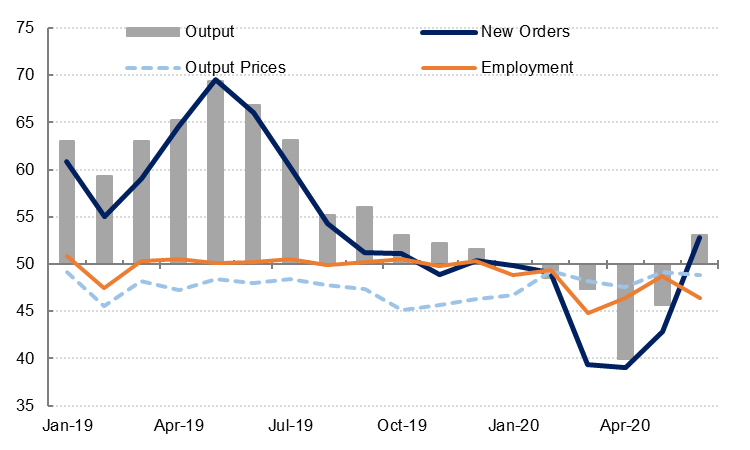

The UAE headline PMI rose to 50.4 in June from 46.7 in May, the first reading in expansion territory this year. Output and new work increased in June as economic activity continued to normalize. New export orders also increased m/m for the first time since January. While the rise in output and activity in June is encouraging, it is a month-on-month improvement following three months of relatively steep contraction in output.

Employment in the UAE’s private sector declined in June at a faster rate than in May, as firms highlighted the need to reduce operating costs, even as activity increased. Staff costs declined only marginally last month.

Purchasing activity increased for the first time since January in response to higher output and new work, and stocks of inventories were slightly higher as well. Firms continued to discount selling prices to encourage sales, even as input costs rose slightly in June. Suppliers’ delivery times shortened as restrictions on movement were eased further.

The future optimism index rose to 59.5 from 56.1, the highest reading since March, as more firms were optimistic about the economy continuing to recover over the next year.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

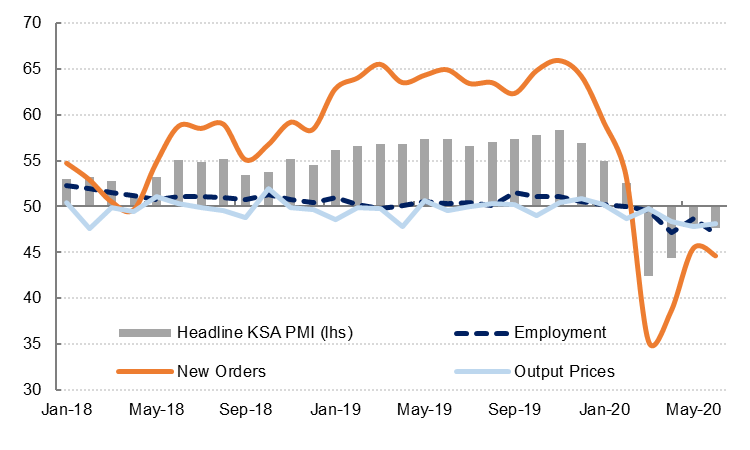

Saudi Arabia’s PMI declined slightly in June to 47.7 as output, new work and employment fell at a faster rate than in May. Panellists noted “subdued economic conditions” and “cautious spending patterns” among both businesses and consumers even as coronavirus-related restrictions on activity were gradually lifted from the end of May. This was also reflected in a faster decline in the quantity of purchases by firms last month. The PMI survey was conducted from 12-22 June.

As a result of the softer demand conditions, firms implemented further job cuts in June and the employment index declined to a series-low of 47.0. Staff costs also declined last month but at a slower rate than in May. Input costs were fractionally lower in June, while selling prices fell for sixth month in a row. We expect prices to rise as VAT is adjusted to 15% from 1 July, but firms may absorb some of this cost if consumer demand remains soft. Tighter fiscal policy in the kingdom is likely to weigh on a recovery in domestic demand in H2 2020.

The future output index declined to 49.0 in June from 53.2 in May, the first sub-50 reading since April 2012. While some firms were optimistic about their future output, more were uncertain about the rate at which the economy would recover in the coming months.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research