The development of the UAE’s manufacturing base came into sharp focus in March 2021, with the announcement of Operation 300bn. The 10-year strategy, driven by the Ministry of Industry and Advanced technology (MoIAT), seeks to expand the contribution of the industrial sector from AED 133bn to AED 300bn by 2031.

The strategy seeks to prioritise the development of key sub-sectors, including food and beverage (F&B) and pharmaceuticals. In addition, the UAE recently adopted a new industrial law designed to allow the sector additional flexibility in terms of adopting policies to support manufacturing activity and create incentives for companies to enter.

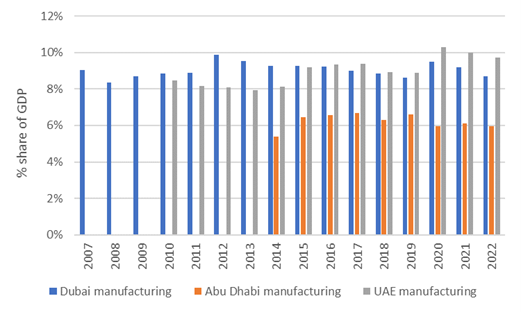

Source: FCSA, DSC, SCAD, ENBD Research

Source: FCSA, DSC, SCAD, ENBD ResearchManufacturing arguably already makes a key contribution to overall UAE GDP. It is the 3rd largest sector in terms of share of nominal GDP, after mining and manufacturing, and retail and wholesale trade. In aggregate manufacturing accounted for just below 10% of nominal UAE GDP in 2022. While the share of manufacturing in nominal GDP is lower in both Dubai and Abu Dhabi (around 8.7% and 6%, respectively), the UAE figure is likely boosted by Emirates such as RAK and Sharjah, with sizeable industrial bases.

In addition, real growth in UAE manufacturing has ticked up relative to pre-Covid trends. Real UAE GDP growth in the manufacturing sector was 8.75% in 2022, well above the average rate of 2.8% observed between 2017-2019.

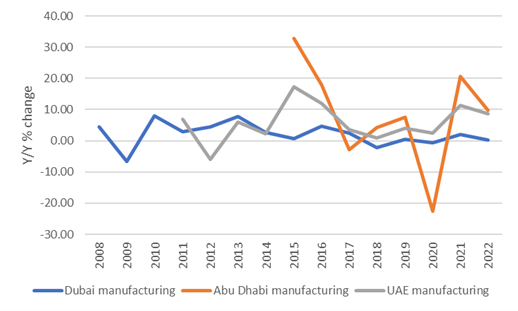

Source: FCSA, DSC, SCAD, ENBD Research

Source: FCSA, DSC, SCAD, ENBD Research Within the emirates, growth in the manufacturing sector varies quite widely. Real manufacturing GDP in Dubai grew just 0.26% y/y in 2022. Annual growth in the sector in Dubai appears to have declined after 2013, falling to an average of 1.2% between 2014 and 2022, from an average of 5.8% between 2010 and 2013.

In contrast, real manufacturing GDP growth in Abu Dhabi was a much more robust 9.7% y/y in 2022. However, it should be noted that there is significantly more volatility in Abu Dhabi’s manufacturing sector growth, likely driven by the variation in the oil price, with knock on implications for petrochemical production.

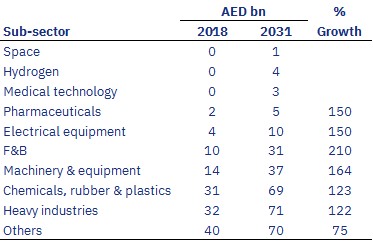

Of the priority sub-sectors set out in Operation 300bn, heavy industries have historically made the largest contribution to manufacturing value added in the UAE. This is followed by chemicals, rubber and plastics, machinery and equipment and F&B.

Source: MoIAT Industrial Investment Guide

Source: MoIAT Industrial Investment Guide

Material growth is expected across the spectrum in all manufacturing sub-sectors. The F&B sub-sector, however, stands out in terms of the degree of growth in value added anticipated between 2018 and 2031. The strategy expects the sub-sector to have grown 210% by 2031.

The F&B sub-sector has also received special attention post-Covid, given both the UAE’s expected increase in population and the longer-run goal of domestic food security. The sector is additionally likely to receive support via the creation of a UAE F&B digital platform, launched in September 2023. The platform creates a digital system that links investors, manufacturers, financial institutions and trade partners.

