UAE

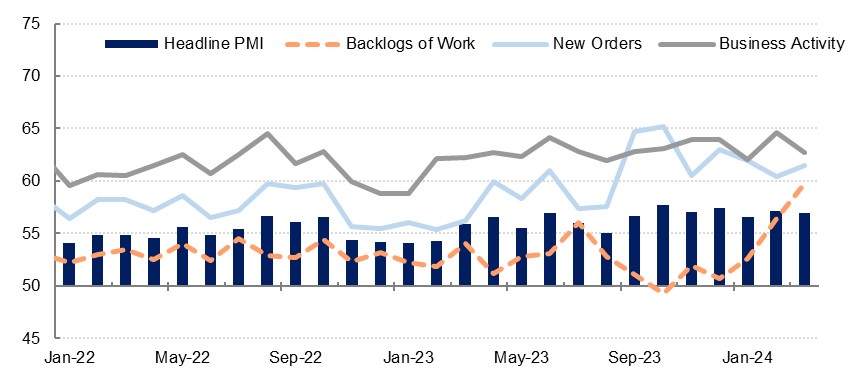

The S&P Global for the UAE dipped to 56.9 in March, from 57.1 in February. This is still a strong reading for the index, however, and there has been a marked turnaround from the comparative slowdown seen in January. Growth in business activity slowed in March but remained robust with nearly a third of respondents noting an uptick in output. The pipeline for the coming months is positive as new orders accelerated in March, with domestic orders still driving the expansion. New export orders were also positive, but growth slowed from February, and it remained lower than the total order growth.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

Backlogs of work rose once again in March, with a combination of high demand and disruption to shipping in the Red Sea leading to the joint-highest level on record for the subcomponent. Firms increased their hiring in order to help cope with higher workloads, with growth in staff count above the series average. Strong business confidence will also have contributed to the hiring, with optimism at the highest level in six months in March, and the second highest in four years.

Firms’ margins continued to be squeezed in the UAE, as firms cut prices charged despite higher input costs. Input price pressures were more modest, however, with only 4% of firms seeing higher purchase costs, in part related to shipping fees. Staff costs rose at the same moderate pace as the previous month, with employees requesting pay rises due to inflation in some cases. Despite these upwards pressures on input prices, firms continued to discount, with price cutting at the acutest level in three-and-a-half years as they sought to remain competitive.

Saudi Arabia

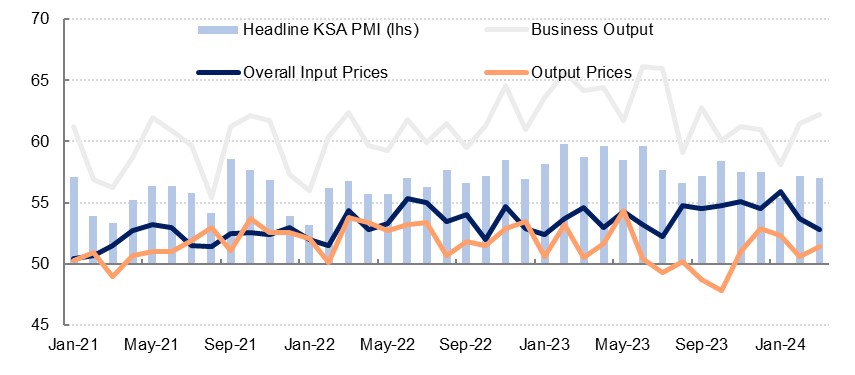

The Riyad Bank PMI survey for Saudi Arabia came in at 57.0 in March, down modestly from 57.2 in February, but still indicative of a robust expansion in the non-oil private sector, and in line with the series average. Output saw an acceleration in growth to a six-month high for the subcomponent, with the manufacturing sector in particular faring well. The outlook for the coming months remains strong, as new orders growth accelerated again to a three-month high even as some firms noted an increasingly competitive market. New export orders ticked up but at a slower pace than total orders, suggesting that it remains domestic orders that are driving the expansion.

The pace of price growth for businesses eased in March, as overall input prices expanded at the slowest pace since July. Purchase cost pressures slowed to the lowest level since September, while staff costs grew at the slowest pace in 14 months, rising just above the neutral 50.0 level with most businesses reporting no change in staffing costs. While input costs slowed, firms rose their prices charged at a faster pace than seen in February, bolstered by strong demand. While again firms noted competitiveness in the market driving them to discount, at the aggregate level this is far less common than has been seen in the UAE.

Business confidence picked up to a four-month high in March, with firms noting a strong economic environment and expanding orderbooks. In this environment, firms increased their staffing at a robust pace compared with the long-run average. This helped businesses bring down backlogs of work in March.

Egypt

The S&P Global PMI survey for Egypt rose to 47.6 in March, up from 47.1 in February, as economic and financial pressures continued to exert a drag on activity. The outlook for Egypt’s economy has improved hugely over the past two months with the announcement of support from the UAE and the enlargement of the IMF programme. Nevertheless, challenges remain, and output continued to contract in March, if at a slightly slower pace than in February, as some respondents noted the disruption to Red Sea shipping as impacting business. New orders continued to fall, but there was an expansion in new export orders for the first time since December 2022, with the devaluation of the Egyptian pound in the middle of the month likely bolstering demand. The adjustment to the FX regime will likely start to have a more marked positive effect on the Egyptian private sector from April’s survey onwards.

Price pressures on businesses remained salient, and while the pace of price growth slowed compared with February, it was still strong. Purchase prices were higher for around a quarter of firms, although some noted that the easing FX market pressures had led to lower costs for them. Staff costs accelerated, meanwhile, with the higher cost of living driving higher wages. Firms continued to pass these costs on to consumers, albeit at a slower pace than seen in February.

Business confidence in Egypt remained weak in March, near the lowest level in the series history despite the new agreements recently signed. Nevertheless, the employment subcomponent of the survey turned positive for the first time since December 2023.