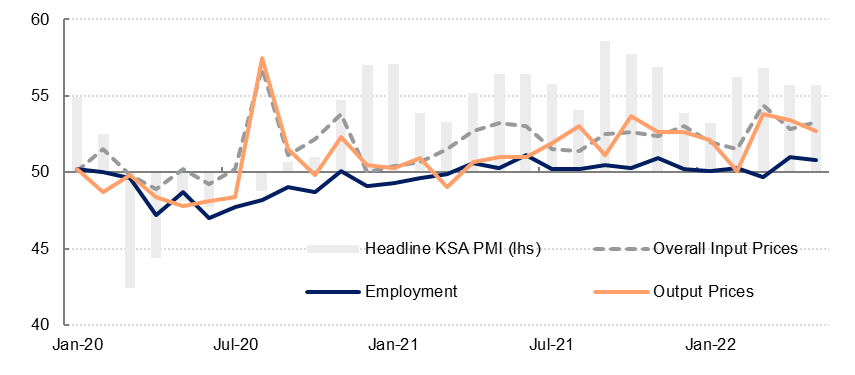

Saudi Arabia’s PMI was unchanged at 55.7 in May with business activity, new work and employment rising at a similar rate as in April. Businesses reported strong demand as the economy continued to recover from the pandemic. Firms slowed their purchasing activity last month however, as input costs rose slightly even as supplier delivery times improved. Panellists reported higher raw material, freight and fuel costs in May, but were able to pass some of this on to consumers. Selling prices in May rose for the fourteenth consecutive month, albeit at a slower rate than in March and April.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

Backlogs of work increased in May for the first time since January 2020, suggesting that capacity constraints are starting to materialise following several months of strong new order growth. Firms remained cautiously optimistic about the outlook although only 11% of respondents expected their output to be higher in a year’s time, with the vast majority expecting their output to remain unchanged. Business sentiment is low relative to the series average, particularly in the context of current high oil prices.

Egypt’s headline PMI ticked up modestly in May, rising to 47.0 compared with the previous month’s 46.9. Nevertheless, the private sector economy remains in contractionary territory, and the survey’s subcomponents illustrate the challenging conditions in which firms are operating. Output declined at the second-fastest rate in two years, and the coming months look equally difficult as new orders contracted more rapidly than in April as inflation hit demand.

Price pressures continue to mount, with input prices accelerating at the fastest pace since November. The depreciation of the Egyptian pound against the USD since March has exacerbated the global pressures related to reopening from the pandemic and the war in Ukraine which were already extant. Firms are passing some of these costs on to consumers, and the pace of output price growth did accelerate in May. With the CPI inflation print already at multi-year highs, it is expected to remain elevated in Thursday’s data release for May.

However, most firms are seemingly still absorbing many of these pressures themselves for the time being, and this has had implications for business operations, as firms have scaled back their quantity of purchases for the fifth consecutive month while employment levels declined for the seventh month in a row, albeit at a less pronounced pace than in April.

Qatar’s PMI rose to a series high of 67.5 in May from 63.6 in April on surging business activity and new work, with firms citing greater tourism activity, the upcoming FIFA world cup, and easing pandemic restrictions as factors contributing to the improved business conditions. Manufacturers reported the strongest increase in output last month, followed by services, wholesale & retail trade and construction.

Employment increased at a much faster rate in May as firms boosted capacity to tackle rising backlogs of work. Input costs increased again due to higher purchase costs and a modest increase in staff costs as well. Output prices rose for the first time in four months as firms passed on some of their higher costs in a robust demand environment.

Despite the strong output and new work growth, firms were still cautious about their outlook with the future output index rising to just 51.0 in May from 50.6 in April.