The Operation 300bn strategy also aims to increase the competitiveness of UAE exports globally. Consistent with the objective of increased diversification away from oil, non-oil exports have played an increasingly important role in the UAE’s trade activity in the last few years.

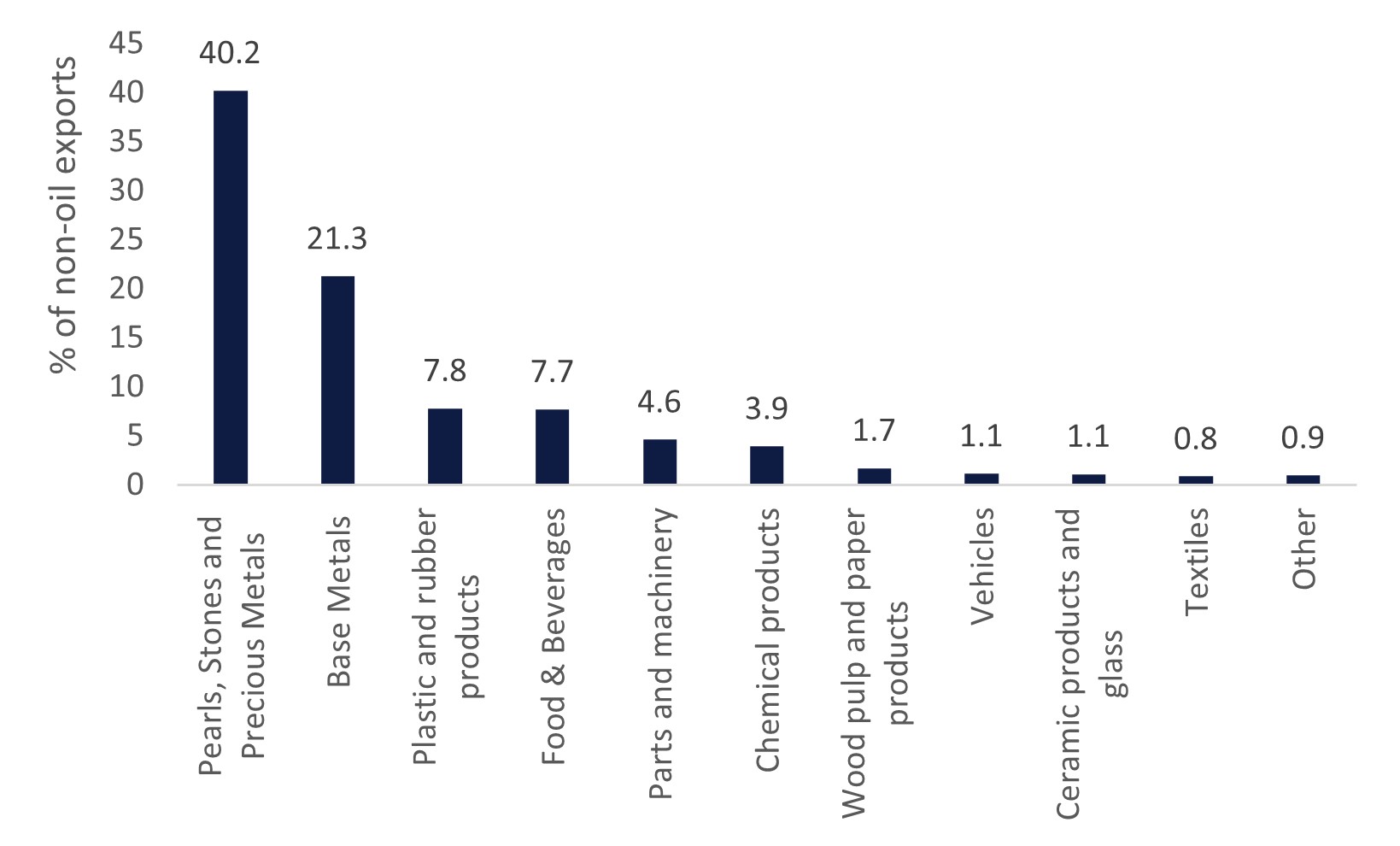

While it is difficult to precisely categorise non-oil exports by type of good, it is likely that a sizeable share of these exports will have originated in the manufacturing sector. The largest segments of non-oil exports are pearls, stones, precious metals and articles thereof (40.2%), and base metals (21.3%). It is worth noting that a portion of exports in these categories will be raw materials, but trade classification codes unfortunately do not allow us to differentiate between manufactured, semi-manufactured and raw goods.

