.jpg?h=457&w=800&la=en&hash=F34F6D0135CDB85DFF29A03F8CEAE77F)

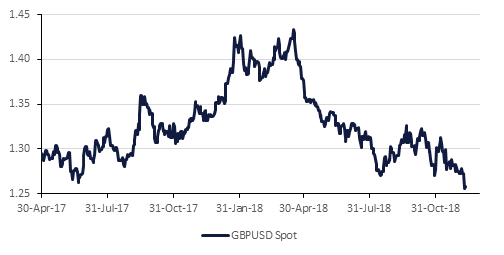

UK PM Theresa May’s decision to postpone the Parliamentary vote on her Brexit deal to the new year saw GBP fall to a 20-month low to the dollar at 1.2507. May’s decision in some ways was inevitable given the probability that she would have suffered a large loss, but it also carries risks as it will weaken her position even further especially as it seems unlikely that she will be able to secure a meaningful re-negotiation of the deal. Indeed she only appears to be seeking to discuss ‘further reassurances’ with the EU over the Irish border backstop, the most contentious part of the overall agreement. Pushing the vote closer to the 29th March deadline for Brexit may serve to focus minds on the possibility of no-deal, but it also plays into the hands of her opponents calling for article 50 to be withdrawn and/or for another referendum to take place. The European Court of Justice has also ruled that the UK has the right to reverse its so called article 50 notice any time before it is due to leave the bloc on March 29th.

The effect of the currency crisis which began in July was clearly visible in Turkey’s Q3 GDP results, which showed a q/q contraction of -1.1%, and y/y growth of just 1.6%. This missed analyst expectations of 2.2% and was the weakest y/y growth since Q3 2016, in the wake of the attempted coup that summer. Trade data showed the direct impact of the lira’s rapid depreciation; exports saw real growth of 13.6% y/y, while imports fell by 16.7%. Of the other components of GDP by expenditure, household consumption grew just 1.1% y/y while gross fixed capital formation declined by 3.8%, reflecting the impact of inflation, rate hikes, and a general decline in confidence. On the other hand, this was mitigated somewhat by a 7.5% y/y rise in government final consumption.

Inflation in Egypt eased to 15.7% y/y in November, down from 17.7% the previous month. This puts the measure back within the CBE’s target range of 13 % ±3 and alleviates pressure on the central bank to reverse its loosening of monetary policy, which has already been on hold since March. On a monthly basis, CPI contracted -0.8%, compared to inflation of 2.6% in October.

In a surprise move, the RBI governor Urijit Patel resigned citing personal reasons. However, given reports of difference in opinion over certain issues between the government and the RBI it is been interpreted as a statement of protest.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries closed lower amid a rebound in US equities. Yields on the 2y UST, 5y UST and 10y UST closed at 2.73% (+2 bps), 2.71% (+2 bps) and 2.85% (+1 bp).

Regional bonds traded in a tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -1bp to 4.62% while credit spreads tightened 1 bp to 190 bps.

Following the change in outlook for Qatar, S&P revised the outlook on three Qatari government related entities to stable from negative. These included Ooredoo, Nakilat and Industries Qatar.

GBPUSD fell to a 20-month low yesterday in the aftermath of Prime Minister Theresa May’s decision to postpone the Parliamentary vote on her Brexit deal (see macro). Having fallen to a 20-month low of 1.2507, not far from our Q4 2018 forecast of 1.25. The price was able to rebound from these lows but GBPUSD still finished 1.30% lower at 1.2561 on Monday.

As we go to print, GBPUSD has recouped an additional 0.13% and currently trades at 1.2574, however the extent of this rebound may be limited. We expect a retest of the 1.25 level in the short-term, a break of which could expose the price to a far more significant decline, especially if there is a weekly close below the two-year 23.6% Fibonacci retracement (1.2550).

This morning JPY is the best performing major currency, advancing on risk aversion in as a result of the decline in equity markets and Treasury yields. Currently USDJPY is trading 0.24% lower at 113.06. We expect a break of the 50-day moving average (113.06) to result in a retest of the 100-day moving average (112.31), a level which provided support in the first week of December 2018.

Developed markets closed mixed amid weak macroeconomic data. The S&P 500 index added +0.2% while the Euro Stoxx 600 index lost -1.9%. The ongoing uncertainty over Brexit weighed on European equities.

Regional markets closed lower. The DFM index continued its negative streak, losing -2.0% to take its year to date losses to -25.8%. Emaar Properties lost -4.6% to close below AED 4.0 level.

Oil prices erased Friday’s gains to start another week of trading on the back foot. Brent fell 2.8% while WTI lost more than 3% as the market relief on OPEC+’s production cut agreement gave way to market reality that the scale of the cuts may not be enough to limit a surplus emerging next year. Libya’s government has declared force majeure on output from its El Sharara field after it was seized by militants but that hasn’t been enough to shake crude out of its downward slump.

The UAE’s energy minister, Suhail al Mazrouei, said a new general cooperation agreement between OPEC and producers outside the bloc would be signed within three months. The agreement may formalize the relationship that has developed between OPEC and other producers in the past two years with Russia exerting a large influence on production decisions.