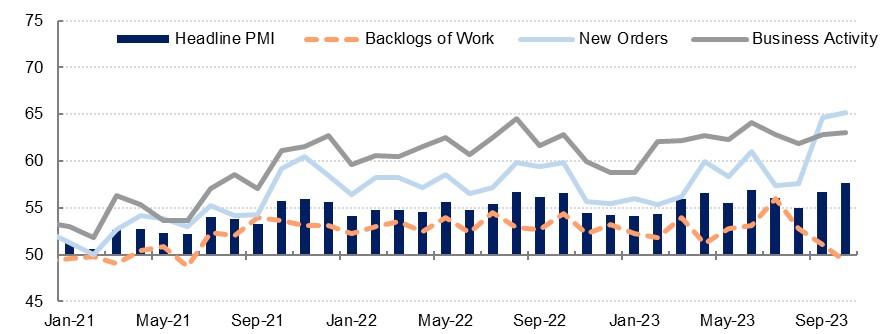

The S&P Global PMI survey for the UAE rose to 57.7 in October, from 56.7 the previous month. This was the highest level for the index since June 2019 and is indicative of a strong start to the final quarter of 2023. The uptick was driven by strong returns in most of the subcomponents of the index, with new orders at their highest levels in over four years. This was on the back of not only domestic orders, which have been the backbone of new order growth over the past several years, but also a robust expansion in export orders. These had been negative or only just over the neutral 50.0 level until July but have accelerated rapidly over the past several surveys.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

In this environment, businesses were positive about the outlook for the next 12 months. The degree of optimism was the second strongest since March 2020 with just over a quarter of respondents expecting growth over the next year. Underlining this sentiment, firms hired at a moderately faster pace in October than in September both on the back of current requirements and plans to expand their businesses. Firms have been building up their inventories in the expectation of robust demand, and this rose at the joint-fastest pace in five-and-a-half years.

Purchase costs picked up in October, with both purchase costs and staff costs growing at a faster rate than the previous month. Firms noted higher fuel prices and the need to raise wages in order to keep hold of experienced staff. Businesses also raised their output prices for the first time in 15 months as they looked to pass some of these higher prices on to customers. With fuel prices likely to remain higher in Q4 compared with the start of the year, these dynamics will likely feed through to consumer inflation in the UAE, with the Dubai measure having ticked up to 3.8% y/y in September, from 2.3% in August.

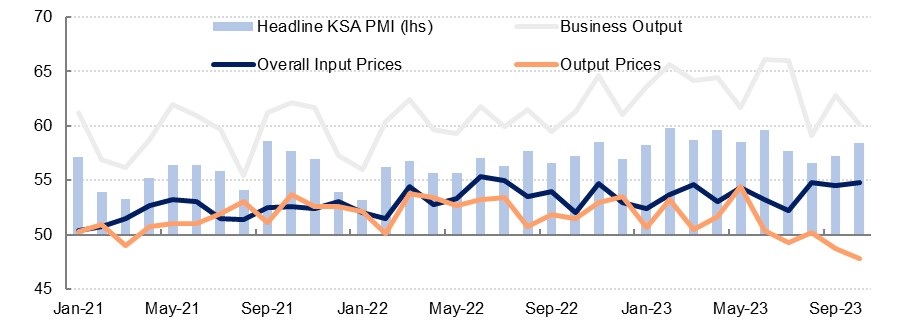

The Riyad Bank Saudi Arabia PMI also rose last month, ticking up to a four-month high of 58.4, from 57.2 the previous month. Output slowed modestly from September, so it was new orders that underpinned the improvement, which rose at the fastest level since June. New export orders were positive for the first time since July but it was still domestic orders that are driving growth at present. Firms noted strong growth in the tourism sector while price discounting supported higher sales.

Source: Riyad Bank, Emirates NBD Research

Source: Riyad Bank, Emirates NBD ResearchOutput prices fell at the sharpest pace since May 2020 as respondents to the survey noted increasing competition for business. Meanwhile, input costs rose at a faster pace with both purchase prices and staff costs ticking up. Higher costs for raw materials contributed to higher input prices, while the tightening labour market drove up staff costs, with firms reporting paying more in order to keep hold of experienced staff.

Despite the growth in new orders, business optimism declined in October. Firms have previously cited growing competition as weighing on the outlook, but the overall view remains positive. The start to the fourth quarter chimes with our non-oil GDP growth forecast of 5.0% this year, similar to that seen in 2022.

Egypt’s S&P Global PMI survey fell to 47.9 in October, from 48.7 the previous month. Output fell at a slightly softer pace than seen in September. New orders declined at a faster pace, with firms noting inflationary pressures as weighing on demand.

Input prices continued to rise, albeit at a slightly softer pace than in the preceding two months. Higher raw materials costs and supply constraints drove up input prices, while staff costs continued to rise as firms compensate workers for higher consumer prices, with CPI inflation at 38% in September. With most firms raising their output prices as they pass on their higher costs to customers, cost pressures in Egypt will remain salient.

Firms also looked to protect their margins through reducing staffing levels, with employment turning negative in October after two months of gains. Businesses also noted a lack of demand. Business purchases continued to decline in October. Business confidence picked up to a 10-month high but still only 13% of respondents expect higher output in 12 months’ time.