Source: FCSA, ENBD Research

Source: FCSA, ENBD ResearchThe next two most important non-oil export goods categories are plastic and rubber products, closely followed by exports from the food and beverage sub-sector, accounting for 7.8% and 7.7% of the value of non-oil exports in 2021, respectively. Setting the two dominate categories (pearls, stone and precious metals, and base metals) aside, the Operation 300bn priority sub-sectors are likely to correspond to the smaller non-oil export share groups.

Of these smaller non-oil export categories, the plastic and rubber products and F&B groupings appear to have seen robust growth in the most recent period for which data is available. Exports in the rubber and plastics category rose 24% between Q3 2021 and Q3 2022, while F&B exports increased 22% y/y over the same period. Despite the sharp growth in the first three quarters of 2022 relative to the same period in 2021, the share of F&B in non-oil exports remains below the levels seen in 2018 and 2019.

Analysis by MEED suggests that there are currently over USD 500bn worth of major infrastructure projects either planned or underway in the UAE. Perhaps unsurprisingly the largest sector in terms of the value of planned or current large infrastructure projects is construction with USD 345.3bn worth of projects.

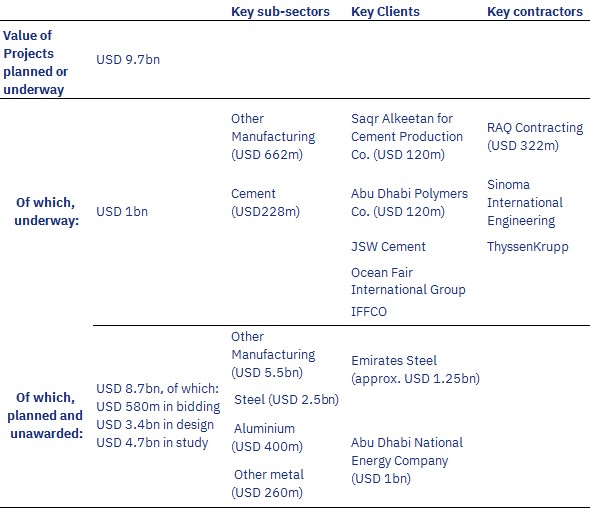

In contrast, the industrial sector currently has in the region of USD 9.7bn worth of projects planned or underway, the smallest of all the sectors considered by MEED. Of these just over USD 1bn are currently in the execution phase with the bulk of the remainder being in the study or design phase. Of those currently underway, the largest sub-sector is ‘other manufacturing’ (USD 662m), followed by cement (USD 228m). According to MEED, ‘other manufacturing’ includes:

1.Warehouses

2.Car showrooms

3.Food production factories

4.Glass manufacturing

5.Paint manufacturing

6.Other miscellaneous industrial production such as cars, furniture, ac systems, electronics etc.

Historically, other manufacturing accounted for roughly 80% of project awards between 2020 and 2022. This was followed by aluminium projects. This appears unlikely to change in the near-term with the USD 8.7bn pipeline of planned but unawarded major projects remaining skewed towards other manufacturing (USD 5.5bn), followed by steel (USD 2.5bn) and aluminium (USD 400m).

Source: MEED

Source: MEED

Separately, the current global drive towards reshoring supply chains – which emerged in part due to Covid-induced supply bottlenecks – may provide additional stimulus for investment in domestic manufacturing infrastructure over the medium-term. Specifically, there have been moves by ADNOC to increase the local production of products used in its supply chain. The entity has thus far signed agreements with domestic and international companies worth AED 52bn since late 2022.

