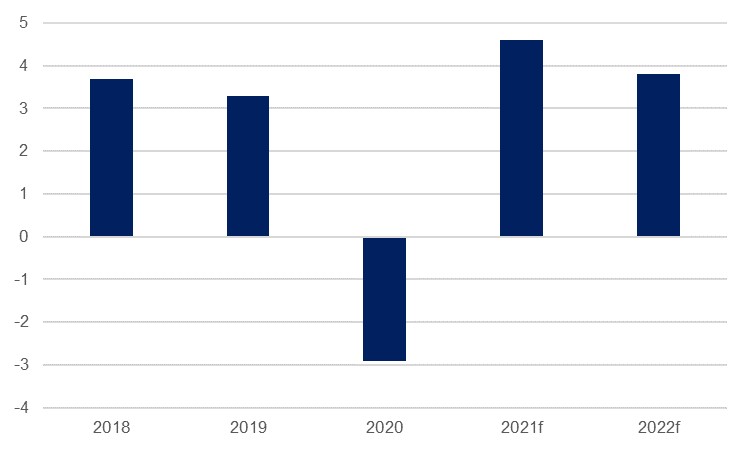

Israel’s economic contraction in 2020 was less severe than projected by either analyst consensus, or indeed the country’s own ministry of finance and central bank. Output shrank by -2.4% last year, a softer decline than the -3.7% projected by the Bank of Israel. This follows growth of 3.3% in 2019. In GDP by expenditure terms, private consumption was perhaps unsurprisingly the major driver of the contraction, falling by -9.4% over the year as restrictions were imposed on retail and leisure activities, and opportunities for household spending curtailed. Exports rose 0.9%, while collective government expenditure rose 3.7%.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

On an annualised basis, real GDP growth in Israel came in significantly higher than anticipated in the fourth quarter, climbing 6.3% q/q, compared with consensus projections of a -3.7% contraction. The fourth quarter benefitted from a ramp-up in vehicle purchases prior to a new sales tax introduced at the start of 2021, which helped offset the effects of the second and third lockdowns, which spread over the start and end of the period. Meanwhile, annualised growth in Q3 was revised up from 39.7% to 41.5%.

Looking ahead, the likelihood is that the Israeli economy will see a substantial improvement in 2021, with projections ranging from the Bloomberg consensus of 4.6% to the Bank of Israel’s particularly bullish 6.3% forecast (predicated on the vaccination programme continuing at the current rapid rate). This positive outlook is thanks to Israel’s strong progress in vaccinating its population, which potentially offers a speedy route to post-pandemic normalisation. Over 4mn Israelis (from a population of around 9mn) have so far received their first dose of the Covid-19 vaccine, and 2.5mn have received their second dose, with millions more set to be administered in the coming weeks. On the back of this there has already been a move to open up leisure and retail facilities such as shopping centres, gyms and cinemas for people who can show proof of vaccination. While the first quarter will likely remain relatively weak, the groundwork has been laid for a speedy improvement towards the end of the period and through the rest of the year. With the gross savings rate hitting an all-time high of 26.7% in December, there is substantial potential for domestic spending.

There are other factors that should support a robust growth recovery, not least the loose monetary policy adopted by the Bank of Israel which cut its base rate back down to 0.1% in April as the pandemic crisis ensued. In common with central banks around the world, this rate cut was also supported by a substantial bond purchase programme. In March the bank launched an ILS 50bn quantitative easing programme, and this was extended by ILS 35bn in October as the bank sought to ‘reduce the credit costs over longer terms for companies and households, as a complementary tool to the short term interest rate policy.’ Improved relations with regional neighbours including the UAE and Bahrain could also boost growth this year, encouraging the tourism sector and fostering investment.

While the outlook is certainly much improved in 2021, there remain a number of challenges which could see the more bullish growth projections being missed. The rapid rollout of vaccinations certainly provides a path out of the pandemic crisis, but for the time being the unemployment rate including the pandemic effect remains at an elevated 12.9%. Households will likely continue to need the support of the central bank and the government over the coming months, but the latter is less certain at present, not least because of the upcoming election scheduled for March 23, the fourth in two years. Prime Minister Benjamin Netanyahu proposed a new support package in February, including direct payments to households, but this was criticised by the central bank and opposition politicians and is unlikely to be passed. Meanwhile, the turbulent politics means that a state budget is yet to be passed for 2020 or 2021.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The appreciating shekel also provides a potential headwind to growth should it start to weigh on exports. The currency hit multi-decade highs in January before the central bank intervened by announcing plans to purchase USD 30bn in foreign currency this year, up from USD 21bn in 2020. The expectation is that as the pandemic crisis eases and imports pick up once again (they declined -8.4% in real terms last year), some of the appreciatory pressure on the currency should ease.