The UAE PMI fell to 45.2 in March from 49.1 in February, the lowest reading since the survey began in August 2009 and signalling a contraction in the non-oil private sector. Both new work (39.4) and employment (44.8) fell at the fastest pace on record. Output also declined but to a smaller degree as consumers increased purchases of food and other essentials. Suppliers’ delivery times increased, likely reflecting supply chain disruptions.

The detail of the survey showed export orders declined in March, but not as much as overall new work, suggesting that it was domestic demand that really took a hit last month. Input costs were broadly unchanged, and average selling prices declined for the 18th month in a row, although to a smaller extent than in Q4 2019. Backlogs of work increased as many current orders were placed on hold due to payment delays.

.png) Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Business optimism was at a similar level to February, near a two-year low. While some firms expressed optimism that Expo 2020 would boost activity in a year’s time, the survey was conducted in the two weeks through 25 March, before the recommendation to delay the expo by a year was made.

The average PMI reading in Q1 was 47.9, which suggests the non-oil sector contracted 2-3% y/y in Q1 2020. Conditions are likely to remain weak in Q2, but our baseline scenario envisages a modest recovery from Q3 2020. At this stage we expect the non-oil sector to contract -0.7% in 2020, with higher oil production expected to boost headline GDP growth to 0.3%. However, risks to our forecasts remain skewed to the downside.

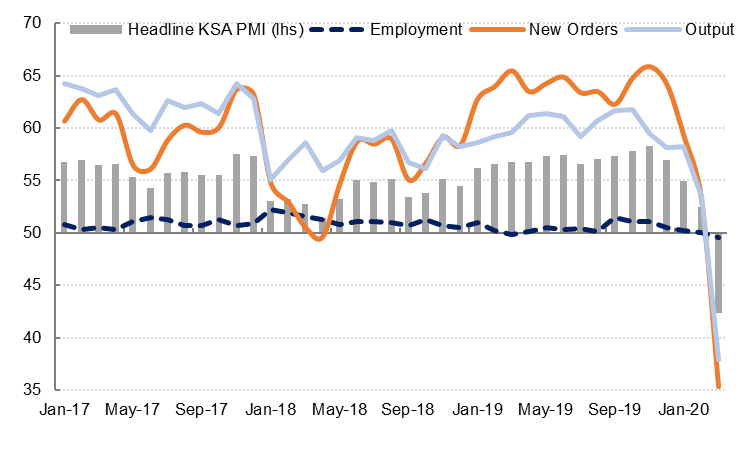

Saudi Arabia’s headline PMI fell more than 10 points in March to 42.2, a record low and the first sub-50 reading for the kingdom’s PMI in more than 10 years of data. Both output and new work contracted sharply as businesses were closed and projects delayed as a result of restrictions imposed by the authorities to limit the spread of COVID-19. However, unlike in the UAE, private sector employment was only fractionally lower (49.6) last month.

Both input costs and selling prices were also only marginally lower than in February, and purchasing activity contracted sharply. The backlogs of work declined as firms reported cancelled projects. Businesses were “neutral” about their future prospects, with the future output index falling to 50.2 in March, the lowest reading since at least 2012.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

The average PMI for Q1 2020 is 49.9, signalling no growth in the non-oil sector in Q1 2020. We expect the non-oil sector in Saudi Arabia to contract -0.2% this year with headline GDP reaching 1.2% as oil output rises. Again, the risk to this forecast is skewed to the downside.

Egypt’s headline PMI reading fell from 47.1 in February to 44.2 in March, marking the fastest deceleration in non-oil private sector activity since January 2017 as the coronavirus pandemic impacted the economy. The deadly storms which battered the country in the middle of the month will likely also have played a part given that people were advised to stay at home and many businesses were closed for the duration. However, while the storms have now passed, the virus continues to escalate and will likely weigh even more heavily on the April PMI survey.

As of April 3, Egypt had 985 confirmed coronavirus cases, with 120 new cases that day. The first cases were identified around a week into March, centred around a Nile Cruise ship, and the government has been introducing ever more stringent measures since in a bid to flatten its curve. These have included advising people to stay at home, a night curfew and the closure of cinemas, restaurants, and other places where people gather. Inevitably, this has had a huge effect on output, especially in the tourism sector, and like the headline figure, this also declined at the fastest pace since the start of 2017. It is not only the domestic market that has been affected by the virus either of course; it is a global pandemic, and the fall in export orders seen in March - the fastest deterioration since 2012 - reflects this.

Perhaps most tellingly, the pandemic has induced a bout of pessimism in the survey respondents not seen before; the future output sub-index fell to a series low in March, as they cited concerns over the economic conditions. While still above the neutral 50.0 line, it marked the third consecutive month of falls.

.png) Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

While the March PMIs point to a significant deterioration in the business condition in the UAE, Saudi Arabia and Egypt, this has been evident in PMI surveys around the world, many of which fell below 40 last month. Activity is expected to rebound once the restrictions around the movement of people are lifted, and non-essential businesses are re-opened. However, the longer the shutdowns remain in place, the larger the economic and financial costs are likely to be.