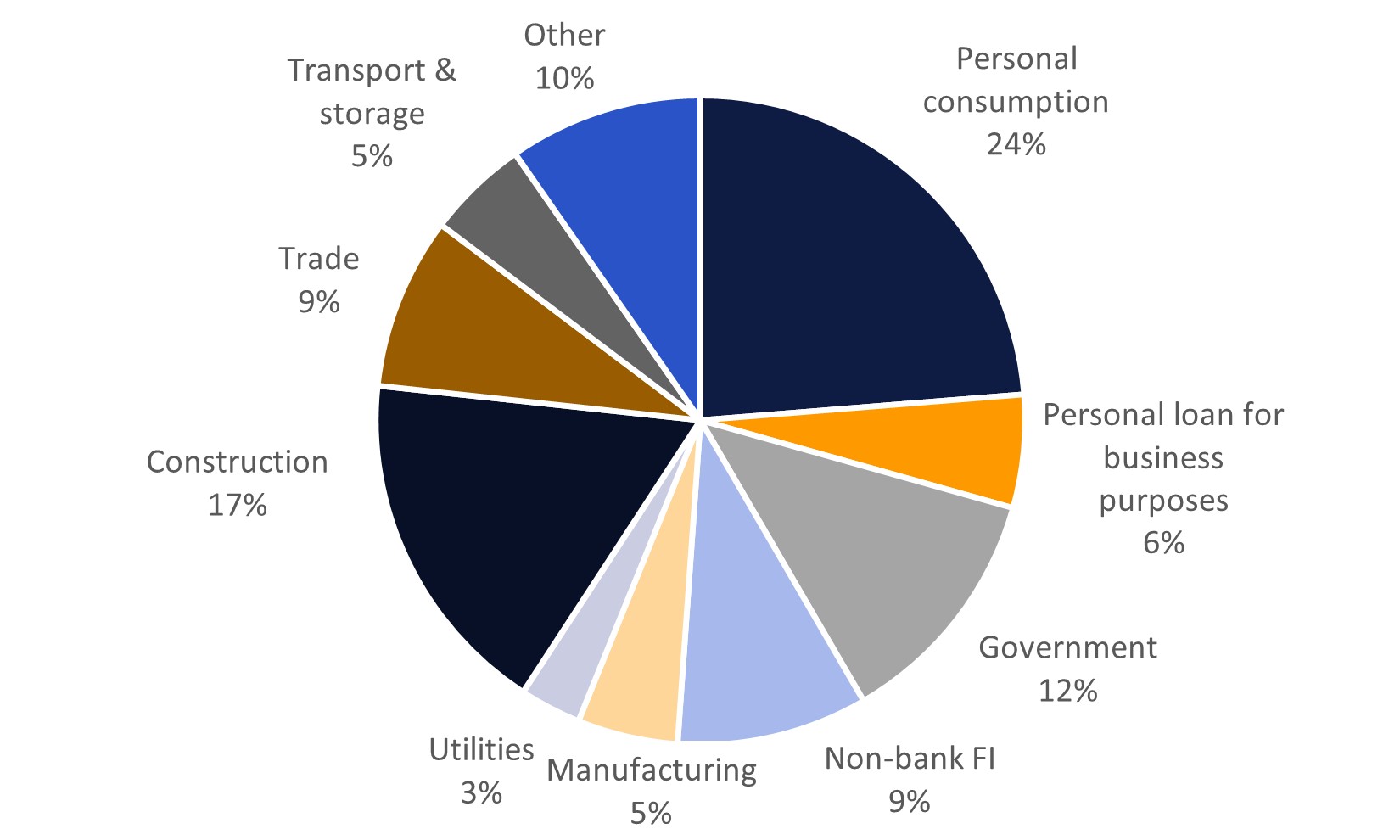

A key driver of growth in the manufacturing sector in the UAE is likely to be companies’ access to capital to fund infrastructure and expansion plans. To date, credit provided by UAE banks to the manufacturing sector accounts for a relatively small share of total credit extended, considering the capital investments likely to be required for expansion. The share of bank credit going to the manufacturing sector has been broadly stable since 2014, at around 5% of the total, whereas the sector accounts for almost 10% of nominal GDP.

