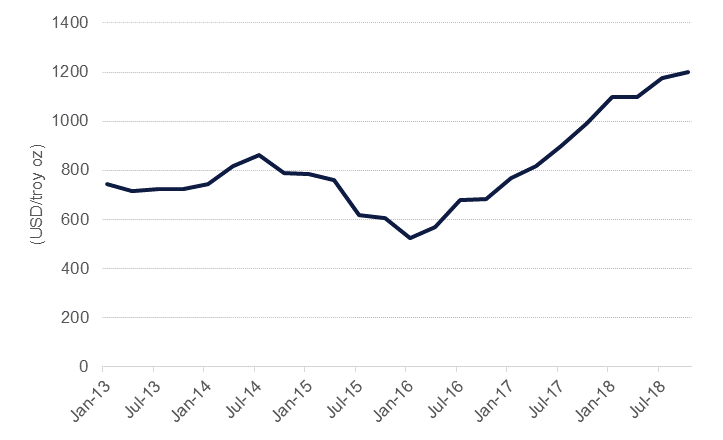

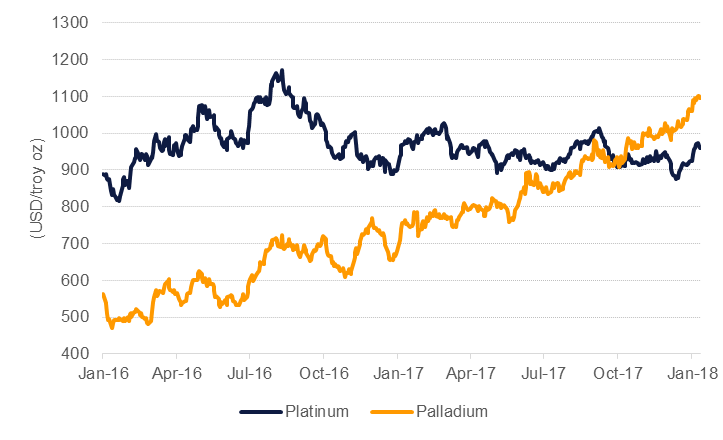

Palladium was the best performing main precious metal in 2017, rising more than 50% year on year compared with gains of 13% for gold and less than 3% for its sister metal platinum. Palladium moved to a premium over platinum in September 2017 and the spread has been steadily widening. From a fundamentals perspective, the strong performance of palladium prices looks set to continue and we are revising our forecasts for the metal higher.

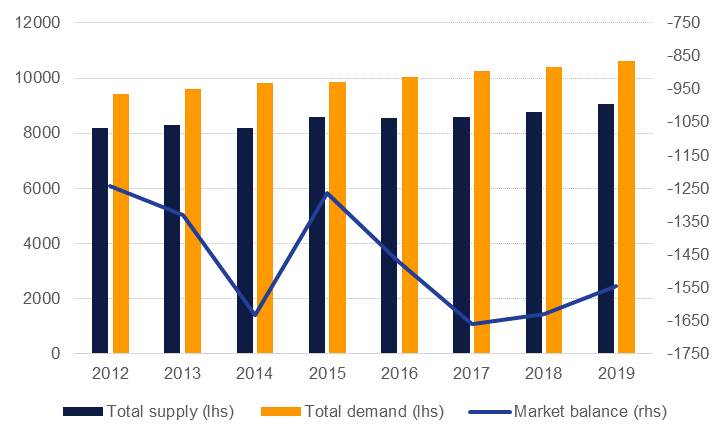

Improving economic growth in most major economies will be supportive for palladium demand in 2018 given it is predominantly used in the manufacture of automobile catalytic converters. Retail investment into bars and coins will also be a significant growth driver for palladium demand this year, anticipated to rise by nearly 18% after a gain of almost 20% last year. Overall demand growth is forecast to grow at 1.3% in 2018 and will help to keep the market in a sustained deficit, nearly twice as wide as that seen in 2015-16.

Inventories of palladium also point to a squeeze in available metal. Comex stocks of palladium are hovering close to 40k oz, compared with more than 500k oz in 2013, and near on their lowest level on record in available data (see charts below). Inventories can meet just a fraction of current demand levels and we expect that some of the decline in ETF positions last year may have been a result of industrial users seeking redemptions in metal form.

Where we would be cautious, however, is in looking at current investor positions. Speculative length in palladium is close to 70% of total open interest in futures and options, far higher than any other precious metal, leaving the trade looking exceptionally crowded. Any stumble on economic data, particularly a shift in the outlook for automotive demand, could see those positions unwind and weigh negatively on prices. A near-term correction also looks warranted from a technical perspective as palladium is registering as overbought on most metrics.

Further interest rate normalization by the Fed also points to a short-term downside risk to palladium, and precious metals more generally, although we would stress that the rate rises are coming for the right reasons (solid economic performance) and reflect conditions that should be supportive for a metal with a heavy industrial use. Indeed, the new corporate tax breaks and strong employment figures are a strong combination for automotive demand growth in 2018.

A more esoteric risk stems from investor interest in cryptocurrencies. There is some crossover in investor attitudes to cryptocurrencies and precious metals as they both stand parallel to traditional currencies and the kind of explosive returns available with cryptocurrencies may attract some funds away from precious metals. However, barriers to entry to cryptocurrency investment are higher than investing in a precious metal ETF and so the divergence of funds may be minimal.

Beyond the supportive fundamentals, precious metals may also be a beneficiary of a pre-emptive flight to quality. Risk assets are performing well so far in 2018, carrying on their 2017 gains, but there appears to be a sense of imminent downside risk that could hit markets negatively. As a result, the outlook for precious metals appears strong in 2018. We expect palladium prices will record an average of around USD 1,140/troy oz this year, up more than 30% on the strong gains recorded in 2017.