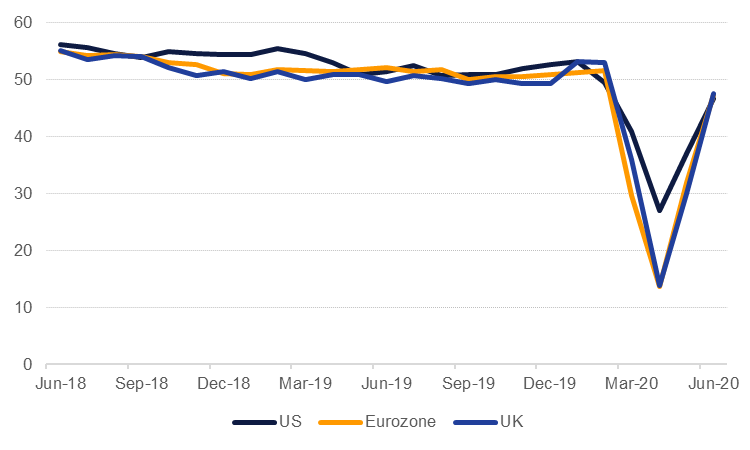

PMI numbers in the Eurozone showed across the board improvements as economies exited lockdowns and activity moved closer to pre-Covid 19 trends. The composite index across the Eurozone gained to 47.5 from 31.9 a month earlier, outperforming expectations. France’s economy in particular showed signs of strength with the manufacturing PMI there jumping back above 50 to 52 compared with 40.6 a month earlier while the services component also showed signs of a tentative increase in activity. Manufacturing and services in Germany are still in contraction but at 44.6 and 45.8 respectively have both improved from the depths of the crisis in March-May.

In the UK the composite PMI gained more than 17pts to reach 47.6. Manufacturing nudged just above the 50 level while services at 47 showed a stark improvement from just 29 a month earlier. More and more economic activity will resume across the UK over the coming weeks which should help to sustain the nascent recovery in economic output. In the US, the composite PMI gained nearly 10pts to hit 46.8 for June with manufacturing outperforming services.

Saudi Arabia will limit the annual Hajj pilgrimage this year to around 1,000 citizens and residents. In 2019, 2.5mn people participated in Hajj, with three-quarters of those coming from abroad. Tourism receipts – which have been mainly due to religious tourism – amounted to more than USD 16bn in 2019 or around 2% of the kingdom’s GDP. We expect the Saudi economy to contract by -4% this year.

The WTO published a revised assessment of global trade for 2020 and expects volumes to not be impacted as badly as feared in their April projections. Trade volumes are expected to decline by 12.9% this year in the WTO’s optimistic scenario before recovery by 21.3% in 2020. However, in the agency’s pessimistic scenario a far steeper drop of 31.9% is expected for 2020, followed by a 24% gain next year.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed mixed amid few catalysts and continued risk-on sentiment. Yields on the 2y UST and 10y UST ended the day at 0.18% (-1 bp) and 0.71% (+1 bp) respectively.

Primary market action continued to dominate regional bond market. Dubai Islamic Bank sold another USD 300mn in a tap offering of 2026 sukuk sold earlier this month. The issue was priced 240 bps over mid swaps. Arab Petroleum Investment Corporation and DP World are also in the market and are expected to price sometime this week.

Moody’s lowered their rating on Oman to Ba3 and kept the sovereign rating on a negative outlook. The agency expects low oil prices over the medium term to cause Oman to build up debt and “erode” its affordability.

The dollar declined against nearly all major peers overnight as data, particularly in Europe, points to an economic recovery underway, even if the pace is tepid. The dollar index fell by 0.4% to 96.46. The Euro extended its gains from the start of the week, adding 0.4% to settle at 1.1308 as PMI data showed a stark improvement from April-May. Germany in particular still has some ways to go but an improvement in consumption should allow the Eurozone economy, and euro, to hold forth in the second half of the year. Sterling also improved thanks to a better than expected PMI, settling up at 1.2520. The Kiwi is a notable loser this morning as the RBNZ kepts rates on hold (as expected) but did not top up its large scale asset purchases (the RBNZ’s form of QE).

The US Federal Reserve’s swap lines with other central banks are showing demand for dollars ebbing as economic conditions stabilise. In the near term that should weigh against the dollar but the risk of further outbreaks could see international banks scramble again for dollars if financing conditions become stressed.

Developed market equities closed higher as better than expected PMI data further fueled hopes of a rebound. The S&P 500 index and the Euro Stoxx 50 index added +0.4% and +1.8% respectively.

Dubai stocks were notable gainers as it extended gains from earlier in the week following easing of travel restrictions. The DFM index added +1.4% on the back of strength in Emaar-related stocks. Emaar Malls and Emaar Properties added +7.4% and +1.8% respectively.

Oil futures are oscillating around recent highs as the market lacks any major catalyst this week. Brent futures are down by around 0.5% in early trade this morning at USD 42.42/b after having lost more than 1% overnight. WTI is down by 0.67% today after muted losses yesterday.

API data reported a build in US crude stocks of 1.75m bbl last week, larger than expected. Data from the EIA out later tonight will confirm if inventories continue to hit record levels.