Source: UAE Central Bank, ENBD Research

Source: UAE Central Bank, ENBD Research

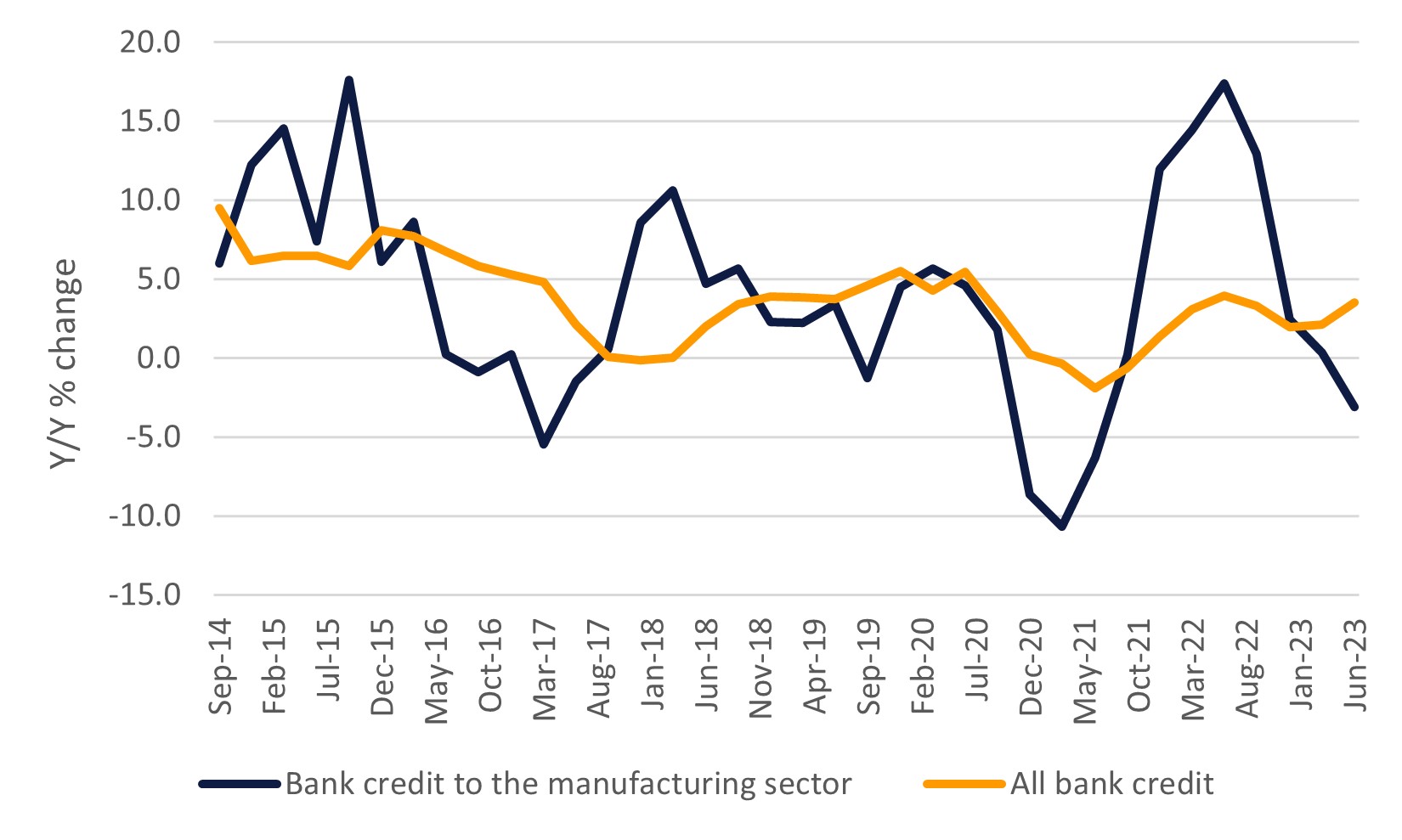

In addition, the pace of growth in bank credit extended the to the UAE manufacturing sector (excluding non-residents), while relatively volatile, has been on a gentle downward trajectory since 2014. This is consistent with the pattern of growth seen in the extension of bank credit in the UAE more generally.

Source: UAE Central Bank, ENBD Research

Source: UAE Central Bank, ENBD Research

While 2022 saw a material expansion in credit to the UAE manufacturing sector, reaching y/y growth of 11.6%, the average pace of growth pre-pandemic (2014-2019) was a more muted 4.3%. Furthermore, bank credit to the manufacturing sector appears to have come off in the first half of 2023, declining 1.4% in the first six months of the year relative the same period in 2022. Higher borrowing costs over the last 18 months may have led to weaker demand for credit and some deleveraging.

