A rate cut at the upcoming FOMC meeting looks ever more likely in the wake of Fed Chair Jerome Powell’s testimony to Congress yesterday. He sounded concerns over trade tensions, poor business sentiment and sluggish inflation and wage growth, which he saw as overriding the positive jobs data in June. The expectation for a rate cut this month was compounded by the release of minutes from the June FOMC meeting, which showed that ‘many’ participants had been in favour of cutting last month. Powell also reaffirmed the independence of the Fed and stated that he would serve to the end of his four-year term.

UK real GDP growth turned positive again in May, expanding 0.3% m/m, compared with the April contraction of -0.4%. Autos production was the primary driver of the gains as work started again after the Brexit-related shutdowns which had weighed on activity in April. The return to growth was in line with consensus, but expectations point towards a q/q contraction of -0.1% in Q2. The pound remained near two-year lows as Brexit uncertainty and rising expectations of a monetary policy reversal weigh on sentiment.

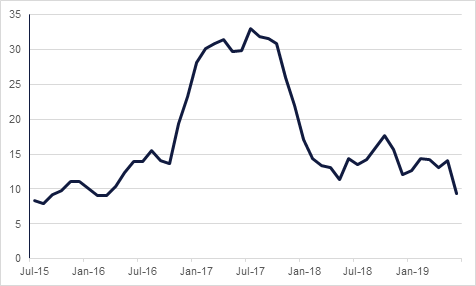

Egypt’s CPI inflation slowed sharply in June, falling to 9.4% y/y, from 14.1% in April. This was the slowest pace since March 2016. On a monthly basis, the CPI price basket contracted -0.8%. Nevertheless, we still believe that the CBE will hold rates at its MPC meeting today, given the inflationary pressures which the most recent round of subsidy reforms, implemented earlier this week, will bring to bear.

There was mixed news out of Lebanon yesterday, as the long-delayed 2019 budget passed parliament committee, but the US imposed sanctions on two members of parliament. Should the budget now pass the parliamentary vote this development sets the stage for, it will reassure investors that Lebanon will make some headway in fiscal consolidation this year. Lebanon is targeting a budget deficit target of 7.6% of GDP, compared to 11% in 2018.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Commentary from Fed chair Jerome Powell reaffirmed market expectations that the Fed would cut later this month with the Fed funds futures now implying a 25% chance of a 50bps cut later this month compared with less than 3% at the start of the week. Powell’s testimony to Congress was perhaps more dovish than expected the Fed chair and the FOMC minutes also pointed to slowing of investment thanks to trade war fears. Yields at the front of the UST curve dropped sharply with the 2yr down nearly 8bps while the 10yr was little changed on the commentary.

European rates also moved higher in line with the Fed with 10yr bunds close at -0.305% after an earlier spike thanks to better than expected data out of France.

Tunisia issued a EUR 700m seven year bond yesterday at 6.37%. According to press reports it was oversubscribed up to EUR 2.2bn.

Jerome Powell’s fairly dovish testimony to Congress, coupled with the release of the June meeting minutes which showed that ‘many’ FOMC members were in favour of cutting last month, led to significant dollar weakness yesterday as expectations of a rate cut were cemented. The dollar index closed at 97.104, below both its 50- and 100-day moving average. This gave the pound some little respite from Brexit turmoil, as it managed to close up 0.3% at GBP 1.2502/USD.

The Powell testimony was a boon for US equities yesterday, with the S&P 500 topping 3,000 for the first time, before closing up 0.5% at 2,993, just shy of the new record high hit last week. The NASDAQ also hit new highs, closing at a record 8,202, up 0.7%. In Europe, the effect was less positive as the DAX fell 0.5%, and the FTSE 100 declined 0.1%.

Regional equities had a positive day, with the DFM closing up 1.2% and the Tadawul 0.5%.

Oil markets jumped overnight on production shutdowns in the Gulf of Mexico as a storm in the area threatened platforms and a near 10m bbl draw in US inventories. WTI ended the day up 4.5% while Brent was not far off at 4.4%. The EIA reported a draw of 9.5m bbl along with healthy decline in gasoline inventories. Production managed to tick higher to 12.3m b/d while exports again broke above 3m b/d.

Reports that Iranian naval vessels have harassed British tankers in the Gulf region will help to keep a geopolitical bid under prices, particularly as the US is now threatening to impose even more sanctions on Iran.

The jump in spot prices helped to turn the tide of weakening time spreads somewhat. In Brent 1-2 month spreads moved back above USD 0.3/b in backwardation while in WTI they continued their march toward neutral.

Click here to Download Full article