UAE

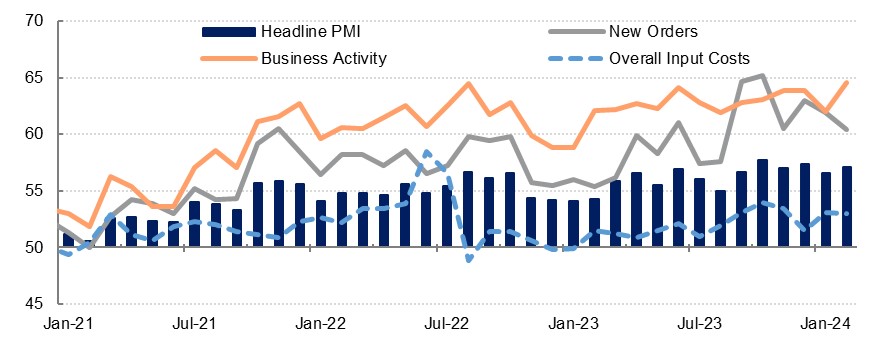

The UAE’s S&P Global PMI survey for February picked up from a five-month low recorded in January as it rose to 57.1, up from 56.6 . This is well above the series average and remains indicative of a non-oil economy that is expanding at a robust pace, with the output subcomponent at its highest level since mid-2019. The pipeline remains strong also, with new orders continuing to expand at a healthy clip, although the pace of expansion was the slowest since August last year. Domestic orders still appear to be the primary driver of new work, but export orders did pick up strongly after only marginal growth in December and January.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

The UAE’s non-oil private sector continues to perform strongly despite numerous external challenges, not least the disruption to shipping through the Red Sea. This has, however, shown up in the survey’s subcomponents as backlogs of work rose at the fastest pace since March 2020, when the Covid-19 pandemic crisis began to seriously impact business. Respondents to the survey cited disruption to freight deliveries as having contributed to the spike, although robust growth in new work also played a part.

Input prices continued to climb in February, at roughly the same pace as seen in January, with purchase prices the primary driver of the uptick as shipping costs and raw materials costs rose. Staff costs also rose, but at a softer and marginal pace, albeit the quickest since October. Nevertheless, firms continued to cut their selling prices in order to remain competitive, with the pace of discounting at its most acute since September 2020.

KSA

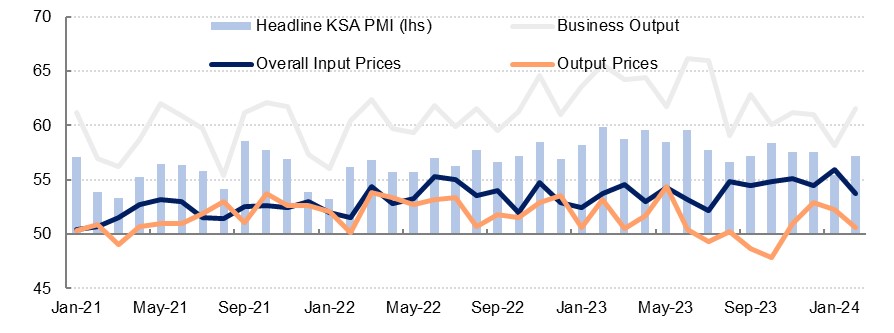

The Riyad Bank PMI survey for Saudi Arabia also saw a recovery, from a two-year low the month prior. In February the headline reading was 57.2, which marked a five-month high and was up from 55.4 in January. Output was also at a five-month high, with especially robust performances recorded in the services and construction sectors, and tourism also credited. New orders slowed in February but continued to grow strongly, and while the bulk of this was still driven by domestic orders, growth in export orders accelerated to the fastest pace in four months as respondents reported expanding into new markets.

Source: Riyad Bank, Emirates NBD Research

Source: Riyad Bank, Emirates NBD Research

Business optimism improved in February after the dip seen in January, and this was reflected in increased hiring by businesses as employment rose at the fastest pace since November. Firms noted that the higher staffing levels helped them clear backlogs of work, which declined again after the anomalous rise seen in January.

Input prices rose at a milder pace in February, the slowest rise since July last year in fact, with both purchase costs and staff costs expanding more slowly. Firms did pass on some higher costs to customers as they cited diminished concerns around competition, but this was at a marginal pace, and the slowest since October.

Egypt

Egypt’s S&P Global PMI survey declined in February, falling to 47.1, down from 48.1 previously. Output fell at the sharpest pace since January last year with businesses citing challenges including shipping disruption, the war in Gaza, and price pressures as weighing on activity. New orders also fell at a sharper pace in February, with wholesale & retail trade in particular seeing a fall in new business. New orders fell at a softer pace and was only marginal as some firms reported an increase in export demand.

Egyptian businesses continued to see rapid price rises in February, as input prices rose at the fastest pace since last January. This was driven largely by purchase costs, related to ongoing FX shortages driving up the cost of imported supplies, while the increase in staff costs was more modest, albeit higher than the previous month as households contended with higher living costs.

Business expectations remained low in February, but they did pick up from January, with rumours that had been circulating around possible new deals with the IMF and Gulf partners likely contributing to the uptick. With the parallel exchange rate having narrowed with the official rate since the deal with the UAE was announced, price pressures and currency shortages should ease somewhat in the coming months, potentially paving the way for an uptick in private sector activity in Egypt this year.