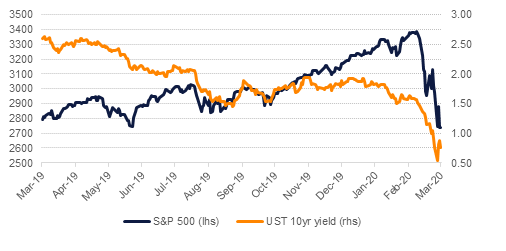

The WHO has declared that Covid19 is now a pandemic, adding to the sense of panic in markets. Governments around the world continue to take unprecedented steps to try and contain the virus: US President Donald Trump has announced that travel from Europe to the US would be suspended for the next 30 days—apart from the UK—to try and stop the transmission via travelers. Regionally, Kuwait has essentially closed the country to international travel and imposed a two-week mandatory holiday top prevent the spread of the virus. Markets are hardly showing any signs of being reassured by these heavy handed steps with equity markets continuing to collapse—S&P futures are already down more than 4% after a near 5% decline in the index overnight—and yields on 10yr USTs are down 11bps in early trading today, wiping out a substantial portion of yesterday’s gains.

The Bank of England cut rates by 50bps to 0.25% in the first emergency cut since the global financial crisis. The cut to rate follows on from moves by the US Federal Reserve, the Bank of Canada and Reserve Bank of Australia as monetary authorities globally ease financial conditions in a globally economy damaged by the coronavirus outbreak. Along with cutting rates, the BoE announced plans to support SMEs with term funding of up to GBP 100bn and cut the countercyclical buffer to 0% to further free up banks to add stimulus to the economy.

Meanwhile, UK chancellor Rishi Sunak unveiled this UK government’s first budget with a major boost to the economy, both to stave off the effects of the Covid19 outbreak as well as delivering on Conservative Party pledges to invest in infrastructure and skills. The government will spend GBP 30bn in 2020/21 of which GBP 12bn is directly tied to supporting the economy as it is impacted by the coronavirus while GBP 7bn will be new spending in line with Boris Johnson’s electoral pledges. Combined with the 50bps cut by the Bank of England earlier in the day, the UK is leading the way in delivering coordinated and sizeable support to its economy as it prepares for a bigger hit from the coronavirus.

Both Saudi Aramco and ADNOC announced they would raise supplies to higher than their production capacity as early as April as part of OPEC’s efforts to secure market share at the expense of prices. Aramco will supply markets with more than 12m b/d in April and will raise the company’s production capacity by 1m b/d to 13m b/d for the first time. An increase of that magnitude is enormous and it is not clear how long the increase in capacity will take. ADNOC said it would supply 4m b/d to markets in April and “accelerate” its plans to increase capacity to 5m b/d.

Source: Bloomberg

Source: Bloomberg

It was a choppy session of trading for treasuries as the focus remained on government response to the crisis which for better part has been rather underwhelming. The curve steepened with yields on the 2y UST and 10y UST closing at 0.52% (-1 bp) and 0.86% (+6 bps) respectively.

The Bank of England cut rates by 50 bps in an emergency meeting. Yields on 10y UK Gilts rose 5 bps to 0.29%.

Regional bonds continued to see sell-off. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose 22 bps to 3.41% and credit spreads widened 18 bps to 255 bps.

The dollar showed some modest gains overnight thanks to a risk-off tone re-emering to markets. Gains were strongest against GPB (down 0.7% to 1.282) even as the BoE’s emergency 50bps cut and the UK government’s budget look strong enough to help insulate the economy from the impact of Covid19. Indeed the BoE’s policy of term lending to SMEs helped GBP rally following the rate cut. Both JPY and CHF are strengthening against the dollar as risk off sentiment dominates markets.

The ECB meets later today and we expect to see a modest 10bps cut to the bank’s deposit facility, taking it to -0.6%. However, without substantial and wide-ranging fiscal support, rates moving further into negative in the Eurozone are unlikely to have any impact to restoring confidence or consumption. The EUR is up strongly against the dollar in early trades today—up 0.4% at 1.1318—but that could reverse should the ECB disappoint markets later in the day.

Developed market equities closed lower as lack of broad based government stimulus and continued worries over coronavirus spooked investors. The S&P 500 index closed -4.9% while the Euro Stoxx 600 index dropped -0.7%.

Regional equities closed mixed. The DFM index dropped -1.0% while the KWSE PM index added +1.4%. The markets are following moves in global markets amid lack of any corporate news flow.

Oil prices returned to their losing ways overnight with both Brent and WTI futures down by around 4%. In early trading today Brent is at USD 33.93/b and WTI at USD 31.26/b, both down by 5.2%. Aggressive supply messaging from Gulf NOCs—ADNOC and Aramco—in particular is weighing on the market while the closure of the US to European travel will also kill sentiment.

Adding to the downward pressure, the US EIA reported a build in crude stocks of 7.7m bbl last week although substantial draws in gasoline and distillates helped to nullify the impact. Production fell back by 100k b/d to 13m b/d and we would expect to see the output number decline as E&P companies take rigs out of service. The EIA also revised down its projections for oil supply growth. The agency now expect US supplies to grow by 6.3% (from 7.9% previously) in 2020 and to decline by 2.6% in 2021 from a similar sized gain previously.

OPEC revised its projections for global oil demand sharply lower in its lastest oil market report. The producers’ bloc now expects demand at just 60k b/d, essentially 0 growth y/y, down from almost 1m b/d previously. Non-OPEC supply growth was revised lower as well by around 500k b/d.