GBP rallied again overnight after the UK parliament adopted a motion that rules out leaving the EU without a deal in any scenario. Members of parliament will now vote on a postponement to the current 29th March Brexit deadline, but any such delay will also require consent from the EU and it is unclear what the EU will ask for in return. In the meantime, it appears that PM May still sees an opportunity to promote her own deal which might come back for a third vote in the coming fortnight. Elsewhere in the UK’s Spring Fiscal Statement the Chancellor lowered the UK’s growth forecast to 1.2% in 2019 (from 1.6%), while GDP forecasts for 2020 and 2021 were revised up. While sterling remains buoyed for now, we would caution that it is likely to stay ‘noisy’ in the foreseeable future as headline political risks will continue and markets do not know what if anything will result from any pause that might now occur. While a delay to Brexit might sound superficially attractive to markets, kicking the can down the road again will not solve the fundamental disagreements in parliament and may even make the political situation more unstable.

U.S. durable goods order rose by 0.4% m/m in January following a 1.3% December rise, while orders ex-transportation fell 0.1% after rising 0.3% in December. Assumptions about GDP growth are not much affected, which broadly see a downside risk from the 2.6% estimate for Q4 and a weaker profile in Q1. Meanwhile producer prices rose 0.1% in February, and the core index also rose 0.1%, highlighting that pipeline price pressures remain very subdued and offering no indication that the Fed monetary policy is likely to change for some time.

Following a 0.9% m/m contraction in December 2018, Eurozone aggregate industrial production grew 1.4% m/m in January, greater than the 1.0% consensus. Despite the monthly improvement, production was still 1.1% lower compared to the previous year, indicating that the Eurozone has started the first quarter on softer footing. Meanwhile Chinese data released overnight showed economic activity slowing at the start of the year, with industrial production and retail sales growing at their slowest rates at this time of year for almost a decade. However, capital investment and property investment both picked up.

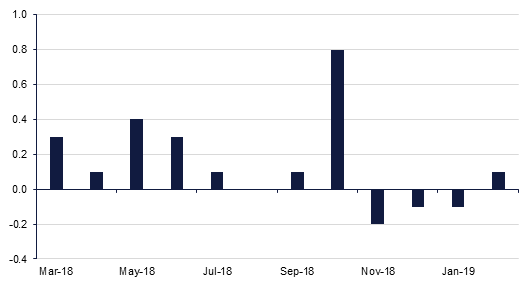

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries closed lower amid continued risk appetite and better than expected economic data.

Yields on the 2y UST, 5y UST and 10y UST closed at 2.46% (+1 bp), 2.43% (+3 bps) and 2.62% (+2 bps) respectively.

Regional bonds continued their positive run. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -4 bps to 4.24% and credit spreads tightened4 bps to 174 bps.

Emirates NBD raised USD 1bn in a perpetual offering at 6.125%.

GBP outperformed yesterday after Parliament voted against leaving the EU without a deal (see macro). GBPUSD closed 2.02 % higher on Wednesday, its greatest daily gain since April 2017, closing at 1.3338, after having traded as high as 1.3381. This morning the price has declined by 0.61% amid waning optimism and as we go to print GBPUSD is trading at 1.3257. We expect support at the 38.2% one-year Fibonacci retracement (1.3181). Of note is that the price has broken above the 100-week moving average (1.3216) and while the price remains above these levels, the medium term outlook is bullish.

Developed market equities continued their positive run as economic data came in better than expected. The S&P 500 index and the Euro Stoxx 600 index added +0.7% and +0.6% respectively.

The Tadawul (+1.0%) was a notable exception in what was a relatively weak day of trading for regional equities. The first phase of inclusion of Saudi equities in FTSE index will be completed today. In terms of stocks, Aramex jumped +9.1% after Australia Post sold their stake in a direct deal at AED 4.09 per share. The deal also opens up foreign ownership limit in the stock.

Crude prices were helped higher overnight thanks to a considerable draw in US petroleum inventories. WTI added more than 2.4% overnight while Brent gained 1.3% and both are edging higher this morning at USD 58.42/b for WTI and USD 67.80/b for Brent. Both contracts are at their 2019 highs at current levels, up 28.7% for WTI ytd and 23.5% for Brent.