The Federal Reserve is set to cut interest in September, a stance that was all but confirmed by Fed chair Jerome Powell at the Jackson Hole central banking conference. Chair Powell said that “the time has come for policy to adjust” and that the “direction of travel is clear.” However, he did not explicitly lay out the scale of rate cuts, either for an initial move in September or the totality of adjustment, saying instead that the “timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

Inflation, which has been the primary target of Fed policy since it first hiked rates in 2022, has eased considerably. Headline CPI inflation in the US dropped below 3.0% y/y in July, down from 3.5% earlier this year and substantially lower than the recent peak of 9.1% hit in June 2022. The PCE deflator, the Fed’s actual target for inflation, has cooled in tandem with headline CPI with the measure falling to 2.5% y/y as of June, down from more than 7% hit mid-way through 2022.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

The disinflationary trend in the US looks to be intact and the Fed may now have garnered the confidence to begin easing back on policy even ahead of hitting its 2% target on the PCE deflator. In real terms, policy rates in the US are at 2.6% at their widest level since 2007, just before the Global Financial Crisis. Rapid shelter price appreciation has evidently cooled while energy prices—gasoline in particular—are now lower in year/year terms. With the inflation element of the Fed’s mandate seemingly under control, the shift for policymakers is now to the labour market. At Jackson Hole, Chair Powell stressed that the cooling labour market was “unmistakable” and that they had room to adjust policy downward to manage any “unwelcome further weakening” in the US jobs market.

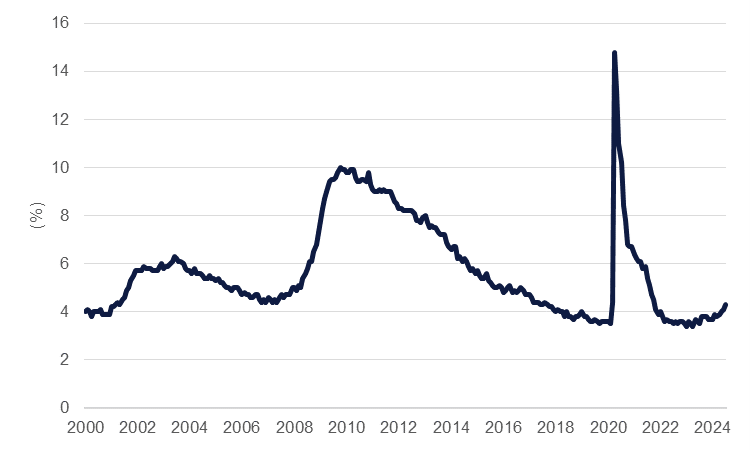

Financial markets convulsed earlier in August in response to the weaker than expected July non-farm payrolls report, which showed 114k jobs added last month while the unemployment rate rose to 4.3%, its highest level since Q4 2021. Headline unemployment is still low by historic levels but has nevertheless been rising consistently since the start of 2024, up by 0.6ppt since December 2023. Other measures of the labour market have also weakened—initial jobless claims have also trended higher since the start of the year—but the rise has been noisy and looks to have reverted to pre-pandemic norms.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

With the inflation element of the Fed’s mandate looking more manageable, markets will be highly attuned to the upcoming labour market prints in judging whether the Fed will cut by 25bps in September or will cut by a larger degree. The next non-farm payrolls report will be released on September 6, a day ahead of the black-out period preceding the September 17-18 FOMC decision. A disappointing print will likely see sharp readjustment in market pricing for the September meeting and for rates over the rest of 2024. Following the Jackson Hole conference, markets are expecting 34bps of easing in September and a total of 100bps by the end of the year, implying that at least one of the next three remaining Fed meetings would be a larger than 25bps cut.

At present, we remain of the view that the Fed will take a measured and slow path in adjusting policy lower and expect a 25bps cut in September, followed by an additional 25bps in Q4. Should labour market data severely disappoint, such as a sharp rise in the unemployment rate, then the risks to our rates call are for an additional move in Q4 (both November and December FOMC meetings).