- The US presidential election came a step closer to being finally resolved as President-elect Joe Biden has been designated by the General Services Administration as the winner of the election, allowing the transition team access to briefings, funds and Trump administration officials in order to plan out the handover of power.

- Meanwhile, President-elect Biden continues to select his executive team, naming former Fed Chair Janet Yellen as his pick for Treasury Secretary. Yellen’s focus is likely to be more on policies aiming to boost employment and reduce inequalities, rather than focus on cutting taxes or easing regulations. However, as we have noted previously, major fiscal stimulus will be a challenge with a deadlocked Congress.

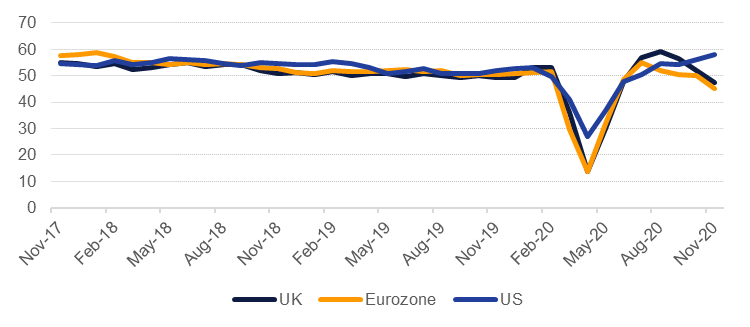

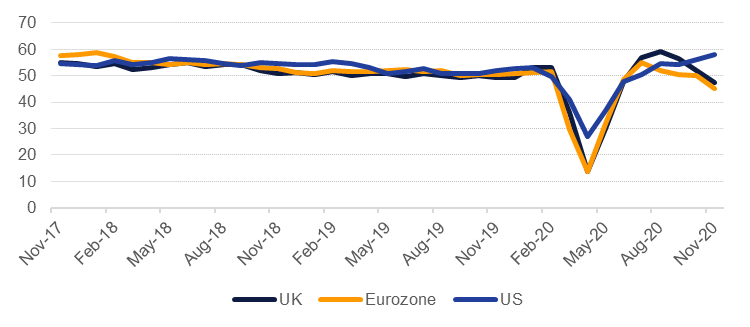

- PMI data for the Eurozone showed the consequence of lockdowns being used again with the flash estimate for November falling to 45.1 down from 50 a month earlier. The services sector was again the underperformer, slipping to 41.3 from 46.9 a month ago as restaurants and retail activity are severely curtailed by Covid-19 restrictions. The trend was reinforced on a country level with services activity in both France and Germany weakening considerably, to 38 and 46.2 respectively, while manufacturing has held up relatively better.

- The UK showed a roughly similar story to the Eurozone with the services PMI down to 45.8, its weakest reading since May, while manufacturing managed to increase m/m to 55.2 from 53.7 in November. The UK may seek to strengthen Covid-19 tier restrictions in December once England ends its current lockdown at the start of the month.

- PMI numbers from the US were the best of the developed markets released yesterday. The November composite PMI rose to 57.9 from 56.3 a month ago with both services (57.7) and manufacturing (56.7) rising. The strong performance of services is a positive surprise given that many states have begun to reimpose lockdown measures, hitting restaurants and hospitality in particular. However, data may begin to converge on Europe and the UK as more states take measures to control Covid-19.

- The UAE will allow 100% foreign ownership in some onshore companies, and made other amendments to the companies law to improve corporate governance and make it more attractive for private companies to IPO, according to local press reports. The policy reform had initially been announced over a year ago, but the changes to the relevant legislation have now been approved by the President. The move is expected to boost foreign investment, and many of the changes come into effect at the start of December. Individual emirates can mandate some level of UAE national ownership in some sectors, and strategic sectors such as oil & gas exploration, transport and utilities are exempt from the new rules.

Composite PMIS show cost of lockdowns in November

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

- Bond markets closed lower overnight despite news of the presidential transition being made official only occurring late and European data coming in poorly. Yields on USTs were moderately higher to start the holiday-shortened week, with the 2yr up marginally to 0.1594% and the 10yr adding almost 3bps to 0.8537%.

- Oman tapped two of its existing issues for more funds overnight, pricing a USD 200m tap of its 2027 bond at 6.3% and raising USD 300m in its 2032 issuance at 6.9%. Both are considerably tighter than coupons on the initial issuance, benefitting from the rally in Oman sovereign debt as new reforms have been announced, it not yet implemented.

- Fitch revised its outlook on Tunisia’s sovereign rating to negative and affirmed its rating at ‘B’. The agency noted a “fragmented political landscape” that would mean risks for fiscal reform along with government plans to monetize its deficit as rationale for the outlook change.

FX

- Strong PMI numbers from the US helped to lift the USD overnight, particulary against the Euro and GBP as the economy in the US appears to be outperforming both in the near term. The dollar index was up by 0.12% with most of the gains coming later in the day. Certainty over the US election results may also act as a near term boost to the greenback against major peers.

- The NZD is the major mover this morning, up more than 0.7% as the finance ministry in New Zealand has proposed adding controlling house prices to the central bank’s remit.

Equities

- US equity markets started the week on the front foot, bolstered by more positive news on the vaccine front – this time from AstraZeneca – and on the news that the transition to the Joe Biden presidential administration in the US was finally starting. In the US, the NASDAQ (0.2%), the S&P 500 (0.6%) and the Dow Jones (1.1%) all closed higher.

- Within the region, the DFM gained 1.3%, while the Tadawul closed 0.3% higher.

- In Europe, weak PMI data, the ongoing rise in Covid-19 cases, continued restrictions on movement, and warnings by the BoE governor that the potential damage of no trade deal being reached between the UK and the EU being worse than that posed by the pandemic all served to weigh one equity indices, despite the positive vaccine news. The CAC and the DAX both lost 0.1%, while the FTSE 100 closed 0.3% lower.

Commodities

- Oil markets gained to start the week, bolstered by the now official orderly transfer of power underway in the US as well as more additional positive Covid-19 vaccine test results. Brent settled up at over USD 46/b, a gain of 2.5% on the day, while WTI closed at more than USD 43.06/b, up 2.2%. Both contracts are also tentatively higher today.

- Brent time spreads closed in backwardation at the front of the curve for the first time since June. While the flip is only marginal, barely more than neutral, it does send a positive signal that markets expect to see some near term tightening of oil markets. Spreads are likely, however, to be highly volatile, in the lead up to the OPEC+ meeting next week.

To watch today

- Germany IFO Business climate – 90.3 estimate/92.7 previous

- US Conference Board Consumer Confidence – 92.9 estimate/100.9 previous

Click here to Download Full article

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research