There has been progress on averting another US government shutdown, as the Senate replied to the House’s bill extending spending to March 23 with a plan which would cover spending through to March 2019. Concessions to Republicans on defence and to Democrats on domestic spending will help the bill on its final passage through the House today. There are hurdles remaining, however, as minority leader Nancy Pelosi and significant numbers of democrats threaten to oppose the bill if assurances aren’t given regarding a separate vote on immigration issues.

There were also positive political developments in Germany, where Angela Merkel’s CDU reached agreement to form a new coalition government with the SPD, over four months after September 24 elections. The agreement now has to go to the SPD’s members for a vote, but this has been made more likely by the significant concessions the junior party has managed to obtain from the CDU - both the finance and foreign ministries have gone to the SPD. This is significant for the wider Eurozone as it will give the SPD a platform from which to pursue its policy of greater integration with Europe, potentially widening the rift between the ‘core’ and ‘periphery’ countries.

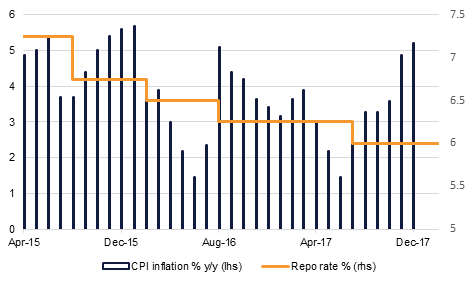

The Reserve Bank of India left repo rates unchanged at 6% and maintained neutral stance even as it flagged upside risks to inflation. Five of the six member committee voted in favour of the decision. The RBI forecast inflation for H1 FY 2019 to stay between 5.1% and 5.6% and between 4.5% and 4.6% in H2 FY 2019. The central bank also said in its statement that ‘the nascent recovery needs to be carefully nurtured’. We expect the RBI to remain on a prolonged pause and look for cues from implementation of policies announced in the budget and the monsoon season before any change.

The Reserve Bank of New Zealand has also kept its benchmark official cash rate unchanged at 1.75%, as expected. Dovish language and a downward revision to the inflation outlook makes extended loose monetary policy more likely, and the New Zealand dollar weakened against the greenback.

US Treasuries drifted lower as movement in equities returned to normal levels and volatility started to subside. Yields were higher across the curve with 2y USTs, 5y USTs and 10y USTs yielding 2.12% (+2 bps), 2.55% (+2 bps) and 2.83% (+3 bps) respectively.

Regional bond markets continue to drift lower as it tracks move in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 1bp to 3.99%.Credit spreads, however, tightened 5 bp to 145 bps.

Qatar National Bank raised USD 3.5bn from a three-year senior unsecured term-loan facility. The bank plans to use the proceeds for general corporate purposes. The bank paid a previous USD 3bn loan prior to the issue of the new facility.

NZD softens for a second consecutive day following the first RBNZ policy meeting of 2018. NZDUSD fell to a one month low after the central bank indicated that it would hold interest rates at the current record low level of 1.75% until mid-2019, highlighting that it expects to reach its inflation target two years later than previously forecasted.

As we go to print, NZDUSD is trading 0.65% lower at 0.71914. In the short term, we expect a test of 0.7169, the 50% one year Fibonacci retracement. A break of this level is likely to catalyse larger declines towards 0.70.

Developed markets equities closed mixed in what was another volatile day of trading. Most equity indices recovered from day’s losses while the US equities drifted lower. The S&P 500 index dropped -0.5% while the Euro Stoxx 600 index gained +2.0%. European markets received an extra boost from Germany where Angela Merkel reached a deal to form the government. The VIX index remained at elevated levels even as it declined -7.5%.

Regional markets closed mixed with the Tadawul losing -0.7% and the DFM index adding +0.8%. The Qatar Exchange added +2.7% following a -7.3% decline over the past 5 days. Nothing major in terms of stock movements.

Oil price declined for the fourth day in a row, with both benchmarks losing more than 2%. WTI closed USD 61.79/b and Brent ended the day at USD 65.51/b. Brent is now at its lowest level all year. The catalyst was the bearish EIA report which showed that US oil production has now broken above 10m b/d for the first time since the 1970s along with other bearish indicators; overall crude stocks added around 1.9m bbl last week while there were heavy builds in gasoline, distillates and jet fuel.

Market structures continue headed decidedly downward in response to the news with spreads at the front of the WTI curve USD 0.2/b and Brent has now settled firmly below USD 0.5/b. Long-dated roll yields still appear attractive on the current shape of the curve but may have hit their peak as markets reassess how much US oil can emerge over the news few months.