.jpg?h=3096&w=5504&la=en&hash=6B210302F399A78970B63DA505DBB8F3)

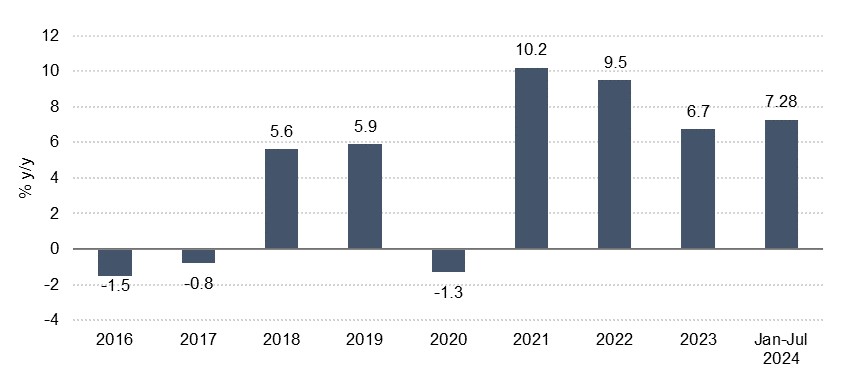

We forecast a 4.0% expansion in non-oil GDP in Saudi Arabia this year and a further 4.5% in 2025, underpinned by investment activity related to the Vision 2030 development plan. Another factor that we expect to support non-oil GDP growth both this year and next is household consumption, with timely indicators demonstrating positive momentum. Monthly sales data shows that spending growth continues at a positive rate and over the year to July, spending (including point of sales transactions, e-commerce spends on mada debit cards and cash withdrawals) expanded 7.6% y/y, accelerating from the 6.7% expansion seen in 2023. Growth was faster in 2021 and 2022, at 10.2% and 9.5% respectively, but that was largely due to reopening gains following the Covid-19 pandemic still being won.

Source: Haver Analytics, SAMA, Emirates NBD Research. *2016-2018 figures do not include e-commerce spends

Source: Haver Analytics, SAMA, Emirates NBD Research. *2016-2018 figures do not include e-commerce spends

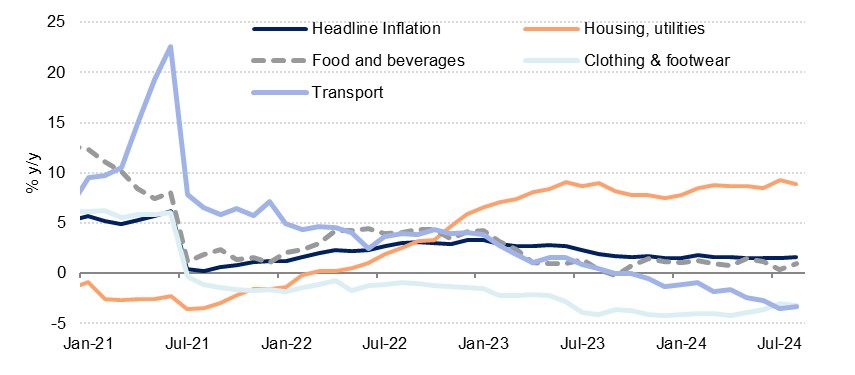

The pace of growth so far this year is well above the average inflation rate of 1.6% y/y over January to August, implying a strong real expansion in spending in Saudi Arabia. And even that slow pace of inflation is not entirely reflective given that almost all the headline price growth in KSA is being driven by higher housing and utilities prices, which rose an average of 8.6% y/y over the first eight months of the year – and are more likely to be paid via standing bank orders, transfers, or cheque payments. Food and beverage prices are up by an average of just 1.0%, while prices for most of the other components of the CPI basket have been deflationary through the course of 2024 even with seemingly strong demand. This has been reflected in the S&P Global PMI survey for Saudi Arabia, where firms are starting to cut their prices charged even as their input prices rise, citing a need to remain competitive in an increasingly crowded market.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

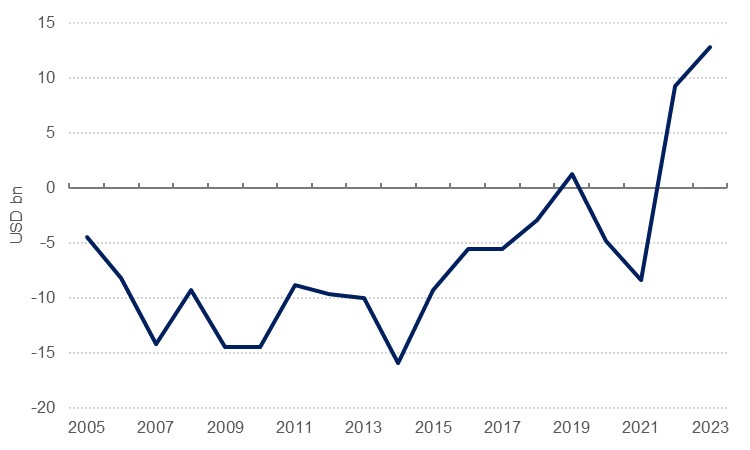

Prior to the pandemic, growth in spending was far more lacklustre, with the pick-up in recent years reflecting in part the increasing dynamism in the non-oil sector. The relaxation of social restrictions has provided a much wider range of options for spending on entertainment for instance in the kingdom, and this is reflected in balance of payments data also. Net travel spending on the current account turned positive for the first time in Q1 2022 and has continued to mount since as spending that used to be done abroad is increasingly made at home. Equally, the rapid increase in foreign visitors traveling to Saudi Arabia for leisure tourism is also supportive of increased spending.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Another factor that would be supporting increased spending in Saudi Arabia is the ongoing growth in the population. Between the publication of its last two censuses, in 2022 and 2010, the population expanded by an annual average pace of 2.5% to 32.2mn making it the fastest growing in the G20. With the ramp-up in investment activity over the past several years as the giga-projects get underway, this pace has likely accelerated further and will continue to do so. The growth in the population has not been solely driven by expatriate workers either; of the gain in the population since the last census, 4.8mn were Saudis, contributing to the young age of the Saudi population with the median at just 22 years, a statistic which also points towards solid spending growth through the years to come.

The positive sentiment around the economic outlook for Saudi Arabia is shared by consumers there, which should further buoy spending. According to the Primary Consumer Sentiment Index produced by Ipsos, Saudi Arabia’s consumers have been the most positive about their economic outlook this year. In September, the index rose to a record high of 75.45. This positivity is backed up by credit data, with personal loans up 7.0% y/y in June.