’s economic recovery would be “weak” if the government did not provide more fiscal stimulus. He noted that the risk of doing “too much” to support the economy was small and that households and businesses would suffer “unnecessary hardship” if the government did too little. The Fed chair did not mention any further Fed programs, and still has an arsenal of untapped programs worth trillions of dollars that can be placed at the disposal of firms and credit markets. He also noted that quick action by officials last spring avoided the worst outcome for the economy.

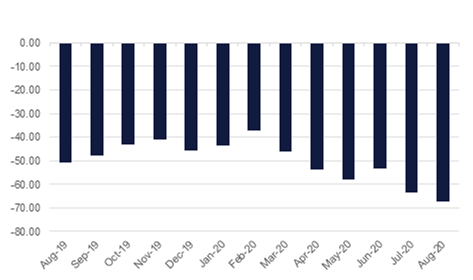

The US Commerce Department said on Tuesday that the trade deficit in August surged 5.9% m/m to USD 67.1 bn, the largest in 14 years as imports rose faster than exports. Imports of goods & services increased by 3.2% to USD 239bn, with goods imports up USD 6.5 bn to USD 203bn. Total exports increased 2.2% to USD 171.9 bn, with goods exports up USD 3.5bn to USD 119.1 bn. The closely watched trade deficit with China decreased USD 1.9bn to USD 26.4bn in August. The widening of the trade deficit could be a drag on economic growth in the third quarter.

German industrial orders rose 4.5% m/m in August. Order intake stands at only 3.6% m/m lower than in February, before COVID-19 lockdown measures were imposed. Data showed that orders from abroad increased by 6.5% m/m, supported by a 14.6% m/m surge in orders from the rest of the euro zone. Domestic orders rose by 1.7% m/m. The German economy contracted by -9.7% in the second quarter at the height of the pandemic, however the latest industrial figures should go some-way in boosting hopes for a robust third-quarter in Europe's largest economy.

Source: US Commerce Department, Emirates NBD Research

Source: US Commerce Department, Emirates NBD Research

Treasuries closed higher at the end of the overnight session as US president Donald Trump ended negotiations with Democrats for a new stimulus package. The president walked away, preferring to unveil new stimulus only after he wins the November election. Earlier in the session Fed chair Jerome Powell had again called on the federal government to provide stimulus, warning of “unnecessary hardship” without it. Yields on the 2yr UST were broadly unchanged but 10yr yields fell nearly 5bps, helping to flatten the curve back to below 60bps.

We would expect to see more fallout from the news that no stimulus will be immediately forthcoming later today across higher risk bond markets. EM USD bonds closed higher overnight, ahead of the news.

Qatar Islamic Bank is reportedly in the market for a USD sukuk that may come later this month. The deal would be benchmark size and the bank has an A1 rating from Moody’s with a stable outlook.

The USD failed to establish any major movement in either direction on Tuesday but jumped up late in the evening after US President Donald Trump called for an end to talks on a fiscal stimulus package. The DXY index advanced to reach 93.840. USDJPY was largely unaffected by this however, falling by only -0.11% and currently trades at 105.65.

Subsequently the EUR experienced a dramatic decline, falling by -0.4% and is extending losses this morning to 1.1730. The GBP was amongst the biggest movers, slipping by -0.76% to reach 1.288, after EU Vice President Maros Sefcovic stated that a no-deal Brexit was becoming "ever more likely". The AUD fell more than 1% overnight and trades around 0.7120 whilst the NZD fell by 0.9% and is testing lower at 0.6585 this morning.

The S&P 500 had made gains earlier in the day yesterday following Fed Chair Jerome Powell’s warning that the economy could suffer ‘tragic’ results if renewed fiscal support was not provided. However, these were erased after President Donald Trump later advised his team to cease discussing the matter with the Democrats, instead promising a new ‘major stimulus bill’ will be introduced ‘after I win’, and the index closed down 1.4%. The Dow Jones and the NASDAQ lost 1.3% and 1.6% respectively.

In Europe, hopes for new Covid-19 testing systems generated modest gains, with the FTSE 100 closing 0.1% higher with travel firms in particular closing up on the day. Meanwhile, France’s CAC closed up 0.5% and Germany’s DAX 0.6%. In Asia, Chinese markets remain closed but Japan’s Nikkei gained 0.5% but is down 0.2% so far this morning.

Oil prices are giving up some of their overnight gains this morning in response to the abandonment of fiscal stimulus talks in the US. Brent is down by 1.7% in early trade today while WTI is off by more than 2%. Elsewhere the API reported a build in US crude inventories of a little less than 1m bbl last week with official data to be released later tonight.

The EIA estimated that crude output in the US will fall by 800k b/d to 11.45m b/d, a smaller drop than previously estimated. The EIA also estimates a modest decline of 360k b/d for 2021 to an average output of 11.09m b/d.