Source: UAE Central Bank, ENBD Research

Source: UAE Central Bank, ENBD Research

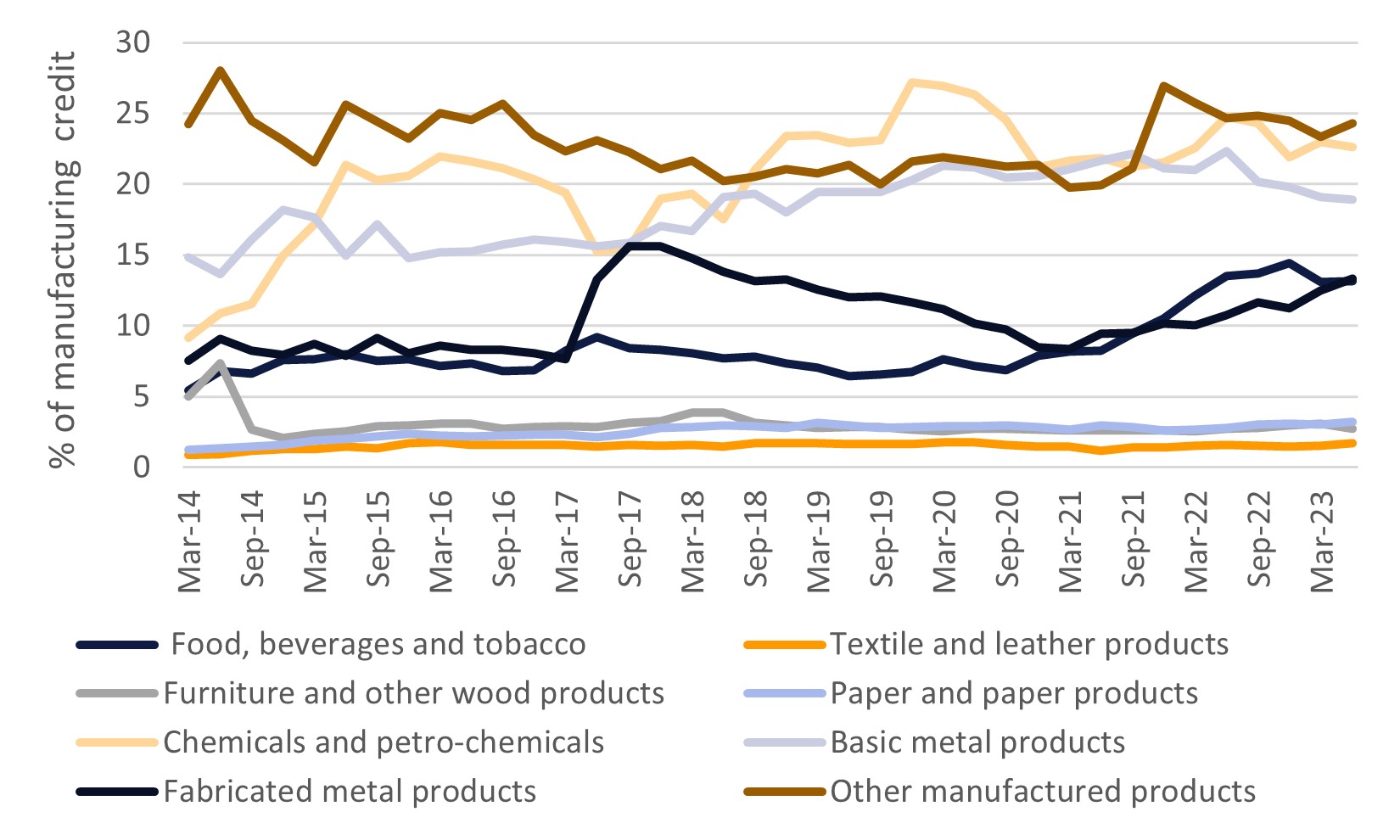

Within manufacturing, the sub-sectors that receive the largest amounts of bank credit are other manufacturing, chemicals, chemical products and petrochemicals, and basic metal products. These sub-sectors accounted for 24%, 23% and 19% of total manufacturing bank credit in June 2023. The share of credit flowing to F&B, one of the priority sectors identified in the Operation 300bn strategy, has increased in recent years, rising to 13% by mid-2023.

Apart from bank credit, companies in the sector will also have access to funding through debt issued in bond markets, sales of stocks or tapping into retained earnings.

In addition to these traditional sources of funding the Emirates Development Bank (EDB) has also set aside AED 30bn to provide support to the sector. The EDB is expected to assist 13,500 SMEs by contributing to their financing needs.